Personal Liability Insurance in 2025: What You Must Know

Personal Liability Insurance in 2025

Personal liability insurance serves as a vital yet frequently underestimated component within the expansive framework of homeowners insurance policies. As we approach the year 2025, the landscape surrounding personal liability insurance is expected to undergo significant and transformative changes, reflecting evolving needs and emerging risks.

These anticipated changes are expected to be driven by the continuous evolution of legislative frameworks, the increasing valuation of both personal and real estate assets, and the growing range of activities that people engage in.

Many of these activities inherently come with a heightened potential for liability claims, reflecting the shifting dynamics of modern lifestyles and societal trends.

Homeowners must remain exceptionally vigilant and well-informed about these constantly evolving changes to guarantee their insurance coverage adequately protects them in the face of these increasingly complex and dynamic risks.

In the current fast-paced and ever-changing landscape, it is more crucial than ever for individuals to take the time to carefully and consistently review their insurance policies to ensure they meet their ongoing needs and provide comprehensive protection.

This proactive approach helps them adapt to factors such as inflation and changes in property values, while also addressing emerging liabilities that modern lifestyles and technological advancements might bring into play.

Whether you are a homeowner or a renter, it offers essential protection against the risk of potential lawsuits and financial hardships that may arise from accidental incidents.

These incidents could include property damage or injuries unintentionally caused by you, your family members, or even your pets, ensuring peace of mind and financial security in unexpected situations.

This comprehensive guide delves deeply into the realm of private legal responsibility insurance coverage, highlighting its critical importance, and numerous advantages, and providing practical advice on securing the best possible protection for your valuable assets while fostering peace of mind.

What is Personal Liability Insurance?

Personal liability insurance is essentially a safety net that comes into play when you’re held legally responsible for an injury to another person or damage to their property. It’s a component of standard homeowners or renters’ insurance policies, providing coverage that extends beyond the physical confines of your home.

This type of insurance can cover legal fees, medical bills, and other damages, ensuring that an unfortunate incident doesn’t lead to financial ruin. Personal liability insurance is a kind of protection that protects policyholders against authorized claims for harm or property injury triggered by others.

It covers legal defense costs and settlements or judgments, which is usually a monetary lifesaver in the occasion of an unexpected accident. Whether somebody slips in your icy driveway or your canine bites a passerby, personal liability insurance steps in to cover the associated prices, as much as the coverage restricts.

Why is Personal Liability Insurance Important?

Personal liability insurance is crucial because it acts as a safety net for your financial security. Without it, you could be personally responsible for paying out of pocket for claims that exceed your other insurance coverage or for incidents not covered by other policies.

This type of insurance is particularly important for homeowners and pet owners, as it can protect against claims of property damage or bodily injury that occur on your property or as a result of your actions or those of your family members, including pets.

Accidents occur unexpectedly, and without enough protection, you can be held personally liable for costly medical bills or property injury. In the present day’s litigious society, lawsuits can result in significant financial losses, doubtlessly placing your belongings, financial savings, and even your house in danger.

Personal legal responsibility insurance coverage acts as a security web, guaranteeing that you’re financially protected from such risks.

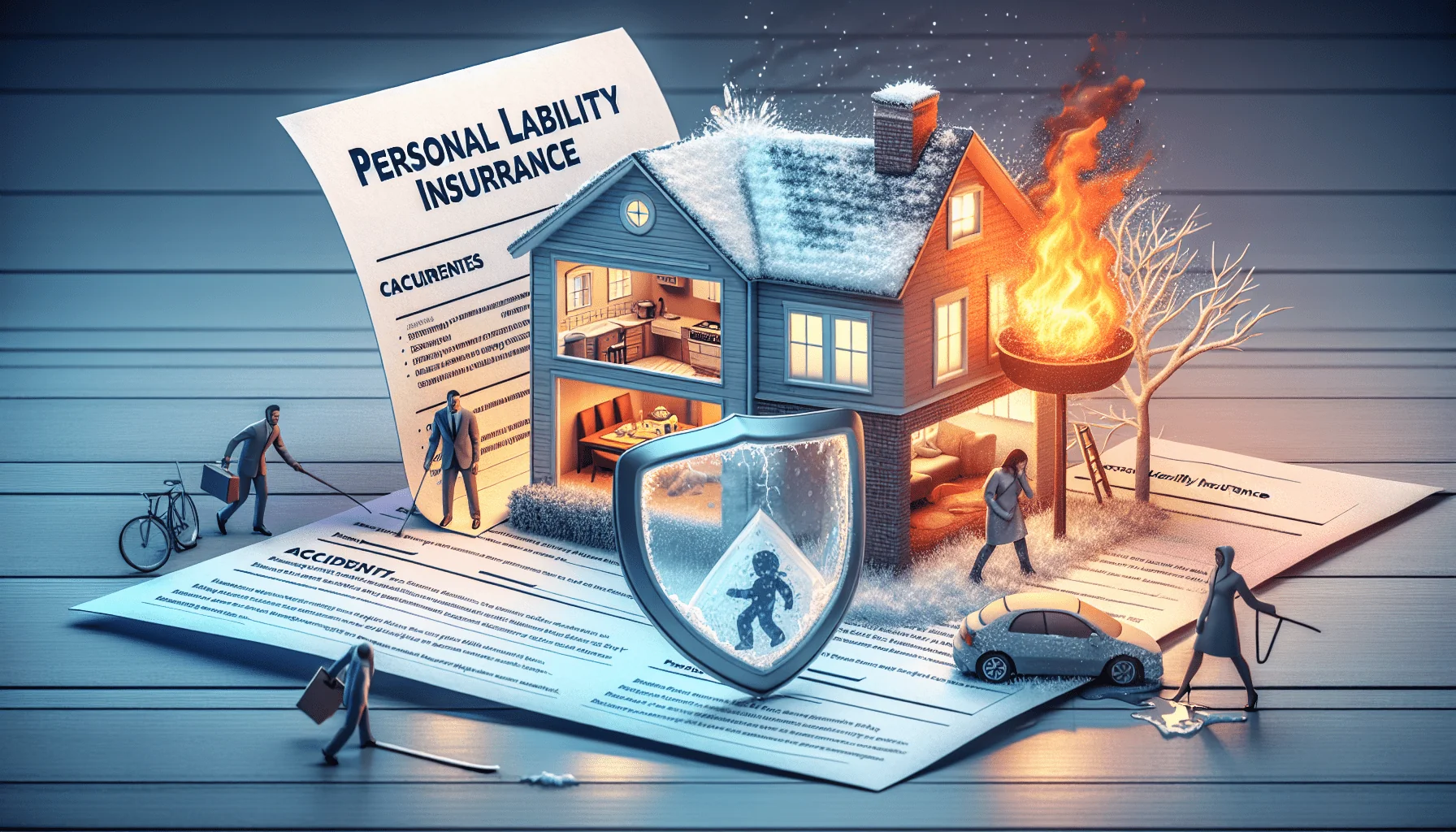

Key coverage areas of personal liability insurance:

1: Bodily Injury: Property Damage: In addition to covering injuries you may inadvertently cause to others, personal liability insurance also extends to the damage you might cause to someone else’s property.

Whether it’s accidentally breaking a valuable vase at a friend’s house or your child hitting a baseball through the neighbor’s window, this aspect of your policy can help cover the costs of repairs or replacement.

This protection not only helps to maintain your relationships by ensuring you can make amends for accidents, but it also safeguards your finances from unexpected out-of-pocket expenses.

If somebody is injured on your property (e.g., a visitor journeys over an unfastened rug), private liability insurance helps cover medical payments, misplaced wages, and authorized protection prices.

2: Property Damage: In addition to personal liability and property damage, homeowner’s insurance typically includes coverage for personal belongings. This means that if your possessions are stolen or damaged due to covered peril, such as a fire or severe weather, your policy can help replace them.

It’s important to have an inventory of your belongings and understand the limits and exclusions of your policy, ensuring you have adequate coverage for valuable items.

Accidental damage to someone else’s property (e.g., your youngster breaks a neighbor’s window) can also be lined, guaranteeing that you do not bear the restore or substitute prices.

3: Legal Defense: 4: Peace of Mind: Ultimately, the most significant benefit of having personal liability insurance is the peace of mind it provides. Knowing that you are financially protected in the event of unforeseen accidents or legal challenges allows you to live your life with greater confidence and security.

This coverage acts as a safety net, ensuring that your savings and assets are not jeopardized by claims that could otherwise be financially crippling. Even if a declaration in opposition to you is groundless, defending yourself in court might be expensive. Personal legal responsibility insurance helps cover these authorized bills, together with legal professional charges and courtroom prices.

4: Libel and Slander: Additionally, personal liability insurance extends protection to instances of libel and slander, which are increasingly common in the age of social media and online communication.

Should you inadvertently make a statement that harms someone’s reputation, this coverage can be invaluable in shielding you from the financial repercussions of a lawsuit.

It provides peace of mind, knowing that you have a safety net in place to handle the unpredictable nature of personal interactions in the digital era.

Some policies may cover lawsuits related to defamation claims (i.e., damaging somebody’s popularity by means of false statements), offering peace of thought in the present day’s social media-driven world.

How Much Coverage Do You Need?

Determining the right amount of coverage for your needs is a nuanced process that hinges on various factors, such as the nature of your online presence, the scale of your audience, and the type of content you produce.

For those who engage heavily in opinion-driven content or work within contentious industries, higher coverage limits may be prudent to safeguard against potential legal challenges.

It’s essential to consult with an insurance specialist who understands the intricacies of digital liabilities to ensure that your policy is tailored to the unique risks you face in the virtual landscape.

The quantity of personal liability coverage you need is dependent upon your monetary scenario and belongings. Most homeowners’ insurance policies provide a standard coverage quantity, sometimes starting from $100,000 to $500,000.

But, when you’ve got vital belongings, similar to a high-value home or savings, it’s advisable to contemplate growing your protection or buying an umbrella coverage. Umbrella insurance provides additional liability protection beyond the bounds of your commonplace coverage.

How Does Personal Liability Insurance Work?

When a claim is filed against you for damages or injuries that you’re responsible for, personal liability insurance steps in to cover the costs up to the limit of your policy. This includes legal fees, medical bills, and other associated expenses that may arise from the incident.

Without this coverage, you would be personally responsible for paying these costs out of pocket, which could be financially devastating, especially if the damages are substantial. On the occasion of a lined incident, the method sometimes works as follows:

1: Incident Occurs: Upon the occurrence of an incident, you must promptly notify your insurance provider to initiate a claim. The insurer will then evaluate the situation to determine if it falls under the terms of your policy coverage.

If the claim is accepted, the insurance company will work with you to assess the extent of the damages and calculate the appropriate compensation to cover the losses, ensuring that you’re not left to shoulder the financial burden alone.

If somebody is injured on your property or in the event you’re held accountable for property injury, you file a claim with your insurance supplier.

2: Investigation: Assessment and Adjustment: Once the claim is filed, an insurance adjuster will be assigned to assess the damage or injury involved. This professional will review the circumstances, inspect any physical damage, and may interview witnesses or consult with experts if necessary.

Their goal is to determine the extent of the insurance company’s liability and to provide an estimate for the cost of repairs or medical expenses, which will form the basis of the settlement offer. The insurance company investigates the claim, figuring out legal responsibility and assessing potential damages.

3: Settlement: Once the assessment is complete and liability is established, the negotiation phase begins. The claimant and the insurance company enter discussions to reach an amicable settlement amount.

This process may involve several rounds of negotiation, with each party presenting evidence and arguments to support their valuation of the claim. If an agreement is reached, the insurance company will issue a settlement check to the claimant, thereby closing the claim.

However, if negotiations stall and a settlement cannot be agreed upon, the claim may proceed to litigation, where a court will determine the outcome. If the claim is legitimate, your insurer will cover the costs up to your policy’s limit. In cases where damages exceed your coverage, an umbrella coverage might help cover the rest.

Exclusions: What Personal Liability Insurance Doesn’t Cover

Understanding the limitations of personal liability insurance is crucial to ensure that you are adequately protected. Common exclusions typically include intentional acts that cause harm, business-related liabilities, and, in many cases, incidents involving certain breeds of dogs or exotic pets that are considered high-risk.

It’s important to read your policy carefully or consult with your insurance agent to clarify what is not covered, so you can consider additional policies or riders to fill in those gaps. Personal legal responsibility insurance coverage has its limits, and understanding the exclusions is vital. Typically, it doesn’t cowl:

1: Intentional hurt or damages: Business-related activities conducted in your home: If you’re running a business from your residence, standard personal liability insurance usually won’t cover incidents related to that business. For such cases, you may need to look into a separate commercial liability policy to ensure you’re adequately protected.

This distinction is crucial for home-based entrepreneurs to understand, as mixing personal and business liabilities can lead to significant coverage gaps. Any injury or harm triggered intentionally by the policyholder is excluded.

2: Business-related incidents: To further mitigate risks, home-based entrepreneurs should consider the scope of their business activities and how they interact with their personal lives. For instance, if clients or customers regularly visit your home, you may need additional liability coverage to account for potential accidents or injuries occurring on the premises.

Similarly, if you store sensitive client data on your home computer, cyber liability insurance becomes essential to protect against data breaches and cyber-attacks. If you are operating a business from home, your private legal responsibility protection will not extend to business-related claims.

3: Auto accidents: When considering auto accidents in the context of home-based businesses, it’s crucial to understand that your personal auto insurance policy may not cover incidents that occur while conducting business activities.

For instance, if you’re delivering products or visiting clients using your personal vehicle, and an accident takes place, you could be held personally liable for damages if your insurance doesn’t recognize the business use of your car.

To mitigate this risk, it’s advisable to speak with your insurance provider about adding a commercial rider to your existing policy or obtaining a separate commercial auto insurance policy to ensure comprehensive coverage while on the road for business purposes. Liability from car accidents is covered under auto insurance, not private legal responsibility insurance coverage.

Practical Tips to Enhance Your Coverage:

1: Assess Your Assets: Understanding the value of your assets is crucial in determining the extent of coverage you require. Take inventory of your business equipment, inventory, and any other assets that could be at risk in the event of a vehicle-related accident.

By doing so, you can tailor your policy limits to ensure that you’re not underinsured, which could leave you vulnerable to out-of-pocket expenses, or overinsured, which could lead to unnecessary premiums.

Make sure your coverage is sufficient to protect your home, financial savings, and other belongings. If you have personal high-value belongings, take into account an umbrella coverage.

2: Review Your Policy Regularly: Understand Your Deductibles: It’s crucial to know the deductibles that apply to your policy, as these will directly affect your out-of-pocket costs in the event of a claim.

A higher deductible typically means lower premiums, but it also means more financial responsibility if an incident occurs. Weigh the pros and cons of your deductible amount and consider if it aligns with your current financial situation and risk tolerance.

Adjusting your deductible can be a strategic way to manage your insurance costs while ensuring you’re not caught off guard by unexpected expenses. As your life circumstances change (new house, marriage, children), guarantee your protection adapts accordingly.

3: Explore Bundling Options: Bundling multiple insurance policies with the same provider can offer significant savings and simplify your financial management.

By combining home, auto, and life insurance under one roof, you not only streamline your paperwork but also may unlock discounts that are not available when policies are purchased separately.

It’s essential to compare the bundled rates with individual policy costs to ensure that this approach provides the best value for your unique situation. Combining householders and auto insurance can often save you money and simplify claim processing.

4: Consider Umbrella Insurance: Umbrella insurance offers an additional layer of protection that goes beyond the limits of your standard policies. This type of coverage is particularly beneficial for individuals with significant assets or those at a higher risk of legal action due to their profession or lifestyle.

By investing in an umbrella policy, you can secure peace of mind, knowing that you are safeguarded against potentially catastrophic financial losses that could arise from legal battles or claims that exceed your primary insurance coverage.

For those with substantial belongings, umbrella insurance offers an extra layer of protection, sometimes in million-dollar increments, at a comparatively low value.

Authoritative Outbound Link

- Link to respected monetary assets like Investopedia or Forbes to offer extra credibility.

Conclusion: Protecting Your Future with Personal Liability Insurance

Personal liability insurance provides essential protection for householders, protecting in case of accidents or damages for which you’re discovered legally accountable. Without this safeguard in place, you could face financially crippling court costs and compensation payouts that can threaten your assets and future earnings.

It’s not just a wise investment; it’s a crucial layer of security in an unpredictable world. By ensuring that you have adequate personal liability insurance coverage, you’re not only looking after your financial well-being but also providing peace of mind for yourself and your loved ones.

With the fitting coverage in place, you’ll be able to relax straightforwardly, figuring out that your monetary future is secure. Whether it is guaranteeing that you’re adequately covered or considering additional protection with an umbrella policy, safeguarding yourself from surprising legal responsibility claims is a prudent choice for each house owner.

Call to Action: To ensure you’re making the best decisions for your home and future, it’s wise to consult with an insurance expert who can provide personalized advice tailored to your unique situation.

They can help you navigate the complexities of homeowners insurance, identify gaps in your coverage, and suggest appropriate levels of protection.

Taking this step not only gives you peace of mind but also fortifies your financial security against potential risks and liabilities. Contact your insurance provider in the present day to assess or replace your private legal responsibility protection and make sure you’re protected.

National General Insurance: Comprehensive Coverage for Auto, Home, and More

Building Insurance: Everything You Need to Know

Top 5 Small Business Insurance Quotes in 2025: Complete Guide to Protecting Your Business