Hey there! So, you’re sipping your morning espresso, and it hits you—with the price of constructing supplies skyrocketing, may you be underinsured? It’s a bit like realizing you’ve been sporting socks with holes at a flowery dinner. Awkward, proper? Let’s dive into this subject and see why it’s vital to maintain your insurance coverage, sport sturdy!

What’s the Deal with Rising Build Costs?

Imagine constructing a LEGO mansion and halfway through realizing you’re missing pieces. This is similar to the rising construction costs today. Recently, prices for building materials have increased rapidly. According to Statista, costs have risen by about 10% annually. Yikes!

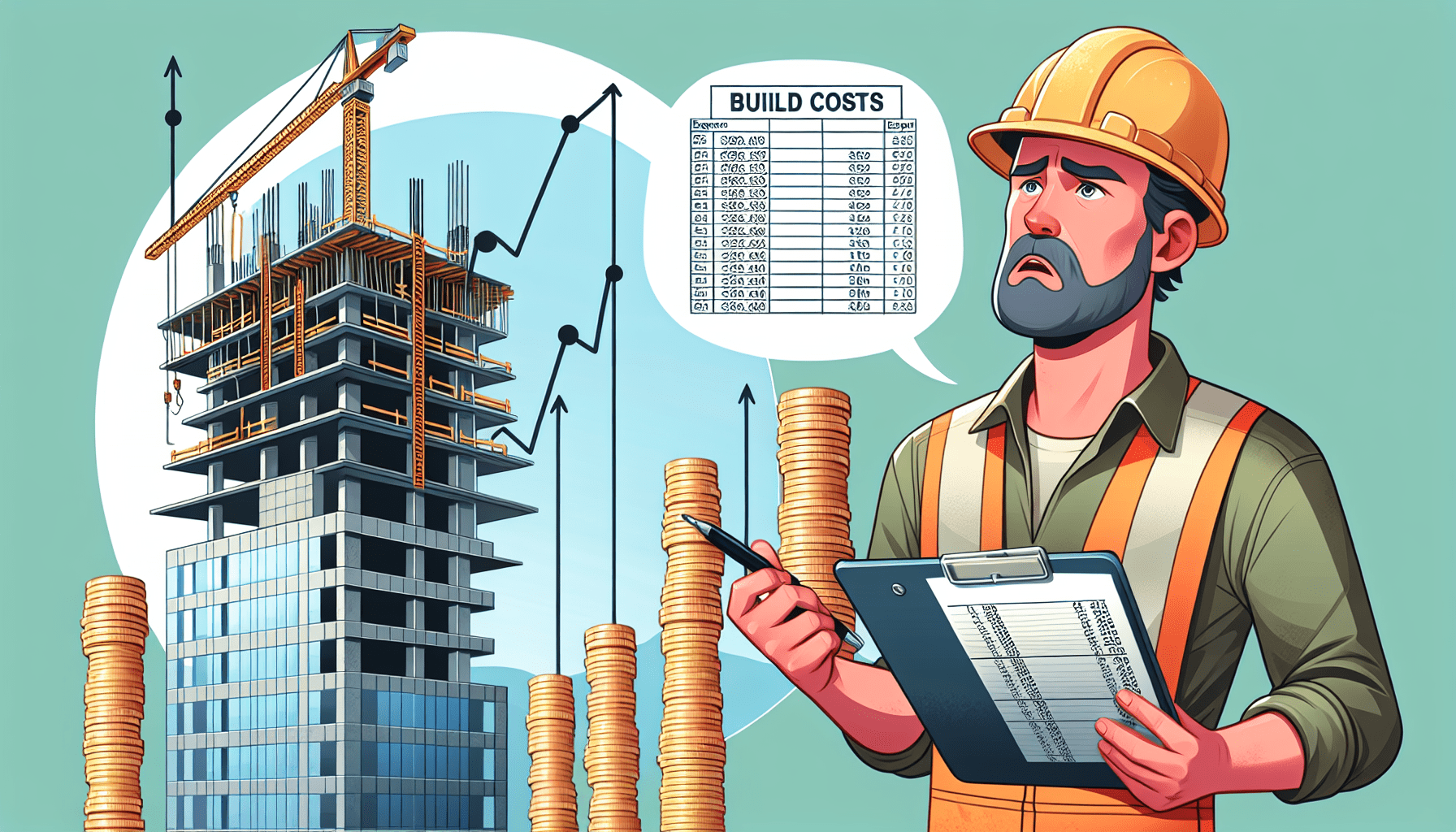

Why Should You Care About Underinsurance?

Imagine your home as a pizza masterpiece. You want every topping, but the chef only adds cheese. Being underinsured is like ordering a deluxe pizza and getting just plain cheese. If something happens and you’re underinsured, you won’t have enough coverage to rebuild or repair your private home. Not ideal, right?

Real-Life Example:

Meet Bob. Five years ago, he bought his dream home and insured it for $300,000. Fast forward to today, a storm strikes, and construction costs have surged. Now, rebuilding may cost $400,000, yet Bob’s insurance only covers $300,000. Bob finds himself in a tough spot.

How Can You Avoid the Underinsurance Trap?

- Review Your Insurance Regularly: Don’t be like me with fitness center memberships—set and overlook. Schedule a yearly insurance coverage overview.

- Know the Market: Keep a watch on development prices. Trust me, it is simpler than binge-watching a brand-new Netflix collection.

- Consult an Expert: Talk to insurance coverage and actual property professionals. They’re like your GPS for navigating this complicated terrain.

Fun Fact:

Did you know the Great Wall of China was insured for $100 million in 2007? This was done as a precaution, just in case any significant damage occurred!

Interactive Element: Check Your Coverage

Calculator Widget: Enter your private home’s present worth and native development price index to see in case your insurance coverage is as much as snuff!

FAQs

Q1: What is underinsurance?

A1: When your insurance coverage protection is lower than the present price to interchange or restore your property.

Q2: How do I know if I’m underinsured?

A2: Compare your insurance coverage coverage with present construction prices. Use our helpful calculator above!

Q3: Can I replace my insurance coverage coverage anytime?

A3: Absolutely! Most insurers enable updates so long as you present the mandatory documentation.

Conclusion

Rising construction prices don’t have to go away you excessive and dry. By staying knowledgeable and proactive, you’ll be able to make sure you’re adequately coated. It’s like having an umbrella prepared when the climate app predicts rain.

Hope that clears issues up! Now go get pleasure from that espresso, figuring out you have obtained one much less factor to fret about. If you have any questions or tales, drop them in the feedback below!