Home Insurance Discounts

Welcome to Home Insurance Discounts, where protecting your home meets smart financial planning. In this guide, we’ll explore a range of discounts, tips, and expert strategies to safeguard your property while saving money.

Exploring the Terrain: An Outline

Understanding Home Insurance Discounts

Decoding the Basics

Securing your home starts with knowing the basics of insurance coverage discounts. These discounts aren’t universal but are designed for specific situations, letting homeowners adjust their protection and costs.

The Importance of Discounts

Financial Benefits Unveiled

Home insurance discounts are more than just a benefit—they’re a smart strategy for optimizing your financial portfolio. By identifying and leveraging these savings opportunities, homeowners can dramatically lower their insurance costs, freeing up funds for other essential expenses.

Types of Home Insurance Discounts

Bundling: A Fusion of Savings

Save money on home insurance policies by bundling. Combining plans like home and auto with one provider can lead to big savings. This method makes insurance management easier and more affordable.

How to Qualify for Discounts

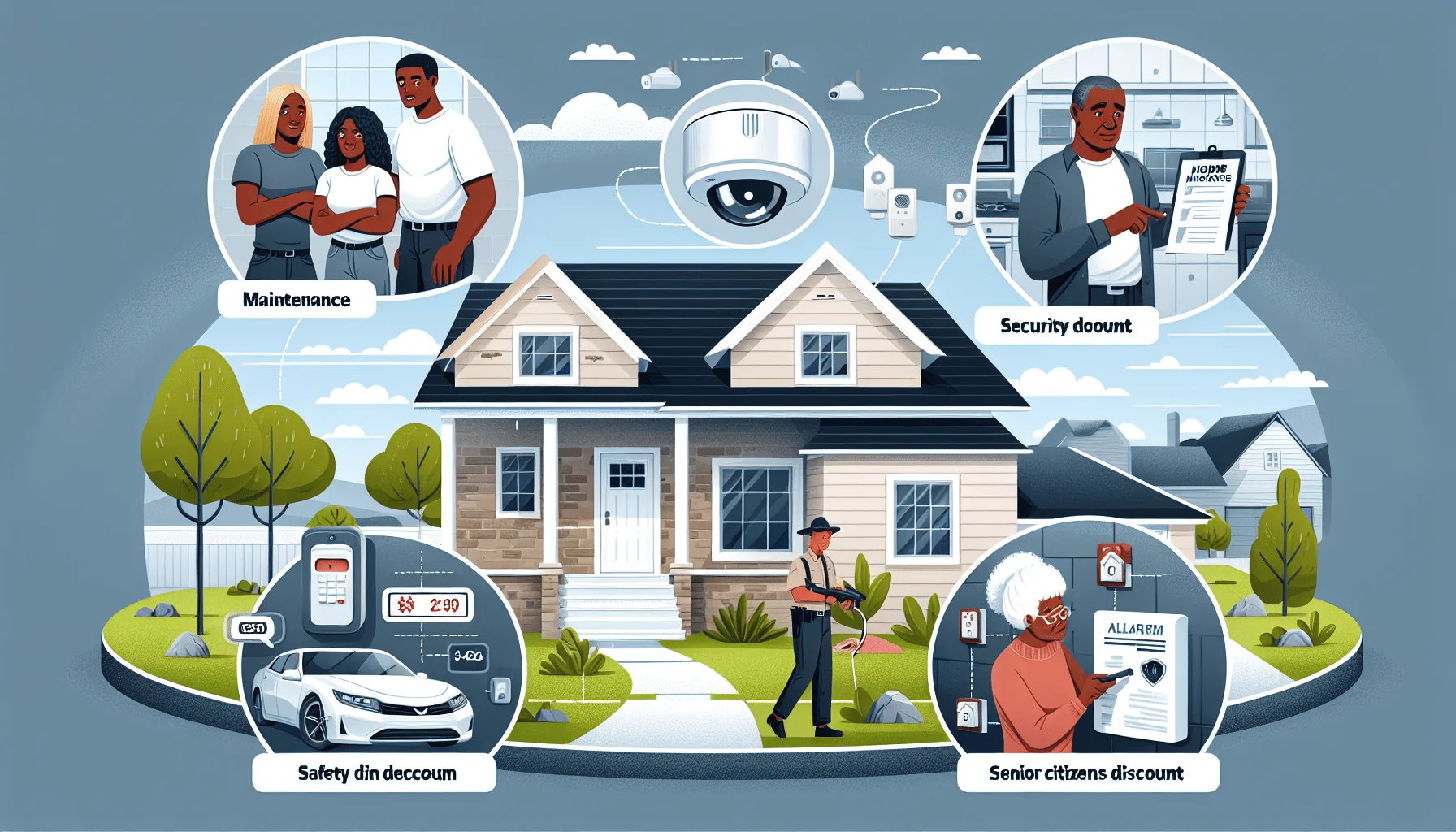

Home Security Systems: Your Guardian Angels

Investing in a sturdy home security system is greater than only a safety measure; it’s a gateway to reductions in your property insurance coverage protection premiums. Insurance providers acknowledge the worth of enhanced security, rewarding house owners with decreased prices for taking proactive steps to protect their property.

Factors Affecting Home Insurance Rates

A Credit Score’s Silent Impact

While many elements affect home insurance coverage prices, one usually uncared-for aspect is your credit score. Maintaining an excellent credit score rating can contribute to reducing premiums. Insurance suppliers view accountable financial conduct as an indicator of reliability, translating into potential monetary financial savings for the home proprietor.

Leveraging Multiple Policies

The Power of Package Deals

Bundling home and auto insurance is just the start. Insurance providers often offer bundle deals, letting families combine multiple insurance policies in one place. This makes managing policies easier and can lead to extra savings.

Smart Home Upgrades

Technological Advances for Premium Reduction

In premium properties, technology enhances comfort and lowers insurance costs. Smart home innovations, such as advanced security systems with sensors and leak detection devices, not only offer convenience but also lead to reduced premiums, highlighting the perfect blend of modern innovation and cost efficiency.

Loyalty Pays Off

The Art of Staying Loyal to Your Insurance

Staying loyal to your insurance coverage protection provider may very well be a rewarding method. Many insurers offer loyalty reductions to long-term policyholders. By sustaining a relentless relationship, house owners can profit from the perks of lowered premiums as a token of appreciation for his or her dedication.

Senior Discounts

Tailored Savings for the Wise and Experience

Aging comes with its perks and in the realm of home insurance,. Many providers offer reduced rates for seniors, acknowledging their wisdom and dedication to responsible homeownership.

The Myth of High Deductibles

Understanding the True Cost

Opting for higher deductibles may seem like an easy way to reduce premiums, but it’s crucial to understand the long-term consequences. This section debunks the myth of excessive deductibles, helping homeowners make well-informed decisions that balance immediate savings with potential future expenses.

Environment-Friendly Discounts

Going Green for Both the Earth and Your Wallet

Homeowners embracing eco-friendly practices can unlock one other realm of reductions. Insurance suppliers usually reward environmentally aware selections harking back to energy-efficient upgrades and sustainable development with decreased premiums.

Homeowners Associations Discounts

Community Benefits Translated into Savings

Residing in a homeowners association (HOA) community offers several benefits, including potential reductions in insurance costs. This section explores how being part of an HOA can lead to lower insurance premiums and enhanced neighborhood safety.

Educational Discounts

Acing the Grades for Lower Premiums

Families with students in school or college can take advantage of academic discounts. Outstanding academic performance not only boosts a child’s educational achievements but may also lead to reduced home insurance premiums. This demonstrates how excelling in school can bring significant financial benefits.

Fire-Resistant Homes

Building Defenses Against Higher Premiums

Living in areas at risk for wildfires doesn’t always mean high insurance costs. Adding fire-resistant features to your home can boost safety and even help you qualify for discounts on your insurance premiums.

Storm-Proofing Your Home

Weathering the Storms of Increased Insurance Costs

As weather becomes more unpredictable, storm-proofing your home is a smart way to stay safe and possibly avoid higher insurance rates. Learn about upgrades that protect your home and your wallet.

Frequently Asked Questions (FAQs)

Common Queries Addressed

Are home insurance coverage protection reductions widespread?

Yes, home insurance coverage protection reductions are prevalent and would possibly significantly cut back your insurance coverage protection payments. By understanding the numerous types of reductions and qualifying requirements, house owners might make educated selections to avoid wasting on premiums.

How can I qualify for loyalty reductions?

Loyalty reductions are generally awarded to long-term policyholders. Staying with an identical insurer and sustaining a relentless relationship might make you eligible for loyalty reductions over time.

Do environmental-friendly reductions make a substantial distinction?

Yes, embracing eco-friendly practices can result in substantial insurance protection reductions. Insurers respect environmentally aware selections, harking back to energy-efficient upgrades, and reward households with decreased premiums.

Can storm-proofing my home lower insurance coverage protection costs?

Absolutely. Storm-proofing your property not only enhances safety but may even qualify you for reductions on insurance coverage protection premiums. By taking proactive measures to protect your property in opposition to storms, you can mitigate the potential enhancement in insurance coverage protection costs.

How do tutorial reductions work?

Educational reductions are generally provided to households with school-age students who maintain good grades. By demonstrating scholastic achievements, house owners can benefit from decreased house insurance coverage premiums as a reward for instructional success.

Is bundling insurance coverage insurance policies a worthwhile method?

Combining multiple insurance policies, such as home and auto insurance, is a highly effective way to reduce premium costs. Many insurers offer significant discounts when you bundle policies, making it a convenient and cost-efficient strategy.

Conclusion

In conclusion, gaining insight into home insurance discounts empowers homeowners to safeguard their properties while reducing costs. Exploring available discounts, understanding eligibility, and applying effective strategies can result in substantial premium savings.

Remember, the essential factor lies in staying educated, being proactive, and leveraging the obtainable options to learn from your property insurance protection experience.