Importance of Business Insurance

Why Business Insurance Matters?

Business insurance is an essential safeguard for any organization, highlighting the Importance of Business Insurance in protecting against unexpected events that could jeopardize its financial stability. From natural disasters to legal disputes, unforeseen circumstances can disrupt operations and threaten your success. Having the right insurance coverage ensures your business remains resilient in the face of adversity.

Business insurance protects against various risks, including property damage, liability claims, and employee injuries. With the appropriate policies in place, you can mitigate financial burdens and focus on growing your enterprise. Investing in comprehensive business insurance is a proactive measure to secure your company’s future.

Beyond regulatory compliance, business insurance serves as a safety net, allowing you to concentrate on opportunities without fear of sudden setbacks. A well-structured insurance plan empowers you to navigate challenges confidently, ensuring your organization’s continuity and long-term success.

Types of Business Insurance

When considering the various types of business insurance, it’s important to evaluate your company’s specific needs. General liability insurance, for example, is essential for protecting your business from legal claims such as bodily injury or property damage.

On the other hand, professional liability insurance, also known as errors and omissions insurance, is crucial for businesses that provide services or advice, as it covers claims related to negligence or misrepresentation. Additionally, property insurance safeguards your physical assets from damage or loss due to events like fire, theft, or natural disasters.

Each type of insurance addresses different vulnerabilities and risks, making it imperative to tailor your coverage to the unique landscape of your enterprise. Business insurance comes in various forms, each designed to address specific risks. Here are some key types of coverage to consider:

1. Property Insurance

Property insurance protects your business assets, including buildings, equipment, inventory, and digital property, against physical damage or loss caused by events such as fires, theft, vandalism, or natural disasters. This coverage helps you recover the cost of repair or replacement, ensuring minimal disruption to your operations.

2. Liability Insurance

Liability insurance safeguards your business against claims of negligence or harm to third parties. General liability coverage addresses bodily injury, property damage, and personal injury claims, while professional liability insurance protects against errors or omissions in providing services. This coverage helps avoid financial strain from legal actions.

3. Workers’ Compensation Insurance

If you have employees, workers’ compensation insurance is crucial. It covers medical expenses and lost wages for employees who experience work-related injuries or illnesses. This not only protects your workforce but also shields your business from potential lawsuits arising from workplace incidents.

Benefits of Business Insurance

In addition to safeguarding against unforeseen events, business insurance can also offer peace of mind, allowing entrepreneurs to focus on growth and innovation rather than potential risks. By transferring the financial burden of risks to the insurance company, businesses can allocate resources more efficiently and plan for the future with greater confidence.

Furthermore, having comprehensive insurance can enhance a company’s credibility, signaling to customers, investors, and partners that the business is responsible and prepared for a variety of challenges. Business insurance offers numerous advantages that extend beyond financial protection. Here are some key benefits:

1. Peace of Mind

Having the right insurance in place provides business owners with peace of mind, knowing that they are safeguarded against unforeseen financial losses that could arise from accidents, natural disasters, or litigation. This sense of security allows entrepreneurs to focus on growing and improving their businesses rather than worrying about potential pitfalls.

Moreover, employees also benefit from this assurance, as they are more likely to work with confidence and dedication when they know their employer is well-protected and stable.

With business insurance, you can focus on growing your company without constantly worrying about unforeseen risks. Knowing you’re prepared for unexpected events provides confidence and allows you to operate with ease.

2. Legal Compliance

Every business has its unique set of risks and needs, and a one-size-fits-all approach to insurance does not suffice. Customized business insurance plans ensure that your specific business requirements are met, providing tailored protection that aligns with your industry, size, and risk profile.

By working with insurance professionals, you can identify the areas of your business that are most vulnerable and select coverage options that address those particular concerns, ensuring comprehensive protection and peace of mind.

Many jurisdictions require specific types of business insurance. By obtaining the necessary coverage, you ensure compliance with regulations, avoiding fines or penalties that could disrupt your business operations.

3. Enhanced Credibility

Building upon a foundation of trust, business insurance also significantly bolsters your company’s credibility. When customers know that you’re insured, they are more likely to view your business as responsible and secure.

This enhanced reputation can be a powerful tool in attracting new clients and retaining existing ones, as it provides tangible proof of your commitment to safeguarding their interests as well as your own.

Having business insurance demonstrates your commitment to protecting stakeholders’ interests. This builds trust among clients, partners, and investors, enhancing your reputation and opening doors to new opportunities.

Factors to Consider When Choosing Business Insurance

When selecting the right business insurance policy, it’s crucial to assess the specific risks associated with your industry and operations. Consider the scale of your business, the nature of your work, and the potential liabilities you may face.

An in-depth analysis of these elements will guide you to a tailored insurance solution that not only safeguards your assets but also aligns with your financial strategy and growth plans. Selecting the right insurance for your business requires careful consideration. Here are key factors to keep in mind:

1. Risk Assessment

Understanding the specific risks associated with your business is the first step in choosing appropriate insurance coverage. This involves evaluating both internal and external factors, such as the nature of your operations, industry-specific hazards, location, and even the current regulatory environment.

A thorough risk assessment will help you identify the types and levels of insurance necessary to provide comprehensive protection against potential threats to your business continuity.

Evaluate potential risks your business may face based on its size, industry, and activities. Identifying vulnerabilities helps determine the type and amount of coverage you need.

2. Insurance Provider Reputation

Consider the financial stability and track record of the insurance providers you’re evaluating. It’s crucial to choose a company that has a strong reputation for settling claims fairly and promptly.

Look into customer reviews, ratings from independent agencies, and the insurer’s history in the industry to ensure that you’re entrusting your business’s protection to a reliable partner.

Choose a reputable provider with a proven track record of excellent customer service and efficient claims processing. A reliable insurer ensures smooth experiences during critical moments.

3. Customizable Coverage

When selecting an insurance provider, it’s also essential to look for flexibility in coverage options. Your business is unique, with specific risks and needs that may not fit into a one-size-fits-all policy.

A provider that offers customizable coverage can work with you to tailor a plan that aligns perfectly with your business’s particular requirements, ensuring that you’re neither underinsured nor paying for unnecessary extras.

This level of personalization can make all the difference in getting the most value and protection from your insurance investment. Opt for flexible policies tailored to your business’s unique needs. Avoid generic solutions and work with providers offering personalized coverage options.

Determining the Right Amount of Coverage

When assessing the right amount of coverage for your business, it’s crucial to analyze various factors such as your industry’s risk profile, the size of your company, and your financial resilience to potential losses. Engage in thorough discussions with your insurance provider to ensure that your policy is neither insufficient nor excessively costly.

It’s a delicate balance, but with careful consideration and expert advice, you can secure a policy that not only safeguards your business but also supports its growth and adaptability in the face of unforeseen challenges. Finding the right level of coverage is essential to balance affordability and protection. Follow these steps to determine your needs:

1. Assess Your Assets

Once you’ve taken stock of your business assets, the next step is to thoroughly assess the potential risks they could face. This involves analyzing both internal and external threats that could cause financial harm to your company. Consider factors such as the likelihood of natural disasters in your area, the potential for cyber attacks, or the risks associated with your particular industry.

By understanding these risks, you can better determine the level of insurance coverage necessary to protect your business against these vulnerabilities. Inventory your business assets, including property, equipment, and intellectual property. Ensure coverage is sufficient to replace or repair these items if necessary.

2. Evaluate Potential Liabilities

After taking stock of your assets, it’s crucial to consider the various liabilities your business may face. This includes risks associated with your operations, such as customer injuries, product liability, and potential legal disputes.

By identifying these potential threats, you can tailor your insurance policies to provide robust protection, mitigating the financial impact of claims and lawsuits that could otherwise jeopardize the stability of your enterprise.

Consider risks associated with your industry, products, and services. Understanding liabilities helps determine the level of coverage required to safeguard your operations.

3. Seek Professional Advice

Engaging with an insurance professional or a risk management advisor is a critical step in ensuring that your coverage meets your specific needs. These experts can help identify potential gaps in your current policy and suggest appropriate endorsements or additional policies that could provide more comprehensive protection.

They can also assist with understanding the complex language of insurance contracts, ensuring that you are fully informed about the terms, conditions, and exclusions of your coverage.Consult an experienced insurance agent who specializes in business coverage. Their expertise can guide you toward the most suitable policies for your needs.

Comparing Business Insurance Quotes

When comparing business insurance quotes, it’s crucial to look beyond the price tag. Evaluate the extent of coverage, the insurer’s reputation for customer service, and their history of handling claims. It’s also wise to check for any additional benefits or support services that could prove invaluable in the event of a loss or a claim.

This comprehensive approach will help you secure insurance that not only fits your budget but also adequately protects your business interests. When shopping for business insurance, compare quotes from multiple providers to make an informed decision. Here’s how:

1. Gather Information

Before diving into the comparison process, ensure you have all the necessary details about your business at hand. This includes understanding the nature of your business, the risks involved, and the specific coverage requirements you may have.

Accurate and detailed information will enable insurance providers to furnish you with the most relevant quotes, which will simplify your decision-making process.

Compile accurate and detailed information about your company, including location, industry, revenue, and past claims. This ensures you receive precise quotes.

2. Request Quotes

Once you have gathered your company’s information, it’s time to reach out to multiple insurance providers for quotes. Doing so will not only give you a range of options to consider but also allows you to gauge the market and understand the average cost for the coverage you need.

Be sure to request quotes well in advance of when you need the policy to start, as this will give you ample time to evaluate your options without feeling rushed.Reach out to various insurers and request coverage estimates based on your needs. Compare options to identify the most cost-effective solutions.

3. Evaluate Coverage and Exclusions

Once you’ve gathered your quotes, take a close look at the specifics of each policy. Pay particular attention to the coverage details and the exclusions listed, as these will determine the extent of protection you’re being offered.

It’s essential to understand not just the costs but also the scenarios in which the policy will not provide benefits, to ensure that you’re not left vulnerable in situations that are crucial to your needs. Review each quote carefully, paying attention to coverage limits and exclusions. Ensure policies address your risks comprehensively.

Top Business Insurance Providers

When selecting a top business insurance provider, consider companies with strong financial stability ratings, positive customer reviews, and a history of reliable claims service. Look for insurers that offer customizable policies, allowing you to tailor coverage to the specific risks and demands of your industry.

Additionally, it’s wise to evaluate the level of support and resources each provider offers, such as risk management tools and educational materials, to help you minimize potential losses and navigate the complexities of business insurance.

Choosing a reliable insurance provider is crucial. Here are some top-rated companies offering excellent coverage and customer support:

1. XYZ Insurance Company

XYZ Insurance Company stands out for its innovative use of AI personalization, which tailors coverage options and recommendations to each client’s unique business needs. By analyzing vast amounts of data, including industry trends and individual risk profiles, their AI systems provide a bespoke insurance experience that optimizes protection and cost-efficiency.

Furthermore, XYZ’s customer support is enhanced by AI-driven chatbots and virtual assistants, ensuring that help is available 24/7 to answer queries and guide policyholders through the intricacies of their insurance policies.

XYZ Insurance offers comprehensive coverage options tailored to various industries and business sizes. Known for financial stability and customer satisfaction, they are a trusted choice.

2. ABC Insurance Corporation

ABC Insurance Corporation stands out with its cutting-edge AI personalization techniques that transform the customer experience. By harnessing the power of machine learning, ABC analyzes individual customer data to provide highly customized insurance solutions that align with each client’s unique needs and risk profiles.

This not only streamlines the decision-making process for customers but also enhances their engagement, ensuring they feel understood and valued throughout their journey with ABC Insurance. ABC Insurance specializes in customizable policies and efficient claims handling. Their industry-specific solutions ensure businesses receive the protection they need.

3. DEF Insurance Group

DEF Insurance Group stands out for its innovative use of AI-driven personalization in the insurance sector. By leveraging cutting-edge technology, DEF analyzes vast amounts of data to offer tailored insurance solutions that meet the unique needs of each customer.

Their commitment to individualized service not only streamlines the insurance process but also enhances customer satisfaction by providing relevant coverage options and proactive customer support.

DEF Insurance excels in risk management and tailored coverage. Their expert team provides personalized solutions to address unique challenges faced by businesses.

The Cost of Business Insurance

Navigating the complex landscape of business insurance can often be a daunting task for companies. DEF Insurance understands this and strives to streamline the process, offering clear guidance and transparent pricing structures.

By leveraging AI personalization, they ensure that businesses are not only adequately protected but also receive the most cost-effective policies tailored to their specific needs and risk profiles.

This approach not only demystifies the cost of business insurance but also instills confidence that every dollar spent is an investment in robust, customized protection. Insurance costs vary based on factors such as business size, industry, and desired coverage. Here are key elements influencing premiums:

1. Business Size and Revenue

Larger businesses typically face higher insurance premiums due to the greater risks associated with their operations and the larger asset base that needs protection. As the number of employees increases, so does the potential for workplace accidents and liability claims, which insurers factor into their pricing.

Moreover, companies with higher revenues often engage in more complex business activities, which can introduce additional risks and necessitate more comprehensive coverage, further influencing the cost of their business insurance policies. Larger businesses with higher revenues often pay more due to increased assets and risks.

2. Industry Risk

The type of industry a business operates in significantly impacts insurance costs due to varying risk profiles. Industries such as construction or manufacturing inherently carry more potential for workplace accidents or equipment damage, which can lead to higher premiums.

Conversely, businesses in sectors like professional services may face lower physical risks but could require extensive coverage for liability or errors and omissions, reflecting the unique challenges and exposures of different industries. High-risk industries, such as construction or healthcare, may face higher premiums due to the likelihood of claims.

3. Coverage Limits

When selecting coverage limits, businesses must carefully assess the potential magnitude of claims they could face. Underestimating these limits could lead to catastrophic financial consequences in the event of a significant claim.

Conversely, excessively high limits may result in unnecessarily high premiums, straining the company’s financial resources. It is crucial for businesses to strike a balance, ensuring adequate protection while maintaining a cost-effective insurance strategy. Higher coverage limits result in increased costs. Balancing adequate protection and affordability is essential.

Liability Insurance for Small Businesses

When considering liability insurance, small business owners must also take into account the nature of their operations and the potential risks involved. Industries with higher levels of risk, such as construction or manufacturing, may require more comprehensive coverage compared to those with lower risk profiles, like consulting or retail.

Furthermore, businesses should regularly review and adjust their insurance policies to reflect changes in their operations, ensuring they remain adequately protected as they grow and evolve. Liability insurance is vital for small businesses to protect against legal claims. Key types include:

1. General Liability Insurance

General liability insurance serves as the bedrock for small business protection, safeguarding against a myriad of common risks. It typically covers claims of bodily injury, property damage, and advertising injury that could arise from daily operations.

Without this fundamental coverage, businesses could face financially crippling lawsuits that might threaten their very existence, making it an essential investment for long-term stability and peace of mind. Provides coverage for bodily injury, property damage, and personal injury claims arising from business operations or premises.

2. Professional Liability Insurance

In an age where data breaches and cyber-attacks are increasingly common, Cyber Liability Insurance has become a critical safeguard for businesses of all sizes. This insurance protects against the financial losses associated with cyber incidents, including data restoration costs, ransomware demands, and legal fees stemming from the exposure of sensitive customer information.

By providing a safety net for these digital risks, companies can operate with greater confidence in their online activities, knowing they are prepared to handle the challenges of the evolving cyber landscape. Protects service-based businesses from claims of negligence, errors, or omissions in professional services.

3. Product Liability Insurance

Product liability insurance is an essential safeguard for businesses that manufacture or sell goods. It provides protection against claims of injury or damage caused by products that a company puts into the market.

This type of insurance can cover legal fees, medical costs, and compensatory damages, ensuring that a company’s financial stability is not jeopardized by unforeseen product issues.

By transferring the risk to an insurer, businesses can focus on innovation and customer satisfaction without the looming threat of product-related lawsuits. Covers claims related to injuries or property damage caused by products manufactured or sold by your business.

Filing a Business Insurance Claim

When it comes time to file a business insurance claim, it’s essential to have all your documentation in order. This includes a detailed account of the incident, photographs of any damage, and records of expenses incurred due to the event.

Prompt and thorough communication with your insurance provider will help ensure that your claim is processed efficiently, allowing you to get back to business as usual with minimal disruption. When filing a claim, follow these steps for a smooth process:

1. Notify Your Provider

As soon as the incident occurs, it’s imperative to contact your insurance provider to inform them of the situation. Prompt notification is not only often a policy requirement but also allows your insurer to quickly begin the claims process.

Provide all necessary details regarding the event, including the time, date, and nature of the incident, to ensure that your provider has a clear understanding of what has transpired. Inform your insurer promptly, providing details about the incident along with relevant documentation.

2. Document Losses

Once you have reported the incident to your insurer, it is crucial to meticulously document all losses. This means taking photographs or videos of the damage, keeping receipts for any repairs or replacements, and making a comprehensive list of all items affected.

Accurate documentation will serve as essential evidence for your insurance claim and will help expedite the process of receiving compensation for your losses. Capture evidence of damages or losses, and track related expenses for use during the claim process.

3. Cooperate with Adjusters

When insurance adjusters arrive to assess the damage, it’s vital to provide them with full access and cooperation. They are there to evaluate the situation thoroughly and determine the extent of the insurance company’s liability. Be honest and detailed in your account of the incident, and provide them with all the documentation you’ve collected.

This collaborative approach can help ensure a fair assessment and facilitate a smoother claims process. Work closely with the claims adjuster, offering transparency and timely responses to requests for information.

Dispelling Common Business Insurance Myths

Understanding the nuances of business insurance can be a daunting task, and misconceptions can easily take root. It’s important to recognize that not all policies are created equal, and what may be true for one type of coverage might not apply to another.

By educating yourself and seeking advice from trusted insurance professionals, you can dispel these myths and tailor a policy that fits the unique needs of your business, ensuring you’re adequately protected against potential risks. Misconceptions about business insurance can lead to costly mistakes. Here are key myths to avoid:

1. “Small businesses don’t need insurance.”

This belief is not only misguided but can also be financially devastating. No matter the size of your business, unexpected events like lawsuits, natural disasters, or accidents can occur, and without proper insurance, these can spell the end for even the most promising small enterprise.

Insurance acts as a safety net, providing the necessary financial support to navigate through such unforeseen circumstances and keep your business afloat. Regardless of size, businesses face risks that can lead to significant financial losses. Insurance is essential for all companies.

2. “Personal insurance covers business needs.”

However, it’s crucial to distinguish between personal insurance policies and those designed specifically for businesses. While personal insurance plans, such as health or life insurance, can provide some level of protection for individual entrepreneurs, they typically do not cover the breadth of risks associated with running a business.

Commercial insurance policies, on the other hand, are tailored to safeguard against the unique challenges businesses face, such as property damage, liability claims, and business interruption. Personal policies typically exclude business-related activities. Separate coverage is necessary to protect your company adequately.

3. “Insurance is too expensive.”

However, the perceived high cost of insurance should be weighed against the potentially devastating financial impact of unforeseen events. By not having adequate insurance, businesses risk paying out of pocket for costly damages or legal claims, which can far exceed the price of insurance premiums.

Furthermore, many insurance providers offer customizable plans, allowing businesses to select coverage options that fit their specific needs and budget, thereby optimizing the cost-benefit balance. The cost of premiums is an investment in safeguarding your assets and minimizing financial risks.

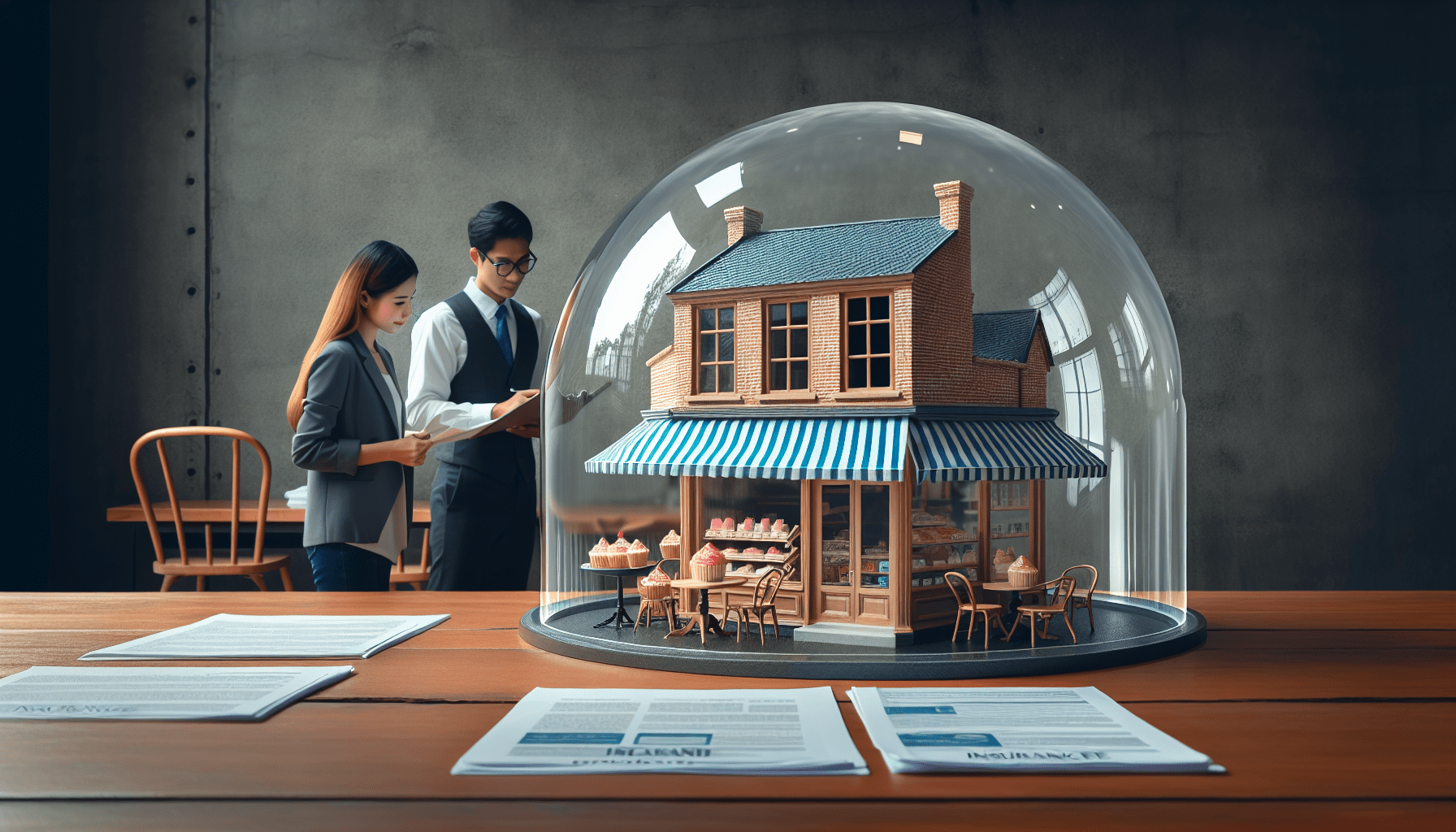

How Business Insurance Protects Your Success

In an unpredictable business landscape, insurance acts as a safety net, ensuring that unexpected events don’t derail your hard-earned progress. Whether it’s property damage, liability claims, or business interruption, the right insurance policy provides a buffer against the shocks that can otherwise lead to severe financial strain or even bankruptcy.

By transferring the risk to the insurer, you gain the peace of mind to focus on growth and innovation, knowing that the foundational aspects of your enterprise are secure. Business insurance is a cornerstone of stability and growth. Here’s how it supports your success:

1. Financial Protection

Financial protection is the bedrock upon which business insurance is built. It provides a safety net against unforeseen losses that can stem from a multitude of risks, such as property damage, liability claims, and business interruption.

This layer of security ensures that, in the face of adversity, your business can recover without the crippling financial burden that could otherwise stifle your operations or even force you to close your doors. Insurance shields your company from unexpected financial losses, ensuring stability and resilience.

2. Business Continuity

Incorporating insurance into your risk management strategy is not just about having a safety net; it’s about proactively protecting your assets and your future. It allows you to assess potential risks and address them before they escalate into more significant issues.

This strategic approach to mitigating risk can save you time and resources, enabling your business to maintain a competitive edge and focus on growth rather than constantly battling setbacks. Coverage allows your operations to continue uninterrupted, even during challenging times.

3. Reputation and Trust

Building on the foundation of a resilient risk management strategy, AI personalization takes customer engagement to new heights. By harnessing the power of artificial intelligence, businesses can tailor experiences to individual preferences, fostering a sense of uniqueness and value among clients.

This bespoke interaction not only enhances customer satisfaction but also strengthens brand loyalty, as consumers are more likely to return to a service that consistently recognizes and anticipates their needs. Displaying a commitment to protection builds credibility and trust with clients, partners, and stakeholders.

Conclusion

Business insurance is an indispensable tool for safeguarding your organization against risks and uncertainties. Understanding the nuances of business insurance can be a complex endeavor, but it’s essential for ensuring that your coverage aligns with the unique risks your business faces. It’s not just about having insurance, but having the right type and level of insurance.

Regularly reviewing and updating your insurance policies can help you keep pace with the evolving landscape of your industry and the external environment, ensuring that your business remains resilient in the face of potential challenges.

By understanding its importance and selecting tailored policies, you can secure your company’s future and focus on growth with confidence.