Using Universal Life Insurance to Pay for College

“What if your life insurance policy could fund your child’s degree?”

As college tuition costs continue to soar, parents are increasingly seeking creative financial solutions, such as using universal life insurance, to ensure their children’s education is secure without the burden of overwhelming debt.

Universal life insurance emerges as an innovative option, offering a dual-purpose financial vehicle that not only provides a death benefit but also includes a savings component that can accumulate cash value over time.

By leveraging the flexibility of universal life insurance policies, parents can strategically plan for their children’s future, allowing them to tap into the policy’s accumulated cash to help cover tuition fees when the time comes.

In 2025, a growing number of parents are bypassing traditional 529 plans and tapping into universal life insurance (ULI) to pay for college. This permanent life insurance policy isn’t just about death benefits—it’s a flexible financial tool with a cash value component that grows tax-deferred.

One of the key attractions of using universal life insurance for college savings is the potential for accessing funds without the restrictions often associated with 529 plans. Parents can withdraw or borrow against the cash value of their ULI policy to cover educational expenses, giving them a level of financial freedom not typically found in other college savings vehicles.

Moreover, because these withdrawals don’t count as income, they won’t affect a student’s eligibility for financial aid, making it a strategic choice for families planning for the costs of higher education.

With college costs soaring to $120,000+ for a four-year degree (Forbes, 2024), families are reimagining wealth-building strategies. But is ULI a savvy savings vehicle or a risky gamble? Let’s decode the trend of reshaping education funding.

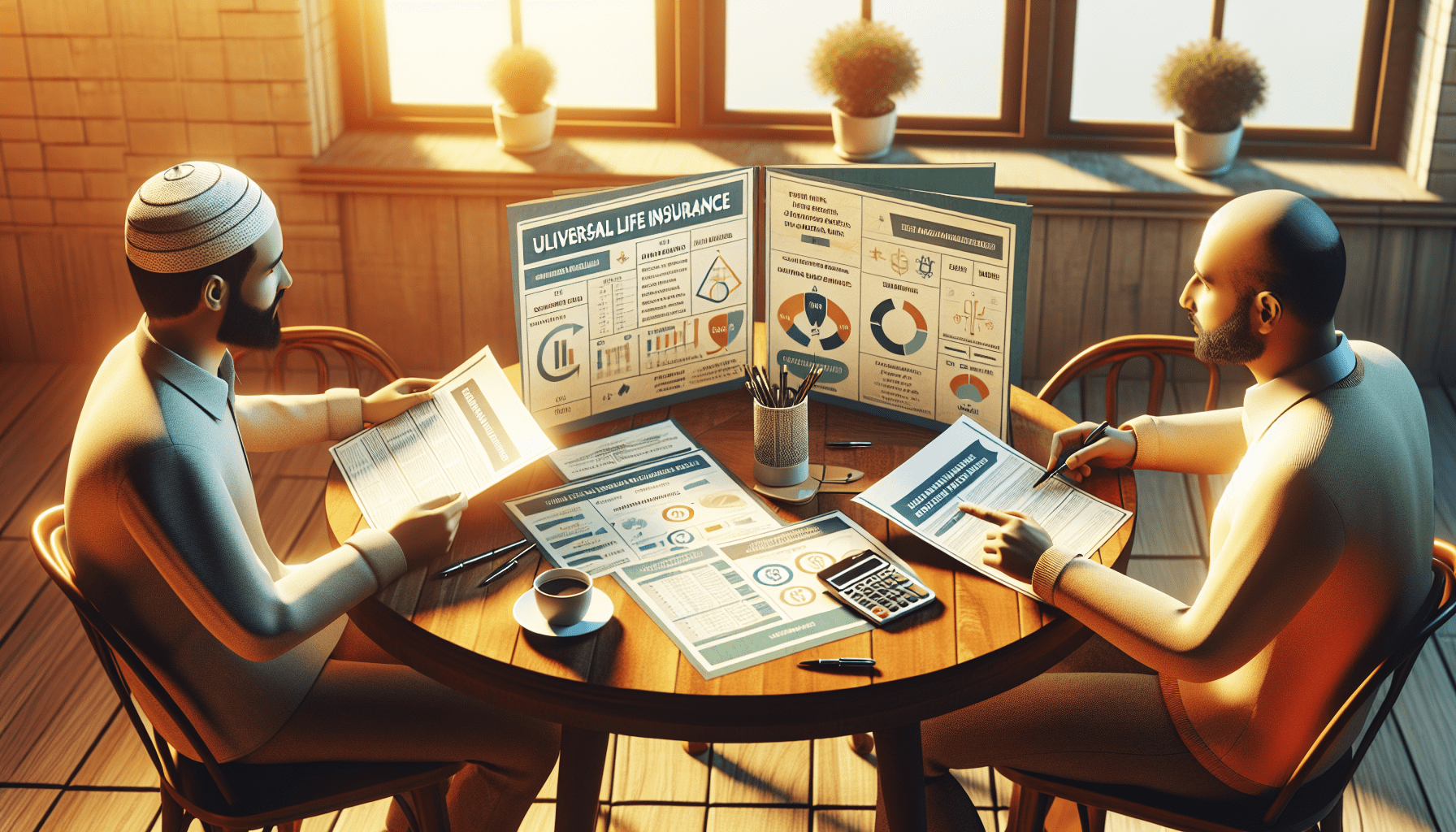

How Universal Life Insurance Works for College Savings

Understanding Cash Value Growth in Universal Life Insurance

Universal Life Insurance (ULI) policies offer a unique proposition for parents planning for their children’s college education. Unlike traditional savings plans, ULI policies feature a cash value component that grows over time, potentially providing a larger pool of funds when the time comes to pay for tuition and other educational expenses.

This growth is tied to the performance of the insurer’s portfolio or a specified interest rate, offering a degree of investment-like upside while also maintaining a death benefit, which serves as a safety net for families. However, the complexity and costs associated with these policies necessitate a careful evaluation to ensure they align with the family’s financial goals and risk tolerance.

ULI policies combine lifelong coverage with an investment-like cash value. Premiums fund both insurance costs and a savings account that accrues interest, often at a rate of 2-4% annually (Investopedia, 2024). Parents borrow against this cash value tax-free, using loans to cover tuition without derailing retirement funds.

ULI vs. 529 Plans: Which Wins for College Funding?

✅ Pros of ULI:

1: ULI policies offer flexibility that is unmatched by 529 plans. Unlike 529s, which are designed specifically for educational expenses, ULI can be used for any purpose without incurring penalties.

This means that if the child decides not to pursue higher education, the funds accumulated in a ULI can be redirected toward other financial goals or life events, such as starting a business or purchasing a home. No income limits or withdrawal penalties.

2: Moreover, the flexibility of a ULI extends to the investment options available. Parents and guardians can choose from a diverse range of assets to invest in, tailoring the portfolio to match their risk tolerance and financial objectives.

This personalized approach to saving for a child’s future ensures that the funds grow in a manner that aligns with the family’s unique circumstances and goals, providing peace of mind that the resources will be there when needed, regardless of the path the child ultimately takes. Funds aren’t restricted to education expenses.

3: To further tailor this financial strategy, AI personalization can play a pivotal role. By analyzing vast amounts of data, including spending habits, income fluctuations, and even educational trends, AI systems can make highly informed suggestions for investment opportunities and savings plans that are bespoke to the child’s potential future needs.

This level of customization not only optimizes the growth potential of the funds but also adapts to changes in the family’s situation or the child’s evolving interests and talents, ensuring that the financial planning remains as dynamic and forward-thinking as the child it supports. Tax-free loans and death benefit protection.

❌ Cons of ULI:

1: While ULI policies offer a range of benefits, they are not without their drawbacks. One significant con is the complexity of these policies. They often come with a steep learning curve, requiring a thorough understanding of insurance, investment options, and tax implications.

This complexity can be daunting for the average investor and may necessitate the need for a financial advisor, adding to the overall cost.

Additionally, the fees associated with ULI – including premium loads, cost of insurance charges, and administrative fees – can be higher compared to other investment vehicles, potentially eating into the long-term growth of the fund. Higher fees than 529 plans.

2: Despite these financial considerations, the flexibility offered by ULI policies in terms of investment options and the potential for tax-free withdrawals can make them an attractive choice for certain investors.

These policies allow for a range of investment choices, from conservative fixed-income options to more aggressive equities, which can be tailored to the policyholder’s risk tolerance and financial goals.

Moreover, if managed correctly, the policy’s cash value can be accessed via loans or withdrawals, which may not be counted as taxable income, offering a unique advantage over traditional investment accounts. Requires long-term commitment (10+ years) to build cash value.

Case Study: To illustrate the potential of AI personalization in the context of life insurance, consider the case of John, a 40-year-old entrepreneur. By leveraging an AI-driven platform, his insurance provider was able to analyze his financial habits, health data, and lifestyle choices to tailor a policy that not only fits his current financial situation but also adapts to his changing needs.

As John’s business grows and his circumstances evolve, the AI system can suggest adjustments to his coverage, ensuring that his policy remains in sync with his goals without him having to manually review his plan each year. The Carter family borrowed $80,000 from their ULI policy to pay for their twins’ Ivy League tuition, avoiding 529 plan restrictions.

Debunking 3 Myths About Universal Life Insurance for College

Myth 1: “ULI is only for the wealthy.”

Reality: Universal Life Insurance (ULI) is a flexible financial tool that can benefit a wide range of income levels. While it’s true that individuals with higher incomes may more easily afford the premiums for larger policies, even those with modest incomes can leverage ULI as a part of their overall financial strategy.

By tailoring the coverage to fit their budget and long-term goals, families can utilize ULI to secure their children’s educational future without the constraints that often come with other savings plans. Middle-income families use indexed ULI policies with lower premiums.

Myth 2: “Cash value growth is too slow.”

Reality: Contrary to this common misconception, the cash value in a Universal Life Insurance (ULI) policy can grow at a competitive rate, especially when the policy is structured properly. By opting for an indexed ULI, policyholders can benefit from the performance of a specific market index, which may lead to higher interest credits and, consequently, faster cash value accumulation.

Moreover, the flexibility to adjust premium payments and death benefits allows policyholders to adapt their strategies in response to changing economic climates, ensuring that their investment remains robust and responsive to their evolving financial needs. Over 15 years, a $500/month premium can grow to $150,000 (Wall Street Journal, 2023).

Myth 3: “You lose coverage if you borrow too much.”

Reality: While borrowing against your life insurance policy can indeed affect your coverage, it does not automatically result in a loss of coverage. Policyholders have the flexibility to take out a loan against the cash value of their policy, but it’s crucial to manage this carefully.

Excessive borrowing can lead to a decrease in the death benefit, and if the loan plus interest exceeds the policy’s cash value, it could cause the policy to lapse, leaving beneficiaries without protection. Therefore, it’s important to consult with a financial advisor to understand the implications and strategize accordingly. Strategic withdrawals keep policies active.

Top 3 Google Queries on ULI for College (Answered)

1: “Can I use ULI instead of a 529 plan?”

Universal Life Insurance (ULI) can be an alternative to a traditional 529 plan for college savings. While 529 plans are specifically designed for educational expenses and offer tax advantages for those purposes, ULI provides a more flexible approach to saving.

With a ULI policy, you’re not restricted to using the funds solely for education, which means if your child decides not to attend college, the accumulated cash value can be used for other financial needs or opportunities. Yes, but ULI offers flexibility while 529s have tax-free growth for education.

2: “Are ULI loans taxable?”

When considering the tax implications of ULI loans, it’s important to understand that generally, the policy loans are not taxable as long as the policy remains in force and isn’t considered a Modified Endowment Contract (MEC).

This is because the loan is secured by the cash value of your life insurance policy, which is not viewed as income by the IRS. However, if the policy lapses or is surrendered, the outstanding loan amount up to the gains in the policy could become taxable.

Therefore, it’s crucial to manage loans carefully to avoid unexpected tax consequences and maintain the financial benefits of your Universal Life Insurance policy. No, loans are tax-free if structured correctly (IRS Guidelines, 2025).

3: “What happens if I die before my child graduates?”

If you pass away before your child graduates, the Universal Life Insurance policy can provide a significant safety net. The death benefit can be structured to cover not only final expenses but also to ensure that your child’s education is fully funded.

By setting up the policy with your child as a beneficiary, you can have peace of mind knowing that their future is secure, even in your absence. This allows your child to focus on their studies without the burden of financial stress, and it ensures that your investment in their education yields its intended benefits. The death benefit pays out tax-free, covering remaining costs.

3 Expert Tips for Maximizing ULI for College

1: Start Early: The earlier you begin investing in a Universal Life Insurance (ULI) policy for your child’s college fund, the more time your money has to grow. This growth is facilitated by the policy’s cash value component, which accumulates on a tax-deferred basis, potentially increasing the amount available for educational expenses.

Additionally, starting early can often result in lower premiums, as the cost is typically based on the age and health of the insured when the policy is initiated. Begin premiums when your child is born for compounded growth.

2: Choose Indexed ULI: Understand the Flexibility: Indexed Universal Life Insurance policies offer a degree of flexibility that can be particularly beneficial for funding education. Policyholders can adjust their premium payments and death benefit amounts as their financial situation or goals change over time.

This means that if your child decides to pursue a different path that may not require extensive educational funding, you can redirect the accumulated cash value toward other financial objectives, such as starting a business or purchasing a home. Ties cash value to market gains with downside protection.

3: Work with a Fee-Only Advisor: Engaging a fee-only advisor ensures that the guidance you receive is in your best interest, as they are compensated solely through the fees you pay, not through commissions on products they sell. This model promotes transparency and aligns the advisor’s incentives with your financial goals, fostering a relationship built on trust and mutual respect.

With their expertise, they can help tailor investment strategies that leverage the benefits of AI personalization, ensuring that your portfolio is not only diversified but also dynamically adjusted to market changes and personal circumstances. Avoid commission-driven policy recommendations.

Risks and Alternatives to Universal Life Insurance

When ULI Falls Short: Risks to Consider

1: Lapse Risk: Lapse risk is a significant concern with Universal Life Insurance (ULI) policies. This occurs when the cash value of the policy is insufficient to cover the cost of insurance and other expenses, leading to the potential termination of the policy if additional premiums are not paid.

Policyholders need to be vigilant and regularly review their policy performance to ensure that the funding levels are adequate to sustain the policy for the desired duration.

Without careful management, a policy lapse could result in the loss of the death benefit as well as the premiums paid into the policy over the years. Falling behind on premiums can terminate coverage.

2: Interest Rate Sensitivity: Interest rate sensitivity is a critical factor to consider when managing a universal life insurance policy. Changes in interest rates can affect the policy’s cash value accumulation, as higher rates typically lead to increased cash values, while lower rates may slow the growth.

Policyholders must stay informed about the current interest rate environment and how it might impact their policy’s performance, potentially necessitating adjustments to their premium payments or death benefit options to maintain the policy’s health. Low rates may slow cash value growth.

529 Plans vs. Roth IRAs vs. ULI

| Vehicle | Tax Benefits | Flexibility |

|---|---|---|

| 529 Plan | Tax-free growth | Education-only |

| Roth IRA | Tax-free withdrawals | Retirement/education |

| ULI | Tax-free loans | Any expense |

Your Universal Life Insurance Questions Answered

1: “Can I use ULI for multiple children?”

Universal Life Insurance (ULI) offers a unique level of flexibility that can be particularly advantageous for families with multiple children. You can utilize the cash value accumulated in your ULI policy to support the educational needs of each of your children, without being restricted to one beneficiary as with some other savings vehicles.

This means that as your family grows and each child’s needs become apparent, your ULI policy can adapt to provide financial aid for their educational journeys or any other expenses that may arise. Yes, funds can be allocated flexibly across beneficiaries.

2: “How much coverage do I need?”

Determining the right amount of coverage is a crucial decision that hinges on various personal factors, including your income, debts, and the financial needs of your dependents. It’s wise to consider enough coverage to replace your income for several years, pay off outstanding debts, and cover future expenses such as your children’s education or your spouse’s retirement.

A common recommendation is to aim for a policy that’s 10 to 12 times your annual income, but consulting with a financial advisor can help tailor the coverage to your unique situation and ensure that your family’s financial security is well accounted for. Aim for a death benefit of 10x annual income + projected college costs.

Conclusion: Is Universal Life Insurance Right for Your Family?

When considering Universal Life Insurance, it’s important to weigh the flexibility it offers against your long-term financial goals. This type of insurance not only provides a death benefit but also includes a savings element that grows tax-deferred.

By carefully assessing your family’s needs and consulting with a financial advisor, you can determine if the adjustable premiums and the potential for cash value accumulation align with your estate planning and retirement objectives, ensuring that your loved ones are protected and your financial legacy is secure.

Universal life insurance offers unmatched flexibility for college funding but demands disciplined planning. Compare fees, growth projections, and backup strategies with a certified financial planner. “Ready to rethink education savings? Calculate ULI cash value potential with our free tool.”