Understanding Building Coverage: Fire Insurance Essentials for Homeowners

Hello! As a homeowner, you’re likely aware that safeguarding your home is just as vital as maintaining its comfort. Today, we’re delving into an essential element of home insurance that many tend to overlook until it’s too late: fire insurance.

So, pour yourself a cup of coffee and let’s discuss how building coverage can serve as a shield for your cherished sanctuary. Protecting your home with the right coverage ensures peace of mind and helps you prepare for unexpected events that could disrupt your life.

What is Building Coverage in Fire Insurance?

Building coverage acts like a superhero cape for your home when disaster strikes, offering protection and peace of mind. This type of insurance specifically covers the structural elements of your house, such as the walls, roof and foundation, against damages caused by unexpected events like a fire.

Picture waking up one morning to discover your kitchen has turned into a smoky ruin (yikes!). With the appropriate insurance in place, you won’t need to stress about covering the costs for those potentially expensive repairs.

Quick Tip:

Tip: Make sure your policy covers the replacement cost, not just the cash value. This ensures you can rebuild your home to what it was before the fire.

Why You Need Fire Insurance Coverage

Fires are inherently unpredictable events that can occur to anyone at any time. Whether sparked by electrical faults, cooking mishaps or other unforeseen circumstances, the potential causes are numerous and varied.

Possessing fire insurance provides a significant sense of peace and security. It acts as a reliable safety net, ready to support you when life unexpectedly presents you with such a challenging situation, ensuring that you are not left to face the aftermath alone.

Case Study: The Smith Family

The Smiths, a delightful family of four, once encountered a disastrous kitchen fire caused by a malfunctioning appliance. Fortunately, they had an extensive fire insurance policy that allowed them to reconstruct their kitchen without depleting their financial reserves.

This unfortunate incident provided them with an opportunity to enhance their kitchen, installing contemporary and upgraded appliances and fittings that transformed their space into a more modern and efficient culinary environment.

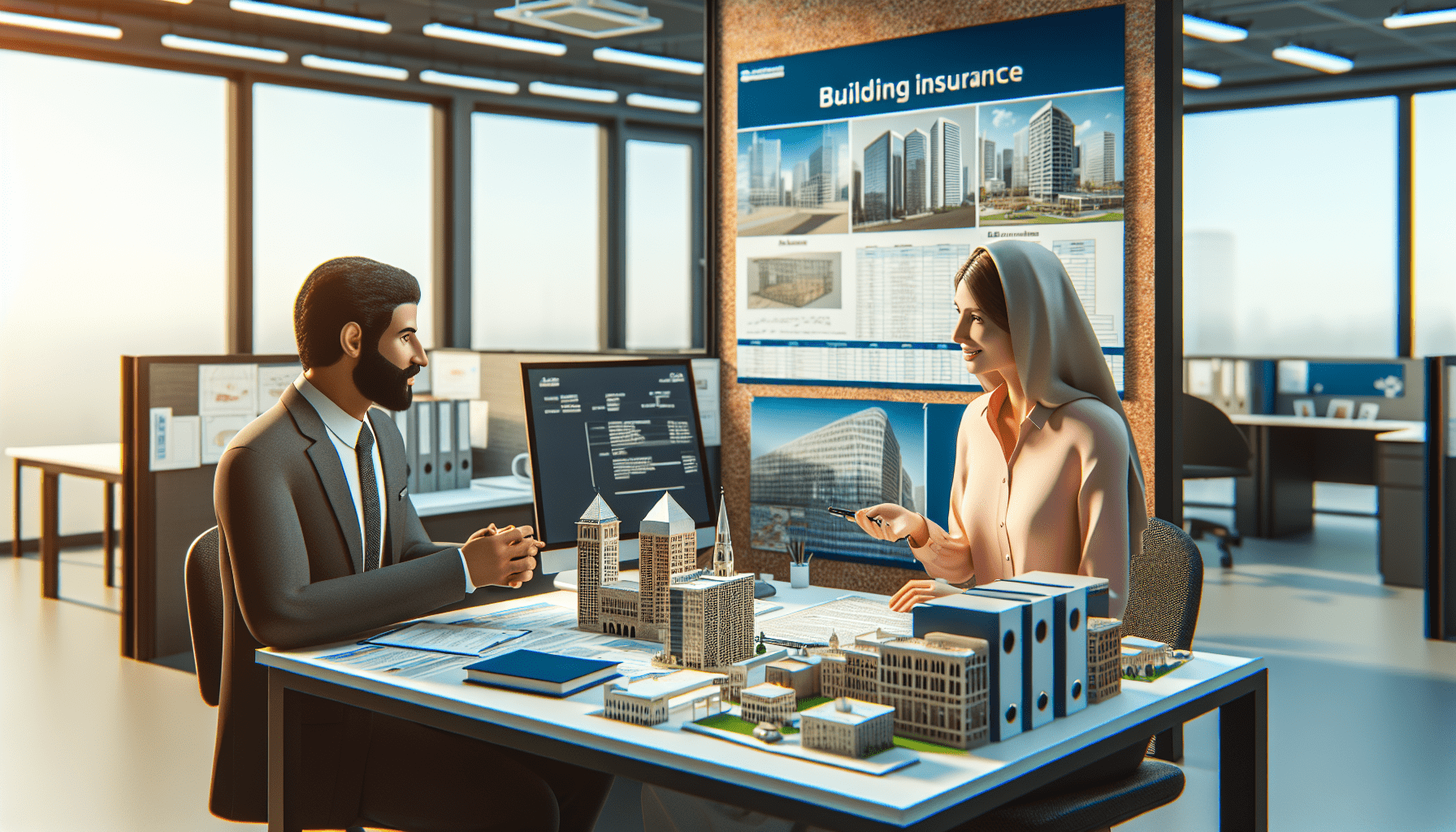

How Much Coverage Do You Need?

Figuring out the appropriate amount of coverage for your home can be quite challenging. An effective guideline is to estimate it based on what it would cost to completely rebuild your home from the ground up.

Consider important aspects such as the home’s location, the types of construction materials used and the prevailing market rates. These elements can significantly influence the cost and should be taken into account when deciding on your coverage.

| Factors | Considerations |

|---|---|

| Location | Urban vs. rural can affect cost |

| Building Materials | Brick, wood or stone? |

| Market Rates | Current construction costs |

Pro Tip:

Pro Tip: Use an online calculator to estimate rebuilding costs. This will help you ensure your coverage is adequate.

Boosting Engagement: Is Your Home Fire-Ready?

Take this brief quiz to evaluate your level of fire preparedness at home. Respond to these questions to determine how well your household measures up on the fire safety scale.

- Do you have a smoke detector installed on every floor?

- Is your fire extinguisher easily accessible and functional?

- Have you checked your electrical appliances for faults recently?

What to Look for in a Fire Insurance Policy

When shopping for fire insurance, look for policies that offer:

- Comprehensive coverage: includes both structural and personal property damage.

- Temporary Living Expenses: Covers costs if you need to live elsewhere during repairs.

- Liability Protection: Shields you from legal claims if the fire spreads to a neighbor’s property.

Action Step:

Action Step: Review your current policy and talk to your insurance agent about any gaps in coverage.

Wrapping Up

Understanding fire insurance can truly make a difference in how you protect your home. By ensuring you have the right building coverage, you’re not just securing bricks and mortar; you’re safeguarding memories and future moments. So, take a moment to review your policy or start a conversation with your insurance provider today. Stay safe and smart!

External Links:

- Learn more about home insurance basics

- Check out the Federal Emergency Management Agency (FEMA) for more fire safety tips.

Remember, keeping your home safe is more than just a necessity; it’s a way of life. Happy homeowning!

The Ultimate Guide to Insurance Essentials

Workers Insurance 2025: Major Changes You Need to Know This Year