Travel Insurance 2025: Essential Coverage

Journey Insurance coverage 2025

The alarm clock buzzes at 4 AM. Your flight leaves in three hours, and you’ve got been planning this dream trip for months. Your luggage are packed, your passport is prepared, and also you’re virtually bouncing with pleasure. However wait – did you bear in mind to purchase travel insurance?

In case you’re like 56% of American vacationers in line with current business information, the reply is perhaps no. But in 2025, with international uncertainties starting from climate-related journey disruptions to evolving well being considerations, touring with out proper insurance coverage is like strolling a tightrope and not using a security web.

This complete information will stroll you thru the whole lot it’s good to find out about journey insurance coverage in 2025, from important protection sorts to choosing the proper coverage to your particular wants. By the tip of this text, you will perceive precisely why journey insurance coverage is not simply really useful – it is completely important for any good traveler.

Why Journey Insurance coverage Has Change into Non-Negotiable in 2025

The New Actuality of Journey Dangers

Journey in 2025 presents distinctive challenges that did not exist even just a few years in the past. Local weather change has intensified climate patterns, resulting in extra frequent flight cancellations and pure disasters. Geopolitical tensions can shift quickly, affecting journey security and accessibility. In the meantime, the continued evolution of worldwide well being protocols signifies that medical emergencies overseas may be extra advanced and costly than ever.

Take into account Sarah Martinez from Phoenix, Arizona, who shared her expertise: “I assumed journey insurance coverage was simply an additional expense till my flight to Greece was cancelled as a consequence of wildfires. With out protection, I’d have misplaced $3,200 in non-refundable bookings. My journey insurance coverage not solely reimbursed me but in addition coated the extra lodging prices whereas I waited for the following obtainable flight.”

Rising Medical Prices Overseas

Healthcare prices for vacationers have skyrocketed globally. A easy emergency room go to in the USA can value upwards of $1,500 for non-residents, whereas medical evacuation from distant places can exceed $100,000. European healthcare, whereas typically wonderful, may be prohibitively costly for uninsured guests, with specialist consultations starting from €200-500.

Journey Cancellation and Interruption Losses

The monetary influence of cancelled or interrupted journeys has grown considerably. Common journey prices have elevated by 23% since 2022, making the potential loss from an uninsured cancellation much more vital. Whenever you consider non-refundable deposits, premium lodging, and distinctive experiences, a single journey cancellation may end up in losses of $5,000 to $15,000 or extra.

Important Kinds of Journey Insurance coverage Protection for 2025

Medical Protection: Your Well being Security Web

Medical protection kinds the inspiration of any complete journey insurance coverage coverage. This safety sometimes contains:

Emergency Medical Remedy: Covers hospital stays, physician visits, prescription medicines, and emergency procedures. Advisable minimal protection: $100,000 for home journey, $1,000,000 for worldwide journeys.

Emergency Medical Evacuation: Supplies transportation to the closest satisfactory medical facility or again to your own home nation if mandatory. This protection is essential for journey vacationers or these visiting distant locations.

Repatriation of Stays: A delicate however mandatory protection that handles the prices of returning deceased vacationers to their residence nation.

Journey Cancellation and Interruption Safety

This protection reimburses you for non-refundable journey prices when you need to cancel or reduce brief your journey as a consequence of coated causes, together with:

- Sudden sickness or harm to you, a touring companion, or fast member of the family

- Loss of life of a member of the family

- Pure disasters affecting your vacation spot

- Terrorism or political unrest

- Job loss or enterprise emergencies

- Jury responsibility or courtroom subpoenas

Baggage and Private Results Protection

Misplaced, stolen, or broken baggage can derail your journey plans and create surprising bills. High quality baggage protection ought to embrace:

- Substitute prices for misplaced or stolen gadgets

- Protection for delayed baggage (sometimes after 12-24 hours)

- Safety for high-value gadgets like electronics and jewellery

- Protection for important gadgets bought as a consequence of baggage delays

Journey Delay Safety

Flight delays and cancellations have turn out to be more and more widespread. Journey delay protection sometimes kicks in after delays of 3-12 hours and covers:

- Extra lodging bills

- Meal prices throughout prolonged delays

- Transportation to meet up with your itinerary

- Communication bills to inform household or enterprise contacts

Specialised Protection Choices for Trendy Vacationers

Cancel for Any Purpose (CFAR) Insurance coverage

CFAR protection, whereas dearer, offers the last word flexibility. It sometimes reimburses 50-75% of non-refundable journey prices while you cancel for any cause not in any other case coated by commonplace insurance policies. This feature is especially invaluable for:

- Costly or once-in-a-lifetime journeys

- Journey throughout unsure occasions

- Vacationers with well being circumstances that may worsen

- Enterprise vacationers with unpredictable schedules

Journey Sports activities and Excessive-Threat Exercise Protection

Customary journey insurance coverage typically excludes protection for journey actions. In case your journey plans embrace actions like:

- Scuba diving past sure depths

- Mountaineering or mountaineering

- Snowboarding or snowboarding

- Bungee leaping or skydiving

- Bike or ATV using

You will want specialised journey sports activities protection or a rider to your commonplace coverage.

Enterprise Journey Safety

Enterprise vacationers face distinctive dangers and necessities:

Enterprise Gear Protection: Protects laptops, tablets, and different important enterprise tools.

Enterprise Interruption: Covers misplaced revenue when enterprise journey is cancelled or interrupted.

Rental Automobile Protection: Enhanced safety for enterprise automobile leases, together with protection gaps that may exist with company insurance policies.

Digital Nomad and Prolonged Keep Protection

For distant staff and prolonged vacationers, conventional journey insurance coverage could not suffice. Specialised protection for digital nomads contains:

- Prolonged coverage durations (as much as 12 months or extra)

- Protection for momentary residence conditions

- Safety for distant work tools

- Telehealth and psychological well being help providers

Methods to Select the Proper Journey Insurance coverage Coverage

Assessing Your Private Threat Profile

Earlier than searching for journey insurance coverage, truthfully consider your particular dangers:

Vacation spot Concerns:

- Political stability of your vacation spot

- High quality and accessibility of native healthcare

- Pure catastrophe dangers

- Crime charges and security considerations

Private Components:

- Your age and present well being standing

- Worth of your journey funding

- Actions deliberate throughout journey

- Journey expertise and luxury stage

Journey Traits:

- Period of journey

- Season and climate circumstances

- Sort of lodging

- Transportation strategies

Evaluating Coverage Options and Prices

When evaluating journey insurance coverage choices, deal with these key comparability factors:

Protection Limits: Guarantee medical protection limits are satisfactory to your vacation spot. Worldwide journey ought to embrace minimal $1,000,000 medical protection.

Deductibles: Perceive what you will pay out-of-pocket earlier than protection begins.

Exclusions: Fastidiously evaluate what’s not coated, together with pre-existing medical circumstances, high-risk actions, and particular circumstances.

Declare Course of: Analysis the insurer’s popularity for claims dealing with and customer support.

24/7 Help Providers: Confirm that emergency help is accessible across the clock with multilingual help.

Understanding Pre-Current Medical Situations

Pre-existing medical situation exclusions generally is a vital concern. Many insurers provide waivers for pre-existing circumstances should you:

- Buy insurance coverage inside 14-21 days of your preliminary journey deposit

- Insure the total non-refundable journey value

- Are medically in a position to journey when buying the coverage

At all times disclose present medical circumstances truthfully to keep away from declare denials.

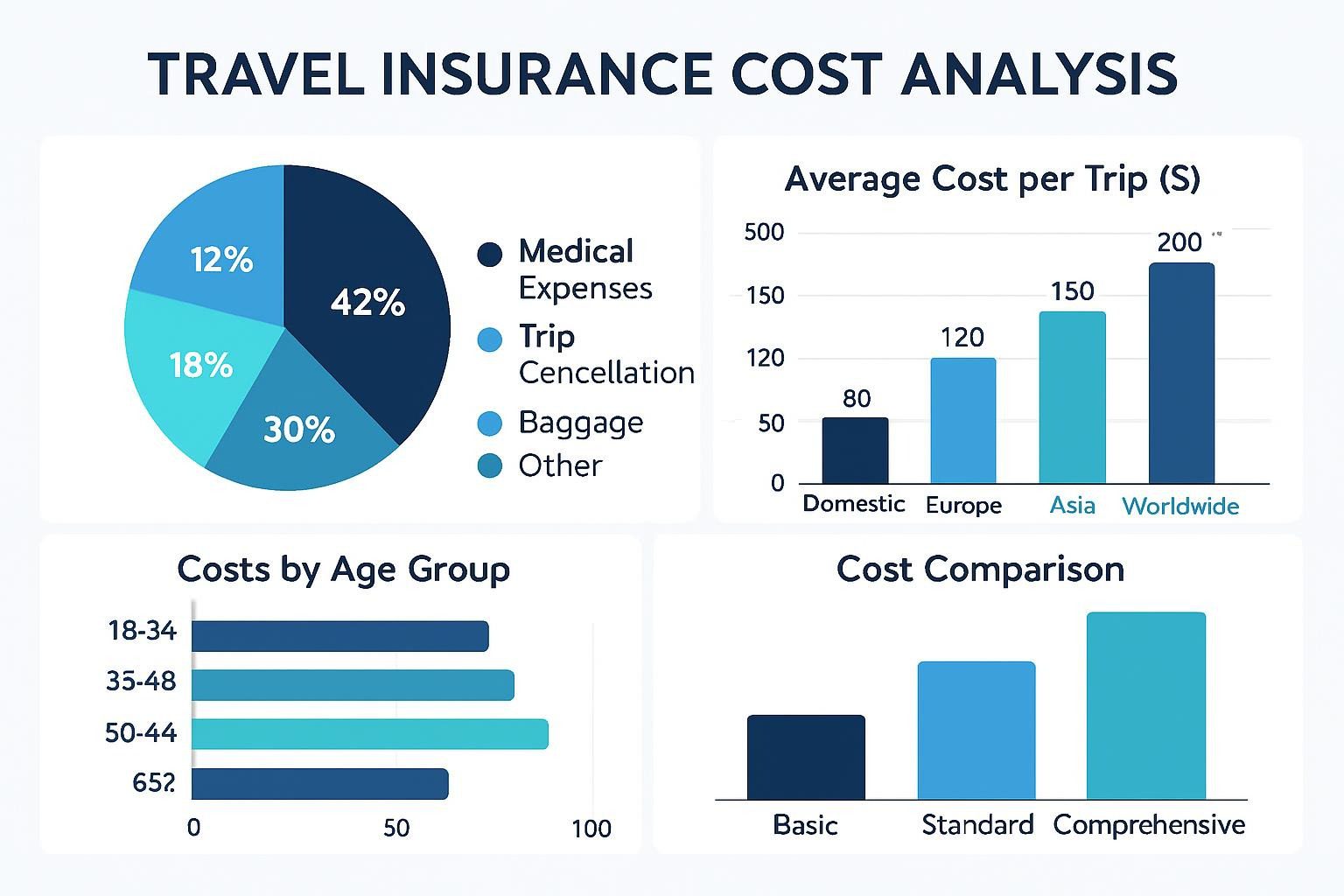

Journey Insurance coverage Price Evaluation: What to Anticipate in 2025

Pricing Components and Typical Prices

Journey insurance coverage prices sometimes vary from 4-10% of your whole journey value, with a number of elements influencing the ultimate worth:

Age of Vacationers: Prices improve considerably for vacationers over 65, generally doubling or tripling in comparison with youthful vacationers.

Journey Period: Longer journeys naturally value extra, however the per-day value typically decreases for prolonged journey.

Vacation spot Threat Stage: Journey to international locations with greater medical prices or political instability sometimes ends in greater premiums.

Protection Ranges: Complete insurance policies with excessive medical limits and CFAR protection value considerably greater than primary plans.

Pattern Price Breakdown for Completely different Journey Sorts

Weekend Home Journey ($1,000 whole value):

- Fundamental Protection: $40-60

- Complete Protection: $80-120

Worldwide Trip ($5,000 whole value):

- Fundamental Protection: $150-300

- Complete Protection: $400-600

- CFAR Protection: $600-900

Prolonged Worldwide Journey ($15,000 whole value):

- Fundamental Protection: $400-800

- Complete Protection: $1,000-1,500

- CFAR Protection: $1,500-2,200

Journey/Excessive-Threat Journey ($8,000 whole value):

- Fundamental Protection: $300-500

- Journey Sports activities Add-on: $100-200

- Complete with Journey Protection: $600-1,000

Worth Comparability: Insurance coverage vs. Potential Losses

To place insurance coverage prices in perspective, contemplate these potential uninsured losses:

- Medical evacuation from a cruise ship: $15,000-50,000

- Emergency surgical procedure in Japan: $20,000-40,000

- Journey cancellation for household emergency: $3,000-15,000

- Misplaced baggage with electronics: $2,000-5,000

- Prolonged resort keep as a consequence of flight cancellation: $200-500 per night time

Mike Chen, a frequent enterprise traveler from San Francisco, discovered this lesson firsthand: “I skipped journey insurance coverage on a $4,000 journey to London, pondering nothing would go flawed. After I ended up within the hospital with acute appendicitis, the invoice got here to $18,000. Now I by no means journey with out complete protection, and the peace of thoughts alone is value each penny.”

Prime Journey Insurance coverage Suppliers for 2025

Complete Comparability of Main Insurers

Allianz Journey Insurance coverage

- Strengths: Wonderful customer support, complete protection choices, robust monetary score

- Greatest For: Households and frequent vacationers

- Common Price: Mid-range pricing

- Notable Options: SmartBenefits for widespread journey points, 24/7 emergency help

World Nomads

- Strengths: Specialised journey journey protection, versatile insurance policies for prolonged journey

- Greatest For: Journey vacationers and digital nomads

- Common Price: Greater-end pricing for complete protection

- Notable Options: Protection for over 200 journey actions, community-focused strategy

Journey Guard

- Strengths: Big selection of coverage choices, robust medical protection

- Greatest For: Worldwide vacationers in search of excessive medical limits

- Common Price: Aggressive pricing throughout all tiers

- Notable Options: Wonderful emergency help providers, pre-existing situation waivers

Travelex Insurance coverage

- Strengths: Good worth for primary protection, simple on-line buying

- Greatest For: Finances-conscious vacationers on shorter journeys

- Common Price: Decrease-end pricing for primary plans

- Notable Options: Easy coverage constructions, fast claims processing

IMG International

- Strengths: Specialised in worldwide journey, wonderful international community

- Greatest For: Prolonged worldwide journey and expatriates

- Common Price: Variable primarily based on protection stage and length

- Notable Options: Renewable insurance policies, robust worldwide medical networks

Specialised Insurers for Particular Wants

SafetyWing: Supreme for digital nomads with subscription-based protection and international attain.

Battleface: Specialised in high-risk and journey journey with complete exercise protection.

Seven Corners: Robust in worldwide medical protection and emergency providers.

Step-by-Step Information to Buying Journey Insurance coverage

Part 1: Pre-Buy Planning (2-3 weeks earlier than journey)

- Calculate Your Journey Funding: Whole all non-refundable bills together with flights, lodging, excursions, and different pre-paid actions.

- Assess Your Current Protection: Evaluate your medical insurance, bank card advantages, and home-owner’s/renter’s insurance coverage to know present travel-related protection.

- Determine Particular Dangers: Take into account your vacation spot, deliberate actions, and private circumstances that may require specialised protection.

- Set Your Finances: Decide how a lot you are keen to spend on insurance coverage, sometimes 4-10% of journey prices.

Part 2: Analysis and Comparability (1-2 weeks earlier than journey)

- Get A number of Quotes: Use comparability web sites and make contact with insurers straight to collect quotes from no less than 3-5 suppliers.

- Learn Coverage Paperwork: Do not simply evaluate costs – rigorously evaluate protection particulars, exclusions, and declare procedures.

- Verify Insurer Rankings: Confirm the monetary stability and customer support scores of potential insurers by A.M. Greatest or comparable score providers.

- Contact Buyer Service: Take a look at responsiveness and helpfulness by calling with questions on protection.

Part 3: Buy and Preparation (14 days earlier than journey for max advantages)

- Buy Inside Time Limits: Purchase insurance coverage inside 14-21 days of your preliminary journey deposit to maximise advantages and waive pre-existing situation exclusions.

- Doc All the things: Hold copies of your coverage, contact info for emergency help, and declare procedures simply accessible.

- Perceive Declare Necessities: Know what documentation you will want for several types of claims (medical data, receipts, police reviews, and many others.).

- Share Info: Present coverage particulars and emergency contact info to relations or journey companions.

Part 4: Throughout Journey

- Hold All Documentation: Save receipts, medical data, incident reviews, and another related documentation.

- Contact Insurer Instantly: For medical emergencies or vital incidents, contact your insurer’s emergency help line as quickly as safely attainable.

- Observe Correct Procedures: Adhere to coverage necessities for medical therapy, declare reporting, and documentation.

Widespread Journey Insurance coverage Errors to Keep away from

Mistake #1: Buying Insurance coverage Too Late

Many vacationers wait till simply earlier than their journey to purchase insurance coverage, lacking out on essential advantages like pre-existing situation waivers and cancel-for-any-reason protection. Buy insurance coverage inside 14-21 days of your preliminary journey cost for max safety.

Mistake #2: Underestimating Medical Protection Wants

Selecting minimal medical protection to economize may be catastrophic. Worldwide medical prices may be astronomical, and evacuation bills can exceed $100,000. At all times go for no less than $1,000,000 in medical protection for worldwide journey.

Mistake #3: Not Studying Coverage Exclusions

Many declare denials outcome from vacationers not understanding coverage exclusions. Widespread exclusions embrace:

- Pre-existing medical circumstances (and not using a waiver)

- Excessive-risk actions and journey sports activities

- Journey to international locations with authorities journey advisories

- Alcohol or drug-related incidents

- Psychological well being circumstances (restricted protection)

Mistake #4: Assuming Credit score Card Protection is Ample

Whereas many bank cards provide journey insurance coverage advantages, protection is usually restricted and should have vital gaps. Bank card journey insurance coverage sometimes offers:

- Restricted medical protection (typically $10,000-25,000)

- Fundamental journey cancellation safety

- Minimal baggage protection

- No emergency evacuation protection

Mistake #5: Not Documenting All the things

Failed claims typically outcome from insufficient documentation. At all times:

- Hold detailed data of all bills

- Get hold of official documentation for incidents (police reviews, medical data)

- Take images of broken or stolen gadgets

- Preserve communication data with airways, resorts, and different service suppliers

Actual-World Case Research: When Journey Insurance coverage Saves the Day

Case Research 1: Medical Emergency in Thailand

Traveler: Jennifer Walsh, 42, graphic designer from Denver Scenario: Extreme meals poisoning requiring hospitalization throughout a two-week trip in Thailand Insurance coverage Protection: Complete coverage with $500,000 medical protection

Jennifer’s expertise started on day three of her dream trip when she developed extreme signs after consuming at an area market. What began as abdomen discomfort shortly escalated to dehydration and harmful electrolyte imbalances requiring fast hospitalization.

Prices Incurred:

- Emergency room therapy: $800

- Three-day hospital keep: $2,400

- IV remedies and medicines: $600

- Missed tour bookings: $450

- Prolonged lodging: $200

- Whole: $4,450

Jennifer’s insurance coverage coated 100% of medical bills and reimbursed her for missed pre-paid actions. The 24/7 help line helped coordinate therapy and translation providers, making a daunting state of affairs manageable.

“With out insurance coverage, this medical emergency would have value me greater than your complete trip,” Jennifer mirrored. “However extra importantly, the peace of thoughts and help made all of the distinction in getting correct care shortly.”

Case Research 2: Pure Catastrophe Journey Cancellation

Traveler: Robert and Linda Thompson, retirees from Florida Scenario: Hurricane disruption forcing cancellation of Mediterranean cruise Insurance coverage Protection: CFAR coverage overlaying 75% of journey prices

The Thompsons had deliberate their twenty fifth anniversary cruise for 2 years, reserving premium suites and shore excursions totaling $8,500. Three days earlier than departure, a serious hurricane pressured the cruise line to cancel your complete itinerary.

Whereas the cruise line provided future cruise credit, the Thompsons wanted fast reimbursement as a consequence of Robert’s upcoming medical process that will forestall future journey for a number of months.

Monetary Impression:

- Non-refundable cruise prices: $6,200

- Shore excursions: $1,200

- Pre-paid gratuities: $300

- Airport parking: $150

- Whole Journey Funding: $7,850

Their CFAR protection supplied $5,887 (75% of coated prices), considerably decreasing their monetary loss. With out insurance coverage, they might have been restricted to cruise credit with restrictions and expiration dates.

Case Research 3: Journey Journey Accident

Traveler: Alex Rodriguez, 29, software program engineer from Austin Scenario: Snowboarding accident within the Swiss Alps requiring mountain rescue and surgical procedure Insurance coverage Protection: Journey sports activities rider with complete medical protection

Alex’s ski journey to Switzerland practically led to monetary catastrophe when he suffered a compound leg fracture on a complicated slope. The accident required helicopter evacuation from the mountain, emergency surgical procedure, and prolonged restoration.

Prices Breakdown:

- Helicopter mountain rescue: $3,200

- Emergency surgical procedure: $15,800

- 5-day hospital keep: $8,400

- Medical tools and medicines: $1,200

- Flight change for prolonged restoration: $800

- Extra lodging: $600

- Whole: $30,000

Alex’s journey sports activities protection dealt with all bills, together with coordination with Swiss medical suppliers and translation providers. The evacuation protection proved important, as commonplace journey insurance coverage would have excluded the skiing-related accident.

“I initially hesitated to pay the additional $120 for journey sports activities protection,” Alex admitted. “That small extra value saved me from a $30,000 catastrophe. I am going to by no means ski once more with out correct protection.”

Digital Instruments and Apps for Journey Insurance coverage Administration

Important Apps for Coverage Administration

TravelSafe: Complete app permitting coverage storage, declare submission, and emergency contact entry. Options embrace:

- Digital coverage storage with offline entry

- GPS-enabled emergency help

- Declare photograph submission and monitoring

- Multi-language emergency phrases

Allianz TravelSmart: Insurer-specific app with extra journey security options:

- Actual-time journey alerts and security updates

- Medical facility locator with high quality scores

- Emergency contact with GPS location sharing

- Journey monitoring and itinerary administration

World Nomads: Specialised for journey and prolonged journey:

- Exercise-specific security info

- Neighborhood options for journey recommendation

- Simple coverage extension for prolonged journeys

- Integration with security and communication instruments

Emergency Preparedness Digital Instruments

Good Traveler (U.S. State Division): Official app offering country-specific security info, embassy contacts, and registration providers.

SkyAlert: Climate and pure catastrophe monitoring with customizable alerts to your journey locations.

Google Translate: Important for speaking medical wants and understanding native emergency procedures.

Future Traits in Journey Insurance coverage for 2025 and Past

Technological Integration

Journey insurance coverage is quickly evolving with technological advances:

AI-Powered Threat Evaluation: Insurers are implementing synthetic intelligence to offer extra correct danger assessments and customized pricing primarily based on particular person journey patterns and well being information.

Blockchain Claims Processing: Some insurers are testing blockchain know-how to streamline claims processing, cut back fraud, and pace reimbursements.

Wearable System Integration: Well being monitoring by smartwatches and health trackers could quickly affect protection choices and pricing, notably for journey vacationers.

Local weather Change Variations

As local weather change will increase weather-related journey disruptions, insurers are adapting:

Enhanced Climate Protection: New insurance policies provide extra complete safety in opposition to climate-related cancellations and delays.

Actual-Time Threat Monitoring: Dynamic pricing primarily based on present climate forecasts and local weather dangers for particular locations.

Sustainability Incentives: Some insurers are starting to supply reductions for eco-friendly journey decisions and carbon offset packages.

Pandemic and Well being Safety Evolution

Put up-pandemic journey insurance coverage continues evolving:

Enhanced Well being Screening Protection: Insurance policies more and more cowl required well being screenings and quarantine prices.

Telemedicine Integration: Distant medical consultations have gotten commonplace options, particularly invaluable for minor well being points overseas.

Versatile Cancellation Phrases: Insurers are sustaining extra versatile cancellation insurance policies developed throughout the pandemic period.

Comparability Desk: Protection Sorts and Advisable Minimums

| Protection Sort | Home Journey Minimal | Worldwide Journey Minimal | Excessive-Threat Journey Minimal | Notes |

|---|---|---|---|---|

| Emergency Medical | $50,000 | $1,000,000 | $1,000,000 | Greater for journey sports activities |

| Emergency Evacuation | $100,000 | $1,000,000 | $1,000,000 | Important for distant locations |

| Journey Cancellation | Journey Price | Journey Price | Journey Price + 25% | Take into account CFAR for flexibility |

| Journey Interruption | 100% Journey Price | 150% Journey Price | 150% Journey Price | Covers extra bills |

| Baggage Safety | $1,000 | $2,500 | $3,000 | Greater for invaluable tools |

| Journey Delay | $500 per day | $750 per day | $1,000 per day | 3–6 hour delay threshold |

| Rental Automobile Protection | Not at all times wanted | $35,000 | $50,000 | Verify present auto protection |

| AD&D Protection | $25,000 | $100,000 | $250,000 | Take into account beneficiary wants |

Skilled Suggestions from Insurance coverage Consultants

Knowledgeable Perception #1: Timing Your Buy

Insurance coverage skilled Maria Santos from Journey Insurance coverage Evaluate emphasizes: “The largest mistake I see is vacationers ready till the final minute to purchase insurance coverage. Buying inside 14-21 days of your preliminary journey cost unlocks most advantages, together with pre-existing situation waivers and time-sensitive protection choices.”

Knowledgeable Perception #2: Understanding Coverage Language

Claims specialist David Kim notes: “Many declare denials stem from misunderstanding coverage phrases. ‘Sudden and surprising’ does not imply the identical factor in insurance coverage language because it does in on a regular basis dialog. If in case you have any doubt about protection, name your insurer earlier than your journey.”

Knowledgeable Perception #3: Documentation Necessities

Journey insurance coverage lawyer Rebecca Foster advises: “The burden of proof is at all times on the policyholder. Begin documenting the whole lot from the second you observed you may have to file a declare. Photographs, receipts, medical data, official reviews – extra documentation is at all times higher than much less.”

Incessantly Requested Questions (FAQs)

Q1: Do I want journey insurance coverage for home journeys inside my residence nation?

Reply: Whereas not legally required, home journey insurance coverage may be invaluable for shielding non-refundable journey prices and overlaying medical bills in case your medical insurance has restricted protection away from residence. Take into account it important for costly home journeys, journey actions, or when you’ve got well being circumstances that may require specialised care.

Q2: Can I purchase journey insurance coverage after I’ve already began my journey?

Reply: Most insurers permit you to buy primary protection after journey has begun, however you will lose entry to many key advantages together with journey cancellation protection, pre-existing situation waivers, and CFAR choices. Some protection could have ready durations when bought after departure. It is at all times finest to purchase earlier than you journey.

Q3: Will my bank card journey insurance coverage be adequate for worldwide journey?

Reply: Bank card journey insurance coverage sometimes affords restricted protection that will not be satisfactory for worldwide journeys. Most bank card insurance policies present solely $10,000-$25,000 in medical protection and should exclude emergency evacuation, which may value $100,000 or extra. For worldwide journey, devoted journey insurance coverage is strongly really useful.

This autumn: How do pre-existing medical circumstances have an effect on journey insurance coverage protection?

Reply: Pre-existing circumstances are sometimes excluded from protection until you buy a coverage with a pre-existing situation waiver. To qualify, you normally should purchase insurance coverage inside 14-21 days of your preliminary journey cost and be medically cleared to journey when buying the coverage. At all times disclose present circumstances truthfully to keep away from declare denials.

Q5: What is the distinction between journey cancellation and journey interruption protection?

Reply: Journey cancellation covers non-refundable prices should you should cancel earlier than departure, whereas journey interruption covers extra prices should you should finish your journey early or rejoin it after an interruption. Journey interruption typically offers greater protection limits (sometimes 150% of journey value) to cowl additional bills like last-minute flights residence.

Q6: Does journey insurance coverage cowl journey actions and excessive sports activities?

Reply: Customary journey insurance coverage insurance policies typically exclude high-risk actions like scuba diving, mountaineering, or excessive sports activities. In case your journey contains journey actions, you will want specialised protection or an journey sports activities rider. At all times verify the coverage’s exercise exclusion checklist earlier than buying.

Q7: How shortly are journey insurance coverage claims processed and paid?

Reply: Easy claims (like journey delays) could also be processed inside 10-15 enterprise days, whereas advanced claims (medical emergencies, evacuations) can take 30-60 days or longer. Offering full documentation upfront speeds the method. Many insurers provide emergency advance funds for fast medical bills whereas claims are processed.

Actionable Steps: Your Journey Insurance coverage Guidelines

Earlier than You Journey

8 Weeks Earlier than Departure:

- Analysis destination-specific dangers and necessities

- Evaluate present insurance coverage protection (well being, bank cards, home-owner’s)

- Calculate whole journey funding together with all non-refundable prices

4-6 Weeks Earlier than Departure:

- Get hold of quotes from a number of insurers

- Examine protection particulars, not simply costs

- Verify insurer scores and buyer opinions

2-3 Weeks Earlier than Departure:

- Buy insurance coverage (inside 14-21 days of preliminary journey cost for max advantages)

- Obtain insurer’s app and register your coverage

- Share coverage info with journey companions and household

1 Week Earlier than Departure:

- Print and pack bodily copies of coverage and emergency contacts

- Perceive declare procedures and required documentation

- Confirm emergency help telephone numbers work out of your vacation spot

Throughout Your Journey

- Hold all receipts and documentation

- Contact insurer instantly for medical emergencies

- Take photographs of broken or stolen gadgets

- Observe correct procedures for any incidents requiring claims

After Your Journey

- File claims promptly (inside required timeframes, sometimes 20-90 days)

- Present full documentation together with your declare

- Observe up on declare standing if not resolved inside anticipated timeframes

- Evaluate your expertise and regulate protection for future journeys

Conclusion: Your Security Web for Good Journey

Journey insurance coverage in 2025 is not simply really useful – it is important for any traveler who desires to guard their funding and guarantee peace of thoughts. With rising journey prices, growing weather-related disruptions, and evolving international well being considerations, the query is not whether or not you’ll be able to afford journey insurance coverage, however whether or not you’ll be able to afford to journey with out it.

The tales of Sarah, Jennifer, the Thompsons, and Alex illustrate that journey insurance coverage is not about pessimistic pondering – it is about sensible safety. Their experiences, starting from flight cancellations to medical emergencies, show that surprising occasions can occur to anybody, wherever, at any time.

Keep in mind these key takeaways:

- Buy early (inside 14-21 days of your preliminary journey cost) for max advantages

- Select satisfactory medical protection ($1,000,000 minimal for worldwide journey)

- Perceive your coverage exclusions and limitations

- Take into account your particular dangers and select protection accordingly

- Doc the whole lot throughout your travels for potential claims

Do not let your subsequent journey turn out to be a financial disaster. Take motion at the moment: analysis your choices, get quotes from a number of insurers, and buy complete journey insurance coverage that matches your particular journey wants and danger profile.

Your future self – whether or not coping with a minor delay or a serious emergency – will thanks for making this good funding in your journey safety.

Prepared to guard your subsequent journey? Begin comparing travel insurance choices at the moment and journey with confidence, understanding you are ready for no matter comes your approach.