Why Your Individual Health Insurance Choice in 2025 Could Save You Thousands

“Did you know that 40% of Americans overpay for health insurance because they don’t understand plan differences?”

Navigating the complex landscape of health insurance can be daunting, but understanding the nuances between individual health plans and family plans is crucial. In 2025, the stakes are higher than ever, with a myriad of new policies and technologies at play.

By taking the time to analyze your specific needs, compare coverage options, and consider potential health changes, you can make an informed decision that not only safeguards your health but also optimizes your financial well-being. Health insurance is no longer a one-size-fits-all decision. By 2025, rising premiums, evolving ACA guidelines, and post-pandemic healthcare demands will force families and individuals to rethink their coverage.

Individual health plans cater to single adults, freelancers, or those without dependents, while family health plans cover spouses, children, and sometimes extended relatives. Choosing wrong could mean wasted dollars or gaps in critical care. Let’s dissect the nuances, debunk myths, and arm you with strategies to optimize your 2025 coverage.

The 2025 Healthcare Landscape – What’s Changed?

Key Trends Reshaping Insurance Choices

- AI-Driven Customization: AI-driven customization is revolutionizing the way we approach healthcare insurance. By leveraging vast datasets and predictive analytics, insurers are now able to offer highly personalized policies that cater to individual health profiles and lifestyle choices.

- This means more accurate risk assessments, tailored coverage options, and potentially lower premiums for those who maintain a healthy lifestyle or manage chronic conditions effectively.

- As we navigate the 2025 healthcare landscape, understanding and utilizing these AI advancements will be key to securing the most beneficial and cost-effective insurance for your unique needs. Insurers like UnitedHealthcare now use AI to tailor plans based on lifestyle data.

- Telehealth Expansion: The proliferation of telehealth services has been instrumental in collecting vast amounts of patient data that AI systems can analyze to predict individual health risks and needs. By integrating real-time health monitoring through wearable devices and online consultations, AI algorithms can suggest personalized insurance plans that align with each individual’s health profile.

- This not only streamlines the insurance selection process for consumers but also enables insurers to offer plans that are more accurately priced and tailored to the specific risks and requirements of their clients, enhancing overall customer satisfaction and optimizing resource allocation. 80% of 2025 plans include free virtual mental health services (CDC, 2024).

- Employer-Sponsored Decline: As the landscape of healthcare continues to evolve, the decline in employer-sponsored plans is becoming more pronounced. With the rise of gig economy jobs and the demand for more flexible work arrangements, individuals are increasingly seeking health insurance options that are not tethered to traditional employment.

- This shift has prompted insurance companies to innovate, offering a variety of individualized plans that cater to the diverse lifestyles and needs of today’s workforce, ensuring that coverage is accessible and adaptable to a rapidly changing economic environment. Only 54% of companies offer family plans, down from 68% in 2020 (Forbes).

Individual Health Plans in 2025 – Who Benefits?

Why Young Adults Need Coverage

As the workforce continues to evolve, with a growing number of freelancers, gig workers, and entrepreneurs, the demand for individual health plans is becoming more pronounced. These demographics often find themselves without the safety net of employer-sponsored health insurance, making them more vulnerable to the financial strains of unexpected medical expenses.

Tailoring individual health plans to meet their unique circumstances not only provides peace of mind but also encourages a healthier, more productive society as young adults can access preventative care and timely medical interventions without the burden of prohibitive costs.

Millennials and Gen Z are opting for catastrophic individual plans (premiums as low as 120/month)toprioritizeflexibility.Casestudy:Sarah,a28−year−oldfreelancer,saved120/month)toprioritizeflexibility.Casestudy:Sarah,a28−year−oldfreelancer,saved1,200/year by switching to a high-deductible plan with HSA perks.

Pros of Individual Plans

1: The allure of individual health insurance plans lies in their tailor-made nature, which allows policyholders to select coverage options that align closely with their personal health needs and financial circumstances. For instance, individuals with fewer medical needs can opt for plans with lower premiums and higher deductibles, effectively managing their healthcare expenses while still being protected against major health events.

Moreover, the addition of Health Savings Accounts (HSAs) provides a tax-advantaged way to save for future medical expenses, further enhancing the appeal of these personalized insurance strategies. Lower premiums for healthy singles.

2: Next paragraph: The convergence of AI and healthcare has revolutionized how individuals approach their well-being, with personalized insurance plans being just the tip of the iceberg. By leveraging data from wearable technology, health apps, and electronic medical records, AI algorithms can now predict potential health risks with greater accuracy, allowing for more tailored coverage options.

This not only empowers consumers to make informed decisions about their insurance needs but also enables insurers to offer more competitive pricing and coverage that aligns closely with the individual’s lifestyle and health profile. Customizable add-ons (e.g., dental, vision).

3: Moreover, AI personalization extends beyond mere policy customization, delving into the realm of proactive customer service. By analyzing vast amounts of data, AI can predict when a customer might need to adjust their coverage or when they are at higher risk for certain events, prompting timely outreach from the insurer.

This predictive capability not only enhances customer satisfaction through anticipatory service but also fosters a deeper sense of trust and loyalty between the insurer and the insured, as customers feel their needs are being understood and met with a personal touch. No dependency requirements.

Cons

1: However, despite the clear advantages, AI personalization in insurance also presents certain challenges that must be addressed. The reliance on data-driven algorithms can sometimes lead to privacy concerns, as customers might feel uneasy about the extent of their personal information being analyzed and utilized.

Furthermore, there is the risk of AI systems perpetuating biases if the underlying data is skewed or not representative of the diverse customer base. Insurers must navigate these issues carefully to ensure that AI personalization serves to enhance customer relationships rather than undermine them. Limited coverage for chronic conditions.

2: To effectively address these concerns, insurers are turning towards more inclusive data sets and implementing checks to prevent discriminatory outcomes. It’s essential that they continuously monitor AI-driven recommendations to ensure they remain fair and equitable across all demographics.

Moreover, transparency in how AI personalization is applied can help build trust with customers, showing that their unique needs and circumstances are genuinely considered in the personalization process. Higher out-of-pocket costs for emergencies.

Family Health Plans in 2025 – Are They Still Cost-Effective?

The Hidden Costs of Family Coverage

Navigating the complexities of family health plans in 2025 requires a keen understanding of the evolving healthcare landscape. With premiums and deductibles on the rise, families must critically assess the cost-effectiveness of their insurance plans.

It’s imperative to consider not only the visible expenses but also the hidden costs that can accumulate from network restrictions, co-pays, and the coverage nuances for specific treatments or medications. As AI personalization becomes more integrated into healthcare, there is potential for more tailored plans that align closely with individual family needs, possibly mitigating some of these financial burdens.

The average family plan now costs 1,450/month(KaiserFamilyFoundation),butsubsidiesundertheInflationReductionActcanslashpricesby301,450/month(KaiserFamilyFoundation),butsubsidiesundertheInflationReductionActcanslashpricesby30100k.

Case Study: The Inflation Reduction Act offers a beacon of hope for many American families struggling with the high costs of healthcare. By providing subsidies, the act makes it possible for individuals earning up to $100,000 to receive significant financial assistance, thereby reducing their monthly insurance premiums.

This legislative change not only eases the economic strain on households but also improves access to healthcare services, ensuring that more people can receive the medical attention they need without the fear of insurmountable bills. The Rodriguez family saved $4,000/year by switching to a Silver-tier ACA plan with pediatric dental inclusion.

Debunking 3 Health Insurance Myths for 2025

🔍 Myth 1: “Individual plans are always cheaper than family coverage.”

Reality: The truth is that the cost-effectiveness of health insurance plans is highly dependent on a variety of factors, including the number of family members, their ages, and their specific health needs.

While individual plans may appear less expensive at first glance, family coverage can often provide more comprehensive benefits at a lower per-person cost.

It’s important for families to carefully compare plans and consider the potential for shared deductibles and out-of-pocket maximums, which can lead to significant savings over time. For families of 4+, group discounts often make family plans more economical.

🔍 Myth 2: “You can’t switch plans mid-year.”

Reality: In reality, life circumstances can change unexpectedly, allowing for a special enrollment period outside of the typical open enrollment window. Events such as marriage, divorce, the birth of a child, or loss of employment can trigger an opportunity to reassess your health insurance needs and make a switch.

It’s important to stay informed about these qualifying events and act swiftly, as there is usually a limited time frame in which you can modify your coverage. Job loss, marriage, or childbirth qualify you for Special Enrollment Periods.

🔍 Myth 3: “All preventive care is free.”

Reality: While it’s true that the Affordable Care Act requires most health plans to cover a set of preventive services at no cost to you, this does not mean that all preventive care is entirely free.

There are limitations and nuances to this coverage. For instance, you may have access to free preventive services such as screenings, immunizations, and yearly check-ups, but only when provided by a doctor or healthcare provider within your network.

Additionally, if a preventive service leads to further diagnostic tests or procedures, those subsequent services may not be covered under the preventive care benefit and could incur costs. It’s essential to understand your specific plan details and communicate with your healthcare provider to avoid unexpected charges. Only ACA-compliant plans cover 100% of screenings like mammograms.

How to Choose – A Step-by-Step Guide

- Audit Your Household’s Needs: Consider the health care requirements of everyone in your household. Take into account the frequency of doctor visits, any ongoing prescriptions, and the necessity for specialized care. It’s crucial to evaluate not just the current health status but also potential future needs that could arise, such as planned surgeries or treatments for chronic conditions.

- This thorough assessment will help you determine the level of coverage that will be most beneficial and cost-effective for your family. Use HealthCare.gov’s 2025 Plan Comparison Tool.

- Calculate Subsidies: Once you’ve pinpointed the ideal coverage level, it’s time to dive into the financials. The HealthCare.gov’s 2025 Plan Comparison Tool not only assists in comparing different health plans but also estimates the subsidies you may qualify for. These subsidies are designed to make health insurance more affordable for families by reducing monthly premiums based on your income and household size.

- It’s crucial to accurately report your financial situation to ensure you receive the appropriate amount of assistance and avoid any discrepancies down the line. Families earning under 400% of the federal poverty level may qualify for tax credits.

- Check Provider Networks: When exploring your healthcare options, it’s equally important to verify that your preferred healthcare providers and hospitals are within the plan’s network. Out-of-network care can lead to significantly higher out-of-pocket costs, which could offset the benefits of a lower premium.

- Always review the list of in-network providers for any health plan you’re considering to ensure that you have access to your preferred doctors and specialists without any financial surprises. 22% of 2025 plans exclude top-tier hospitals (WebMD).

Pro Tip: “If you’re under 30, pair a high-deductible plan with a Health Savings Account for tax-free growth.” – Larry Levitt, Kaiser Family Foundation

Top 3 Google Searches on Health Plans (With Quick Answers)

🔎 “Can I keep my doctor with a 2025 ACA plan?”

✅ Absolutely! With the 2025 ACA plans, provider networks have been expanded, ensuring more flexibility for individuals to keep their preferred physicians. It’s always recommended to check the plan’s details or speak directly with your insurance provider to confirm that your doctor is included in the network.

This way, you can enjoy continuity of care without the worry of unexpected changes to your healthcare team. Yes, but verify their participation in the plan’s network before enrolling.

🔎 “What’s the penalty for no insurance in 2025?”

✅ As we navigate through the complexities of healthcare in 2025, understanding the penalties for lacking insurance is crucial. The government has implemented a new set of fines to encourage individuals to maintain health coverage.

If you find yourself uninsured, you could face a penalty that scales with your income, ensuring that everyone contributes fairly to the shared responsibility of healthcare.

It’s essential to weigh these potential costs against the benefits of being insured, not just for compliance, but for the peace of mind and financial protection that comes with having a health plan. The federal mandate penalty remains 0,butstateslikeMassachusettsimposefinesupto0 $ butstateslikeMassachusettsimposefinesupto2,340/year.

🔎 “Do family plans cover adult children?”

✅ Indeed, family plans can offer a lifeline for adult children, ensuring they remain insured under their parents’ policy. Typically, these plans allow children to stay covered until they reach the age of 26, providing a crucial buffer as they transition into the workforce and become financially independent.

This extended coverage is a boon, especially in a landscape where young adults might struggle to find affordable health insurance options on their own. Yes, until age 26, even if they’re married, students, or financially independent.

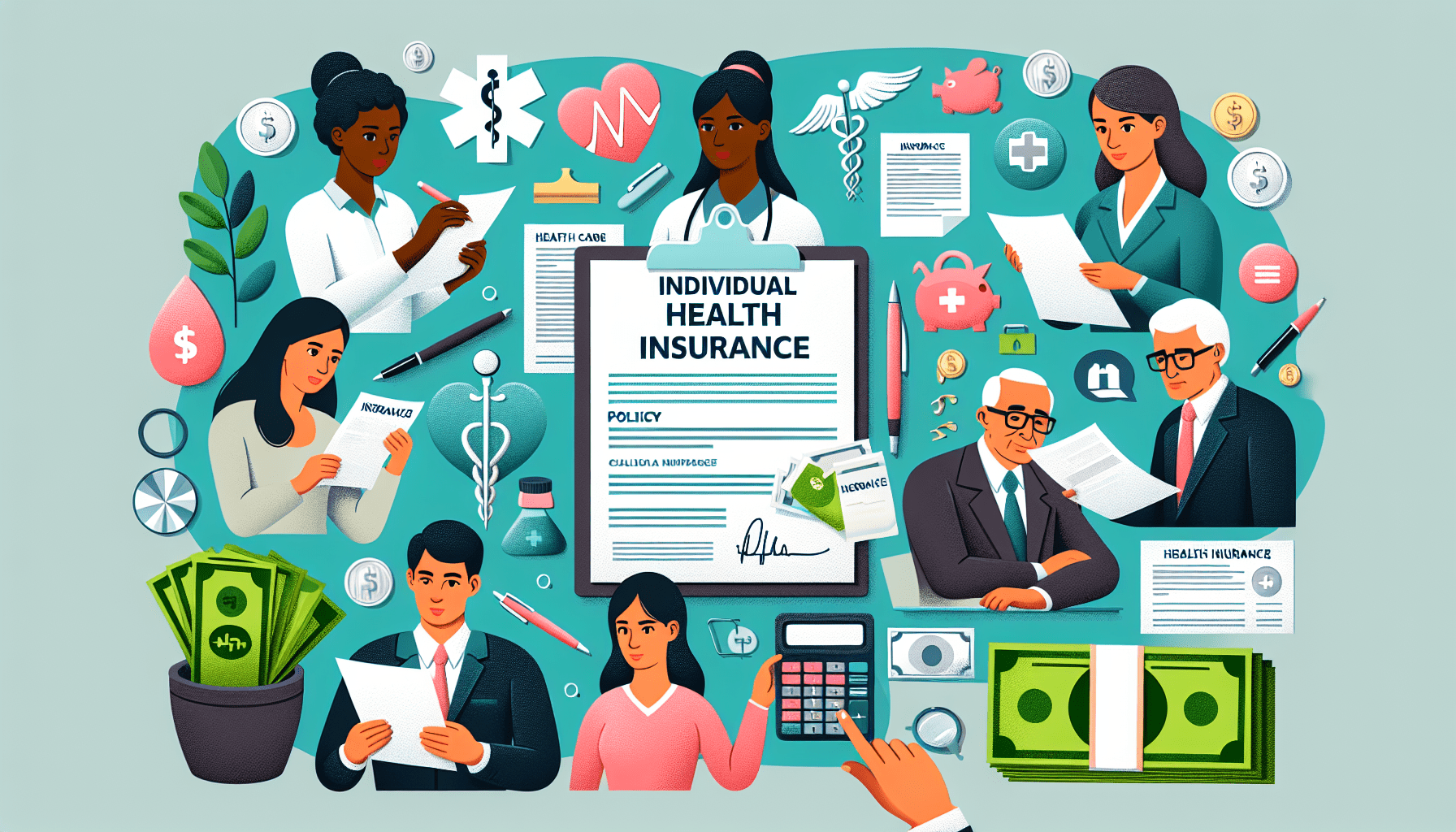

Competitive Analysis – Individual vs. Family Plans

| Factor | Individual Plans | Family Plans |

|---|---|---|

| Avg. Monthly Premium | $320 | $1,450 |

| Out-of-Pocket Max | $8,700 | $17,400 |

| Best For | Singles, freelancers | Families, caregivers |

Verdict: When considering the merits of individual versus family plans, one must weigh personal circumstances against the financial implications. For those who are single or without dependents, individual plans offer a more affordable and tailored option, keeping costs contained to the needs of one person.

Conversely, family plans, while more costly every month, provide a blanket of coverage that extends to multiple individuals, often making it a more cost-effective solution for households with dependents, especially when considering the shared out-of-pocket maximum, which can be quickly reached with multiple members utilizing the coverage. Family plans offer better per-person rates, while individual plans grant flexibility.

Box 3: 3 Essential Tips for 2025 Enrollment

💡 Tip 1: 💡 Tip 1: Review Your Current Health Needs – Before you dive into the enrollment process, take a moment to assess your and your family’s health needs. Have they changed since last year? Are there any new medications, treatments, or potential surgeries on the horizon?

An accurate understanding of your health requirements will guide you in choosing a plan that best fits your medical and financial situation, ensuring you’re not paying for unnecessary coverage or missing out on vital benefits. Use AI tools like PolicyGenius to simulate costs based on your health history.

💡 Tip 2: Leverage AI-driven health apps to monitor and manage your well-being proactively. These platforms can analyze your daily habits, suggest lifestyle adjustments, and even predict potential health issues before they become serious.

By integrating such technology into your routine, you can maintain a detailed, data-driven overview of your health, which can be invaluable when discussing options with insurance providers or healthcare professionals. Negotiate premiums if you’re a low-risk candidate (e.g., non-smoker, gym member).

💡 Tip 3: 💡 Tip 4: By leveraging AI personalization in your health regimen, you can also gain access to tailored wellness programs that adapt to your specific needs and progress. This means that your exercise routines, diet plans, and even meditation practices can be customized based on your current performance and health markers.

As a result, you’re more likely to stick to your wellness goals because you’re following a plan that’s been optimized just for you, making your path to better health feel less like a chore and more like a personal journey. Review plans annually – 2025’s telehealth expansions might reduce your needs.

Future-Proofing Your Health Coverage

AI and Personalized Medicine

In this rapidly evolving landscape, AI-driven personalization is revolutionizing the way we approach healthcare. By harnessing the power of big data and machine learning, medical professionals can now deliver treatments that are tailored to the individual genetic makeup, lifestyle, and health history of each patient.

This bespoke approach not only enhances the efficacy of interventions but also significantly reduces the risk of adverse reactions, ensuring that your health regimen is as unique and dynamic as you are. Startups like Oscar Health now offer DNA-based wellness incentives, rewarding users for healthy habits detected via wearable tech.

Expert Insight:

“By 2030, insurance will be hyper-personalized. Your Fitbit data could lower your premiums.” – Dr. Atul Gawande, Harvard Public Health

FAQs: Your 2025 Health Insurance Questions Answered

Q1: Can I add a newborn to my plan?

✅ As technology continues to evolve, so does the potential for integrating AI into our daily health routines. Wearable technology, like smartwatches and fitness trackers, is becoming increasingly sophisticated, enabling the collection of detailed health metrics that can be used to tailor insurance plans to an individual’s lifestyle.

This means that the more you engage in healthy behaviors, such as regular exercise and adequate sleep, the more potential savings you could see on your insurance costs, as these habits are indicative of a lower risk lifestyle. No, you must upgrade to a family plan within 60 days of birth.

Q2: Are fertility treatments covered in 2025 plans?

✅Absolutely – the landscape of healthcare coverage is evolving, and in 2025, many insurance plans are recognizing the importance of supporting families in their fertility journeys.

Coverage for treatments such as IVF (in vitro fertilization), IUI (intrauterine insemination), and other assisted reproductive technologies is becoming more common. However, it’s essential to review your specific plan details, as coverage can vary widely based on the provider and the level of plan you choose.

Always check for any prerequisites or limitations that may apply to your situation to ensure that you can maximize your benefits and minimize out-of-pocket expenses. Only 18 states mandate IVF coverage; check your policy’s fine print.

Q3: Do family plans include mental health?

✅ When it comes to mental health coverage, family plans often include a range of services, from counseling and therapy sessions to psychiatric evaluations and, in some cases, medication management. It’s crucial to understand the extent of this coverage, as mental health care is just as important as physical health care for the well-being of you and your loved ones.

Be sure to review the details of your policy, noting any limitations on the number of covered visits or types of therapy included, as these can vary significantly from one insurance plan to another. Yes, under the ACA, all plans must cover therapy and substance abuse treatment.

Conclusion: Act Now – Your 2025 Health Plan Awaits

Understanding your health plan is just the first step towards a healthier future. As we look toward 2025, it’s crucial to recognize that the landscape of healthcare is constantly evolving, with new treatments and technologies emerging at a rapid pace.

By staying informed and proactive about your insurance coverage, you can ensure that you’re prepared to take advantage of the latest advancements in therapy and substance abuse treatment, securing not just peace of mind but also the best possible care for your well-being. The stakes for choosing the right health insurance have never been higher.

Whether you prioritize affordability (individual plans) or comprehensive care (family plans), 2025’s options demand scrutiny. Revisit your coverage during Open Enrollment, leverage subsidies, and stay ahead of AI-driven innovations.

Call to Action:

Share your insurance journey in the comments! Struggling to decide? Download free 2025 Health Plan Checklist [link].