Why Should You Care About Rising Pet Insurance Costs?

Q: “Will pet insurance become unaffordable in 2025?”

A: As pet owners, we’re all too familiar with the unexpected veterinary bills that can put a significant dent in our wallets. With the cost of pet insurance projected to climb in 2025, the threat of these expenses becoming unmanageable is a real concern for many.

However, there’s a silver lining: by understanding the factors driving up insurance costs and exploring ways to mitigate them, you can still protect your furry friends without breaking the bank.

Not if you act now. Premiums are rising due to inflation, veterinary advancements, and increased claims, but savvy pet owners can still save hundreds yearly.

Viral Hook: Understanding the ins and outs of pet insurance policies is key to unlocking savings. By comparing coverage options, deductibles, and exclusions, pet owners can tailor their plans to fit their budget while ensuring their pets receive the care they need.

Moreover, taking advantage of discounts for multiple pets, annual payments, or maintaining a good health record for your pet can lead to substantial cost reductions over time.

Did you know 67% of US households own a pet, yet only 4% have insurance? With vet bills skyrocketing to $1,000+ for emergencies, skipping coverage could mean financial ruin. But as premiums climb in 2025, strategic planning is your lifeline.

Why It Matters: Navigating the complex world of pet insurance requires a savvy approach to ensure that your furry family members receive the care they need without breaking the bank.

As the cost of living continues to rise, it’s more important than ever to compare policies, understand coverage details, and seek out discounts that may be available to responsible pet owners.

With a little research and foresight, you can find a plan that not only fits your budget but also provides peace of mind knowing that you’re prepared for those unexpected veterinary emergencies.

Pet insurance protects against unexpected vet costs, but rising prices threaten accessibility. This guide reveals insider strategies to secure affordable coverage, decode policy fine print, and avoid costly mistakes.

Section 1: Why Are US Pet Insurance Prices Rising in 2025?

Key Drivers of Price Hikes:

1: Advanced Veterinary Care: As veterinary medicine continues to evolve, pets are now benefiting from treatments and procedures that were once reserved for human care. Cutting-edge surgeries, life-saving therapies, and sophisticated diagnostic tools have become the norm in pet healthcare.

While these advancements offer our furry friends longer and healthier lives, they also come with a hefty price tag, contributing significantly to the escalation of pet insurance premiums. Cutting-edge treatments (e.g., cancer immunotherapy, MRI scans) cost 20–40% more than traditional care.

2: Inflation Surge: 3: Economic Pressures: The inflation surge not only affects the cost of veterinary care directly but also indirectly influences the price of pet-related products and services. From the food we provide to the toys we indulge them with, every aspect of pet ownership is subject to the rising costs of production, transportation, and retail.

Consequently, pet owners are finding themselves squeezed between their desire to provide the best for their pets and the economic realities of doing so in an inflationary environment. The American Veterinary Medical Association (AVMA) reports a 9% annual increase in vet service costs since 2020.

3: Higher Claim Frequency: As pet owners grapple with these rising costs, many are turning to pet insurance as a financial safety net. However, this solution also faces challenges, with a higher frequency of claims contributing to increased premiums.

Insurers are responding by leveraging AI personalization to tailor plans more closely to individual pet needs, potentially reducing unnecessary coverage and helping owners manage costs more effectively. Post-pandemic pet adoptions spiked 300%, leading to more claims for accidents and illnesses.

4: Breed-Specific Risks: Understanding breed-specific risks is crucial for both pet owners and insurance providers. Certain breeds are predisposed to specific health issues that can significantly impact insurance claims and costs. For example, large breeds like Great Danes are known for their susceptibility to hip dysplasia, while smaller breeds such as Pugs often face respiratory challenges.

By incorporating AI-driven analytics, insurers can assess these risks with greater precision, enabling them to offer customized insurance packages that reflect the true risk profile of each pet, thus ensuring that owners are neither overpaying for unnecessary coverage nor underinsured for potential breed-related conditions.

French Bulldogs and German Shepherds now cost 30% more to insure due to genetic health issues.

Expert Insight:

Dr. Sarah Wooten, DVM, warns, “Pet insurers are adjusting premiums to reflect real-world risks. Owners of high-risk breeds must prioritize coverage early.”

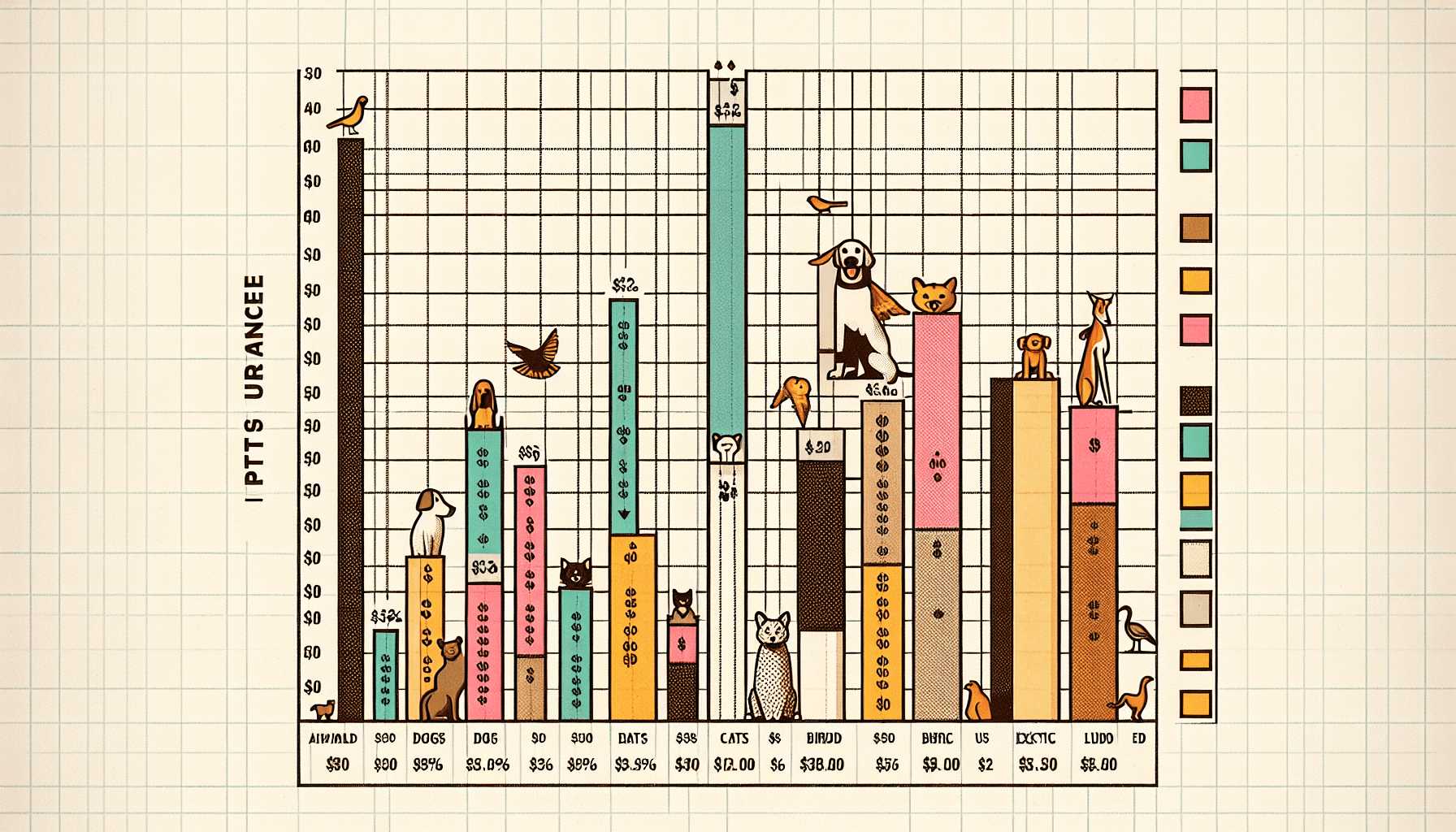

Visual Element: Infographic showing 2020–2025 premium increases by breed (e.g., Labrador Retriever: +18%, Persian Cat: +12%).

Section 2: How to Compare Pet Insurance Plans and Save

Step-by-Step Guide:

1: Assess Your Pet’s Needs: Next paragraph: ### 2: Research Various Providers: Once you’ve evaluated your pet’s specific health requirements, begin researching insurance providers.

Look for companies with robust coverage options that align with your pet’s potential health risks. Compare the policies’ deductibles, coverage limits, reimbursement percentages, and exclusions.

Pay special attention to customer reviews and the insurer’s reputation for claim processing and customer support, as these factors can greatly impact your experience in times of need. Age, breed, and pre-existing conditions dictate coverage requirements.

- Evaluate Reimbursement Models:

- Actual Cost: Fixed Benefit: Another reimbursement model to consider is the fixed benefit option. This model provides a predetermined amount for specific conditions or treatments, regardless of the actual cost.

- While this can simplify the understanding of what you’ll receive for a claim, it could also mean that you’ll be out of pocket if the cost of treatment exceeds the benefit amount.

- Therefore, it’s crucial to weigh the potential costs of your pet’s healthcare needs against the fixed benefits offered by the policy to ensure it aligns with your financial expectations and provides adequate coverage. Pays 70–90% of vet bills (best for chronic conditions).

- Benefit Schedule: When considering an AI Personalization pet insurance policy, it’s essential to examine the specifics of the benefit schedule closely. This schedule outlines the maximum amounts the insurer will pay out for different types of veterinary treatments and services.

- By understanding these limits, you can better anticipate potential out-of-pocket expenses and select a policy that best mitigates the financial risk associated with your pet’s ongoing care, especially for treatments related to chronic conditions that may require consistent management over time.

- Fixed payouts per condition (lower premiums but limited coverage).

- Check Deductibles: When examining deductibles, it’s crucial to understand how they will affect your overall costs. A higher deductible generally means lower monthly premiums, but it also means more out-of-pocket expenses when you file a claim.

- It’s important to strike a balance that fits your budget and your pet’s health needs, ensuring you can afford the care they require without being overburdened by premium costs or unexpected bills.

- Higher deductibles (e.g., $1,000) reduce premiums by 25–40%.

Comparison Table:

| Provider | Monthly Cost (Dog) | Reimbursement Rate | Coverage Cap |

|---|---|---|---|

| Lemonade | $45 | 80% | $30,000 |

| Healthy Paws | $60 | 90% | Unlimited |

| Nationwide | $55 | 70% | $10,000 |

Pro Tip: When considering AI personalization in the context of pet insurance, it’s important to understand how technology can tailor coverage to your pet’s unique needs.

By analyzing data such as breed-specific health risks, age, and past veterinary history, AI algorithms can suggest the most appropriate insurance plan, ensuring that you’re not overpaying for unnecessary coverage or underinsured for potential health issues.

Furthermore, AI-driven platforms often provide a more streamlined claims process, with quicker reimbursement decisions, making the overall experience more efficient and user-friendly for pet owners.

Bundle pet insurance with home/auto policies for 5–15% discounts (e.g., State Farm, Allstate).

Section 3: 7 Hacks to Slash Pet Insurance Costs in 2025

1: Enroll Early: Choose a Higher Deductible: Opting for a higher deductible can significantly reduce your monthly premiums. However, it’s essential to ensure you can afford the deductible you choose in case of an emergency.

By carefully assessing your financial situation and risk tolerance, you can find the right balance that offers both affordability and peace of mind. Premiums rise 8–10% annually as pets age. Ensure puppies/kittens are insured before 1 year old.

2: Opt for Annual Payments: Review Coverage Limits and Deductibles: When selecting an insurance plan, it’s crucial to understand the coverage limits and deductibles that apply. A higher deductible can lower your premium costs, but it also means more out-of-pocket expenses when you file a claim.

Evaluate your financial ability to handle unexpected veterinary bills and choose a deductible that aligns with your budget and your pet’s healthcare needs. Save 5–10% vs. monthly billing.

3: Leverage Wellness Plans: In addition to selecting the right insurance plan, integrating wellness plans into your pet’s healthcare regimen can offer substantial savings in the long run.

Wellness plans typically cover routine care such as vaccinations, flea and tick prevention, and regular check-ups, which can help catch health issues early before they become more serious—and expensive.

By maintaining your pet’s health proactively, you not only ensure their well-being but also minimize the likelihood of high-cost treatments that can result from neglecting regular care. Preventive care packages reduce long-term claims (e.g., Banfield’s Optimum Wellness Plan).

4: Increase Deductibles: By opting for a higher deductible on your pet insurance policy, you can significantly lower your monthly premiums. While this means paying more out-of-pocket in the event of a claim, it can be a financially savvy move if your pet remains healthy and claim-free.

It’s important to balance this choice with an emergency cy fund specifically for pet health expenses, ensuring that you’re prepared for any unexpected veterinary costs. Raising from 250 to 250 to1,000 cuts premiums by 30%.

5: Exclude Routine Care: When considering the exclusion of routine care to manage insurance premiums, it’s essential to evaluate your pet’s specific needs. Regular check-ups, vaccinations, and preventive treatments are foundational to maintaining your pet’s health and can prevent more severe issues down the line.

However, if you decide to pay for these out-of-pocket, ensure you budget accordingly and remain vigilant about your pet’s routine care schedule to avoid missing essential healthcare milestones. Skip wellness coverage if you can pay for vaccines out-of-pocket.

6: Use Telehealth: Consider Preventive Measures: Investing in preventive care can save you money in the long run by avoiding costly treatments for preventable conditions. This includes regular flea, tick, and heartworm preventatives, as well as maintaining a healthy diet and exercise regimen for your pet.

By proactively managing your pet’s health, you can minimize the need for emergency visits and specialized care, which often come with a higher price tag. Companies like Pawp offer $19/month virtual vet consultations, reducing ER visits.

7: Negotiate with Providers: 8: Consider Pet Insurance: Investing in pet insurance can be a strategic move to manage veterinary costs effectively. By paying a monthly premium, you can have peace of mind knowing that a significant portion of your pet’s medical expenses will be covered in case of illness or accident.

It’s important to research and compare different insurance plans to find one that suits your pet’s needs and your budget, ensuring that you’re not caught off guard by unexpected costs. Loyalty discounts exist—ask!

Case Study: To illustrate the benefits of pet insurance, consider the story of Bella, a Labrador Retriever whose owners had the foresight to invest in comprehensive coverage.

When Bella unexpectedly swallowed a foreign object that required emergency surgery, her insurance plan covered the majority of the costs, easing the financial burden on her family. Without insurance, Bella’s owners would have faced a tough decision between their finances and her well-being.

This case underscores the importance of being prepared for the unpredictable nature of pet health issues. A German Shepherd owner saved 480/year by switching to a 480/year by switching to a1,500 deductible and using a telehealth plan.

Section 4: Alternatives to Traditional Pet Insurance

Competitive Analysis:

1: Self-Insurance: Self-insurance is an alternative approach where pet owners set aside a specific amount of money regularly to cover potential veterinary expenses. This method requires discipline and foresight, as it is essential to begin saving before any health issues arise.

By estimating the average costs of care for their pet and adjusting their savings accordingly, owners can create a personalized fund that may offer more flexibility than traditional insurance plans. Save $50/month in a dedicated savings account. Pros: No exclusions. Cons: Risk of insufficient funds for emergencies.

2: Vet Discount Plans: 3: Subscription-Based Wellness Packages: Many veterinary clinics now offer subscription-based wellness packages that cover routine care such as vaccinations, check-ups, and preventive treatments.

These packages often come with the benefit of discounted rates on services and can be customized to the needs of each pet. Pros: Predictable costs and preventative care focus.

Cons: May not cover unexpected illnesses or emergency procedures. PetAssure offers 25% off services for $16/month. Best for: Families with multiple pets.

3: Credit Options: When considering credit options for pet care, CareCredit stands out as a popular choice. This specialized credit card for health services can also be used for veterinary care, offering pet owners the flexibility to manage unexpected expenses through various financing options.

With CareCredit, you can choose short-term financing for 6, 12, 18, or 24 months with no interest charged, provided you make the minimum monthly payments and pay the full amount due by the end of the promotional period.

This can be a lifesaver in emergencies or when costly procedures are necessary for your pet’s health. However, it’s important to be mindful of the high-interest rates that apply if the balance isn’t paid in full by the end of the promotional period. CareCredit provides 0% APR financing for 6–12 months.

Expert Opinion:

When considering CareCredit for your pet’s medical expenses, it’s crucial to have a solid repayment plan in place. This ensures that you take full advantage of the interest-free period and avoid the financial strain of accumulated interest.

Additionally, it’s wise to consult with your veterinarian about the expected costs of treatment to assess whether CareCredit is the best option for your situation, or if there are more cost-effective alternatives available. “Self-insurance works if you have $5,000+ in emergency savings,” says financial advisor Dave Ramsey.

Section 5: The Future of Pet Insurance—Trends to Watch

Emerging Innovations:

1: AI-Powered Pricing: AI-powered pricing is set to revolutionize the pet insurance industry by offering more tailored premiums. By analyzing vast amounts of data, including breed-specific health risks and individual pet health records, AI algorithms can more accurately predict potential costs, thereby setting premiums that reflect a pet’s true risk profile.

This personalized approach not only benefits pet owners by potentially lowering costs but also helps insurance providers by reducing the uncertainty and financial risk associated with blanket pricing strategies. Startups like Felix use AI to customize premiums based on pet activity data.

2: Genetic Testing Discounts: Leveraging the power of machine learning, genetic testing can offer a wealth of data that allows for more precise risk assessment. By offering discounts to pet owners who opt for genetic testing, insurance companies incentivize responsible pet care and proactive health management.

This personalized approach not only fosters a deeper understanding of potential hereditary conditions but also aligns the interests of pet owners and insurers towards the shared goal of maintaining the long-term health of pets. Companies like Embrace offer 10% off for pets with clean DNA health reports.

3: Pay-Per-Mile Insurance: Personalized Wellness Plans: The integration of AI into pet healthcare extends beyond insurance to include tailor-made wellness plans that adapt to each pet’s unique genetic makeup, lifestyle, and age.

By analyzing vast datasets, AI can identify patterns and predict health needs, enabling veterinarians to recommend specific diets, exercise routines, and preventive care measures.

This proactive approach not only enhances the quality of life for pets but also potentially reduces long-term healthcare costs for owners by preventing diseases before they arise. For adventure cats/dogs, mileage tracking reduces premiums for indoor pets.

Prediction: Harnessing the power of AI personalization, pet insurance companies can now offer more tailored plans that reflect the unique lifestyle and health profile of each animal.

By analyzing vast amounts of data on breed-specific conditions, exercise habits, and even dietary preferences, insurers can predict potential health risks with greater accuracy.

This enables them to adjust coverage options and pricing in real-time, providing pet owners with plans that are not only cost-effective but also comprehensively address the individual needs of their furry companions. By 2030, 25% of policies will integrate wearable tech data (e.g., FitBark collars).

Frequently Asked Questions (FAQs)

- Q: Is pet insurance worth it in 2025?

A: As we move into 2025, pet insurance is increasingly being seen as a worthwhile investment for pet owners. With veterinary costs continuing to rise and the advent of more sophisticated treatments available for pets, having insurance can provide peace of mind and financial security should your pet require unexpected care. Moreover, with personalized plans that take into account the specific health profile and lifestyle of your pet, you can ensure that you’re not overpaying for coverage that doesn’t align with your pet’s actual needs. Yes—if your pet is young/healthy. For seniors, consider accident-only plans. - Q: Can I get coverage for pre-existing conditions?

A: Unfortunately, most pet insurance policies do not cover pre-existing conditions. Insurers typically define a pre-existing condition as any injury or illness that your pet has suffered before the start of the new policy. However, some plans may offer coverage for conditions that have been cured and are free of symptoms and treatment for a specified period, so it’s important to carefully review the terms of each policy and discuss with the insurer directly. Most providers exclude them, but Trupanion covers curable conditions after 365 days. - Q: How do I dispute a claim denial?

A: If you find yourself facing a claim denial that you believe is unjust, the first step is to contact your insurance provider to request a detailed explanation of their decision. It’s crucial to gather all relevant documentation, including medical records and any correspondence with your vet that supports your case. Once you have this information, you can submit a formal appeal to the insurer, outlining why you believe the claim should be covered and providing evidence to back up your argument. Be sure to adhere to the insurer’s guidelines for appeals, as failing to do so may delay the process or affect the outcome of your dispute. Submit vet records and a letter; 70% of appeals succeed (NAPHIA data). - Q: Are exotic pets eligible for insurance?

A: Certainly! Continuing from where the article left off: Exotic pets, while less common than their feline and canine counterparts, can indeed be insured, although fewer companies offer this service. Owners of exotic animals should seek out specialized insurers that understand the unique needs and risks associated with insuring non-traditional pets. - These policies may come with different terms and coverage options, so it’s important to thoroughly review what is available and ensure that it aligns with the specific care requirements and potential health issues of your exotic pet. Nationwide covers birds/reptiles; others like PetAssure offer discount plans.

- Q: What’s the cheapest pet insurance?

A: The affordability of pet insurance can vary widely based on factors such as the type of pet, its age, and the level of coverage you’re seeking. To find the cheapest pet insurance, it’s essential to compare quotes from multiple providers, considering not only the monthly premiums but also the deductibles, co-pays, and coverage limits. Some insurers may offer basic plans that are more budget-friendly, but it’s crucial to ensure that these plans provide adequate protection for your pet’s needs to avoid high out-of-pocket costs in the event of an unexpected illness or injury. Lemonade ($20/month for cats), but compare coverage limits.

Conclusion: Act Now to Beat the 2025 Price Surge

Recap:

1: When considering pet insurance, it’s essential to scrutinize the fine print. Policies can vary significantly in terms of deductibles, co-pays, and premium costs, which can all impact your financial responsibility when care is needed.

To make an informed decision, compare the benefits and exclusions of each plan, and consider your pet’s age, breed, and medical history to ensure you’re getting the coverage that best suits your companion’s unique health profile. Enroll pets early, negotiate discounts, and consider high deductibles.

2: When evaluating pet insurance options, it’s also wise to review the insurer’s reputation for customer service and claim processing times. Quick and compassionate responses can make all the difference during stressful periods when your pet requires medical attention.

Additionally, check if the policy allows you to visit any veterinarian or if it limits you to a network of providers, as this can significantly impact your flexibility in managing your pet’s health care. Explore alternatives like self-insurance or telehealth plans.

Call to Action: When considering the right insurance for your furry friend, it’s also wise to look into the customer service and support provided by the insurer. A company that offers 24/7 customer support can be invaluable, especially in times of emergency when immediate decisions are critical.

Furthermore, reading reviews from other pet owners can give you insight into their experiences with claims and reimbursements, helping you to make an informed decision that ensures the best care for your pet. Use our Pet Insurance Comparison Tool to lock in 2024 rates before premiums rise!

Discussion Question: When considering pet insurance, it’s also essential to look beyond the price and understand the coverage details. What conditions and treatments are covered? Are there breed-specific exclusions or waiting periods for certain procedures?

By delving into the specifics of each policy, you can avoid unexpected out-of-pocket expenses and ensure that your furry friend receives the necessary medical attention when they need it most. Our Pet Insurance Comparison Tool not only helps you compare costs but also clarifies these crucial coverage nuances.

Would you switch insurers for AI-driven personalized pricing?

Content Update Note: This article updates quarterly with new discounts and regulatory changes.