Underinsured Home Coverage: Is Your Home a Ticking Financial Time Bomb?

Did you know that 68% of U.S. homes are underinsured by an average of 18%, according to a 2022 report by CoreLogic?

Being underinsured means that in a disaster, such as a fire, storm, or burglary, homeowners may find themselves financially vulnerable, unable to rebuild or replace their lost possessions fully. Full coverage can lead to devastating out-of-pocket expenses, often at the worst possible time.

Unfortunately, many homeowners are unaware of this risk, assuming their standard insurance policy will cover all potential damages and losses, only to discover the harsh reality when it’s too late. Imagine rebuilding your home after a wildfire, only to realize your insurance covers just half the cost. Underinsured home coverage isn’t just a paperwork oversight—it’s a financial disaster waiting to happen.

To avoid facing a critical situation, make it a priority to thoroughly review your home insurance policy well before an emergency arises. Be sure to familiarize yourself with the coverage specifics and regularly update the value of your home and possessions as they evolve.

Maintaining up-to-date insurance is essential to protect your finances and ensure you’re ready to rebuild your home and life after a disaster. Underinsured home coverage occurs when your policy falls short of covering the full cost of repairing or rebuilding your home.

This gap leaves homeowners vulnerable to crippling out-of-pocket expenses. In this guide, you’ll learn how to identify risks, adjust your policy, and protect your most valuable asset—before it’s too late.

Why Underinsured Homes Are a Ticking Time Bomb

Understanding the nuances of your homeowners insurance policy is crucial, yet often overlooked. Many homeowners mistakenly believe that their insurance coverage will automatically adjust to market conditions or the actual cost of construction.

However, without actively reviewing and updating your coverage to reflect changes in the building costs, local regulations, or improvements to your property, you could be left with a policy that falls short when disaster strikes.

Natural disasters, inflation, and rising construction costs have made underinsurance a silent crisis. For example, after California’s 2023 wildfires, thousands discovered their policies didn’t cover updated building codes or material shortages.

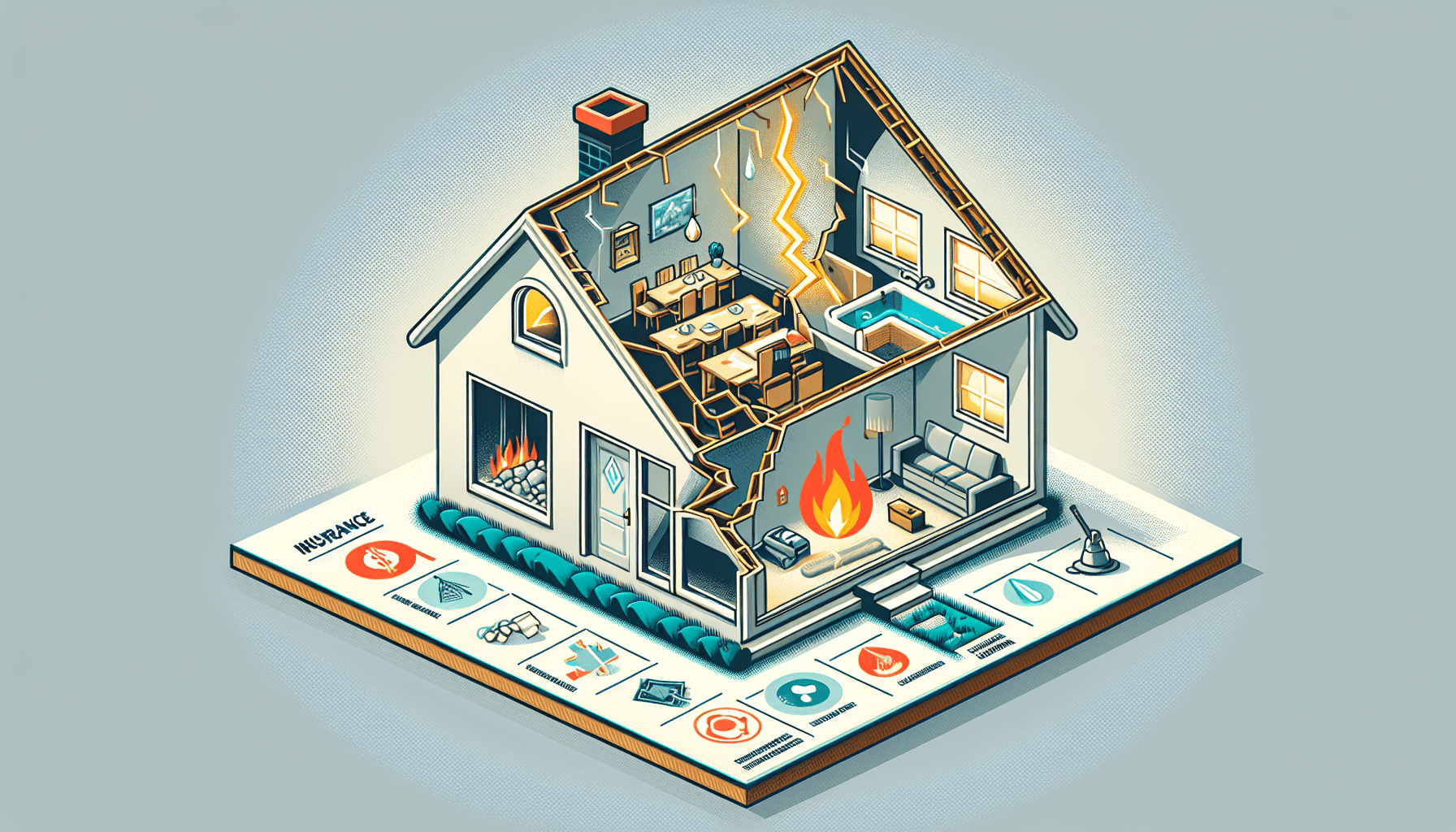

Key Risks of Underinsurance:

1: Rebuilding Challenges: Not having enough insurance can cause serious financial problems for homeowners trying to rebuild. Without proper coverage, they might struggle to pay for repairs, leading to poor living conditions or being unable to rebuild entirely.

Moreover, the emotional toll of losing a home is compounded by the stress of navigating insurance shortfalls, often resulting in protracted negotiations with insurers and potential legal battles to secure additional funds. Your policy may only cover 300,000, but rebuilding costs 450,000.

2: Excluded Perils: To make matters worse, standard policies often come with excluded perils that can leave homeowners in a lurch when disaster strikes. For example, damage from earthquakes or floods typically requires additional coverage, which many homeowners may not have considered until it’s too late.

This mistake can cause serious financial problems, as property owners may have to pay the full cost of repairs or rebuilding. Coverage for floods, earthquakes, and mold often needs separate policies.

3: Personal Property Limits: Understanding personal property limits in an insurance policy is essential. Standard coverage often includes a maximum payout for personal belongings, which may fall short of their actual market value or replacement cost.

Homeowners should list their belongings and think about extra coverage for valuable items like jewelry, art, or electronics that go beyond standard policy limits. These high-value items might require riders.

Debunking 3 Myths About Home Insurance

Myth 1: “Market Value = Replacement Cost.”

Truth: Market value and replacement cost are not the same. Market value depends on what buyers are willing to pay, influenced by location, land value, and real estate trends.

Replacement cost, on the other hand, refers to the amount it would take to rebuild your home as it stands, with the same materials and craftsmanship, in the event of a total loss.

This figure is typically higher than the market value, especially in a down market, and it is crucial to ensure your home insurance policy reflects this to avoid being underinsured. Replacement cost covers rebuilding, not land value. A 500-square-meter home might cost 700k to rebuild.

Myth 2: “My Agent Chose the Best Coverage Limits for Me.”

Truth: It’s easy to assume your agent has picked the perfect coverage limits for your home insurance, but that’s not always the case. As a homeowner, it’s crucial to carefully review and understand your policy to confirm it aligns with your unique needs.

Over time, the cost to rebuild your home can increase due to inflation or improvements you’ve made to the property, and your policy limits may need to be adjusted accordingly to ensure you’re fully protected. Agents rely on outdated tools. Verify calculations using a replacement cost estimator.

Myth 3: “I Don’t Need Annual Reviews.”

Truth: Reality often tells a different story—one where the unexpected can, and does, happen. Annual reviews of your insurance policy are not just about adjusting to the financial ebbs and flows; they serve as a critical checkpoint to reassess your coverage in light of any life changes.

Major home renovations, buying valuable items, or changes in your living situation can impact your insurance needs, possibly leaving you underinsured or paying for unnecessary coverage.

Without an annual review, you may miss the opportunity to tailor your policy to your current circumstances, ensuring assets are adequately protected. Construction costs rose 14% YoY in 2023 (National Association of Home Builders). Annual adjustments are critical.

Step-by-Step Guide to Fixing Underinsured Home Coverage

- Calculate Replacement Cost

To accurately calculate the replacement cost of your home, it’s essential to consider various factors beyond just the market value. This includes the cost of materials, labor charges in your area, and any unique features of your home that may require special attention or higher costs to rebuild. - Engage with a professional appraiser or use an online replacement cost estimator for a detailed assessment, ensuring that your insurance coverage aligns with the actual costs you’d face in the event of a total loss. Use tools like MSB’s Replacement Cost Calculator or hire a professional appraiser. Include:

- Square footage

- Custom features (e.g., hardwood floors)

- Local labor and material rates

- Review Policy Limits Annually

Adjusting Your Deductible for Optimal Coverage: Consider the impact of your deductible on both your premium costs and potential out-of-pocket expenses in the case of a claim. A higher deductible typically means lower monthly premiums, but requires more financial responsibility if damage occurs. - Managing your savings and risk tolerance is key to ensuring your policy offers enough protection without straining your budget. Consider adding an inflation guard endorsement to automatically adjust for rising costs.

- Document Everything

When considering AI personalization in insurance, it’s crucial to understand the role of data in customizing your coverage. Artificial intelligence systems analyze vast amounts of information to tailor policies that fit your unique lifestyle and needs. - By meticulously documenting your possessions, lifestyle changes, and any potential risks you might face, you feed the AI with accurate data, enabling it to offer more precise recommendations and adjustments to your insurance plan.

- This detail enhances your policy’s personalization and makes filing claims easier if needed. Create a home inventory with photos or videos. Apps like Encircle simplify this task.

- Purchase Endorsements

- Ordinance or Law Coverage: Additional Living Expenses Coverage: If your home becomes unlivable after a covered loss, this add-on helps cover temporary living costs.

- It helps to cover the costs associated with temporary housing and living expenses, such as hotel bills and restaurant meals, while your home is being repaired or rebuilt.

- Incorporating AI into this section of your policy customizes coverage to fit your specific lifestyle, streamlining temporary living arrangements and improving your overall comfort. Effortlessly upgrade your coverage options.

- Extended Replacement Cost: Extended Replacement Cost coverage helps homeowners protect against unexpected increases in repair or rebuilding expenses. With AI, insurers can offer more accurate estimates using real-time data on local building rates, material costs, and labor availability.

- If rebuilding your home costs more than your policy limit due to unexpected events, AI-enhanced Extended Replacement Cost coverage can help cover the extra expenses. This adds 25–50% above your dwelling limits, offering peace of mind.

Top 3 Google Searches (With Quick Answers)

1. “How much dwelling coverage do I need?”

To ensure your home is fully protected, your dwelling coverage should be sufficient to cover the total cost of rebuilding it from the ground up. This includes factoring in current construction costs, materials, and any unique features or upgrades your home may have.

Consulting with an insurance professional can provide a personalized assessment to ensure you’re fully protected without overspending on premiums. Aim for 100% of replacement cost, excluding land. Use calculators or consult an independent appraiser.

2. “Does home insurance cover flood damage?”

Unfortunately, standard home insurance policies typically do not cover flood damage. To safeguard your home from the financial impact of flooding, you would need to purchase a separate flood insurance policy.

It’s particularly crucial to consider this additional coverage if you live in an area prone to flooding or if recent climate trends have increased flood risks in your region.

Review your flood insurance policy to ensure it meets your requirements. For more comprehensive coverage, explore obtaining standalone flood insurance through the FEMA National Flood Insurance Program.

3. “Smart Ways to Reduce Your Home Insurance Costs”

Increasing your deductible is an effective way to lower your home insurance premiums. However, you can afford the higher out-of-pocket cost if you ever need to file a claim.

Additionally, installing safety features in your home, such as smoke detectors, burglar alarms, and storm shutters, can provide peace of mind but often qualify you for discounts from insurance providers.

Finally, regularly reviewing and comparing insurance policies can help you find the most competitive rates and coverage options tailored to your needs. Increase deductibles, bundle policies, and install security systems (e.g., ADT).

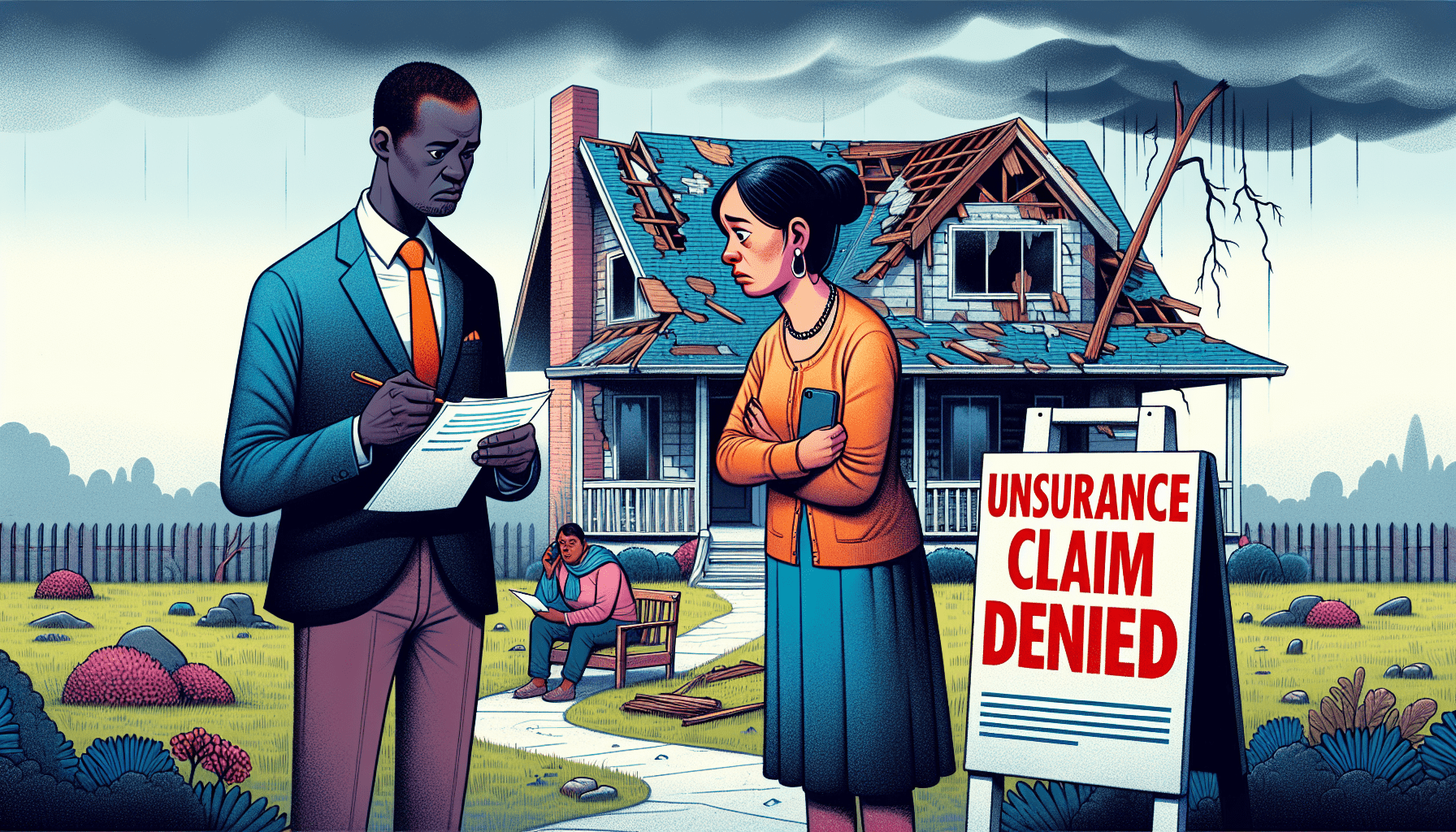

Real-Life Case Study: The Smith Family’s $200k Mistake

The Smith family’s story serves as a cautionary tale for all homeowners. After completing a major kitchen renovation and adding a new wing, they neglected to update their homeowner’s insurance policy to reflect the increased property value.

When an unexpected natural disaster struck, they were devastated to discover that their insurance coverage fell short of the costs needed to repair and rebuild, leaving them with a financial burden that could have been avoided with a simple policy review and adjustment.

In 2022, the Smith family lost their Colorado home to a devastating wildfire. While their insurance provided $400,000 in coverage, rebuilding costs surged to $600,000 due to increased post-disaster expenses. Unfortunately, they hadn’t updated their policy since 2018 or included extended replacement cost coverage.

Lesson: The Smiths’ unfortunate situation underscores the importance of regular insurance policy reviews, particularly in light of changing market conditions and personal circumstances.

Homeowners should review their coverage, considering inflation, property upgrades, and local construction costs.

By doing so, they can ensure that their policy remains aligned with their needs, reducing the risk of being underinsured when disaster strikes. Annual reviews and endorsements are non-negotiable.

3 Essential Tips to Avoid Underinsurance

1: Compare Apples to Apples: When reviewing insurance, compare similar policies. Focus on coverage limits, deductibles, and exclusions—not just the price.

This will help you to understand whether you’re getting comparable coverage or if you may be sacrificing essential protections for a lower premium. Ensure your policy uses replacement cost value (RCV), not actual cash value (ACV).

2: Evaluate Coverage for Valuable Items: Assess the need for additional protection for high-value possessions such as jewelry, artwork, collectibles, or premium electronics. Standard insurance policies often exclude these items entirely, so consider adding riders or endorsements to ensure comprehensive protection.

Talk to your insurance agent to find the best options for your needs. They can help customize your policy and ensure your valuables are covered. Consider insuring items like jewelry, art, or electronics separately.

3: Consult a Pro: 4: Embrace Technology: In today’s digital age, AI personalization is revolutionizing the insurance industry by offering tailored solutions that adapt to individual lifestyles and risks.

Utilizing sophisticated algorithms, AI can analyze vast amounts of data from your daily activities to lifestyle choices, ensuring that your insurance coverage is as unique as your digital fingerprint.

By integrating AI into your insurance planning, you can benefit from a policy that reflects your current situation, anticipates future changes, and provides a dynamic safety net for your valuables. Independent adjusters or contractors can provide realistic rebuild estimates.

The Hidden Role of Inflation in Underinsurance

Inflation often sneaks up, leaving policyholders with coverage that falls short of covering losses. As goods and services become more expensive, so does repairing or replacing property.

Regularly reviewing and updating your insurance policies is essential to stay protected against inflation and avoid the risks of underinsurance.

Construction costs have hit record highs due to supply chain issues and labor shortages. Lumber prices, for instance, jumped 154% in 2021 (Forbes). Without inflation protection, your coverage can quickly become outdated.

Pro Tip: Set up a yearly check-in with your insurance provider. This helps keep your coverage current with changing costs and market trends.

Some insurers provide policies with an automatic inflation guard, which updates your coverage limits to match changes in construction costs. This ensures your investment stays protected without needing frequent updates. If possible, choose a guaranteed replacement cost policy.

How Tech is Revolutionizing Home Insurance

Technology is transforming home insurance. With AI and machine learning, insurers offer personalized policies for each homeowner’s unique risks and needs.

This enables more precise pricing and simplifies the claims process, resulting in quicker payouts and an enhanced customer experience. As technology continues to evolve, increasingly personalized and efficient home insurance solutions are expected to emerge.

Innovative insurtech companies such as Lemonade and Hippo leverage AI to evaluate risks instantly. Their advanced apps utilize satellite imagery to detect potential underinsurance issues, such as aging roof materials.

Future Trend: AI-powered personalization is revolutionizing the insurance industry by offering unmatched customization. Using vast data and advanced machine learning, insurers will design policies tailored to each customer’s lifestyle and changing needs.

This detail allows for more precise pricing, improved risk management, and a better experience for policyholders. The outdated one-size-fits-all insurance model is quickly fading, replaced by blockchain-enabled policies offering transparent and instant claims processing.

Competitive Analysis: Standard vs. Comprehensive Policies

| Feature | Standard Policy | Comprehensive Policy |

|---|---|---|

| Replacement Cost | 100% of stated value | 125–150% with endorsements |

| Perils Covered | Basic (fire, theft) | Extended (floods, earthquakes) |

| Flexibility | Limited | High (custom endorsements) |

Frequently Asked Questions

1. How often should I review my home insurance policy?

When considering the frequency with which to review your home insurance policy, it’s advisable to do so at least annually or in the event of significant life changes, such as a home renovation or the purchase of expensive personal property.

This ensures that your coverage remains in line with the current value of your home and belongings, providing peace of mind that you’re adequately protected.

Additionally, staying abreast of changes in insurance legislation and market trends can help you identify opportunities to adjust your coverage or take advantage of new discounts and endorsements that may benefit your unique situation. Annually, or after renovations, market shifts, or natural disasters.

2. What’s the difference between ACV and RCV?

Understanding the distinction between Actual Cash Value (ACV) and Replacement Cost Value (RCV) is crucial for insurance. ACV compensates you based on the item’s value at the time of loss or damage, accounting for depreciation.

Replacement Cost Value (RCV) coverage ensures damaged items are replaced with new ones at current market prices, without factoring in depreciation. This can impact your payout, making it essential to select coverage that aligns with your budget and risk tolerance. Unlike Actual Cash Value (ACV), which accounts for depreciation, RCV provides the full replacement cost.

3. Can I negotiate coverage limits with my insurer?

Certainly, policyholders have the option to discuss and negotiate coverage limits with their insurers. It’s essential to assess the value of your property and possessions to ensure that your coverage limits are adequate to cover potential losses.

By engaging in a detailed discussion with your insurance agent, you can tailor your policy to fit your unique situation, perhaps opting for higher limits or additional endorsements that provide extra protection for specific valuable items or scenarios not covered under a standard policy. Yes—provide contractor estimates or appraisal reports to justify increases.

4. Does homeowners insurance cover home-based businesses?

While standard homeowners insurance might offer minimal coverage for business equipment and liabilities, it’s typically insufficient for a home-based business. To ensure adequate protection, consider obtaining a dedicated business insurance policy or adding a specialized endorsement to your homeowner’s policy.

This coverage safeguards against business liabilities, income loss, and offers extra protection for specialized equipment and inventory that standard home insurance won’t cover. Instead, get a separate business endorsement.

5. What if my insurer won’t increase limits?

If your insurer won’t increase your coverage limits, find out why. It might be related to your business type, past claims, or perceived risks in your operations.

In these situations, you might need to look for another provider that focuses on business insurance and can meet your coverage needs.

Protecting your business is essential for its long-term success and financial stability. Choose a provider with guaranteed replacement cost coverage.

Conclusion: Don’t Wait for Disaster to Strike

In business, being proactive rather than reactive is the key to maintaining a competitive edge and safeguarding your assets. By opting for an insurance provider that prioritizes your specific needs with guaranteed replacement cost policies, you can rest assured that your business will be equipped to handle unforeseen events with minimal disruption.

The right insurance isn’t just protection—it’s key to your company’s stability and growth. Underinsurance is a problem you can solve today. Update your home’s replacement cost, add essential endorsements, and review your policy. As Warren Buffett wisely said, “Risk comes from not knowing what you’re doing.”

Call to Action:

To stay prepared for the unexpected, take a proactive approach to your insurance. Talk to your provider to fully understand your policy and know exactly what is covered and what is not.

Insurance acts as a safeguard and a wise investment, protecting your business’s financial stability.

Stay ready by staying informed and adjusting as needed to keep your business strong. Download a free Home Inventory Checklist.

2: To get the most out of AI personalization, focus on understanding data and customer behavior. Use algorithms that adapt to customer interactions to deliver unique, customized experiences for each person.

This boosts customer satisfaction, encourages loyalty, and promotes repeat business, creating a win-win cycle for both customers and the company. Bookmark FEMA’s flood map portal to evaluate risks.

3: Using AI personalization, businesses can customize their products and messages to match each customer’s preferences and habits. AI analyzes large amounts of data to predict what they might want next and when they’ll need it.

This proactive approach streamlines the shopping experience and fosters a sense of being understood and valued, which is paramount in building a strong, enduring customer relationship. Share this guide with a homeowner—it could save them $100k.

Discussion Question: In what ways does AI-driven personalization reshape the way businesses engage with their customers? Leveraging data analytics and machine learning, AI enables precise predictions of customer preferences and behaviors, revolutionizing the customer experience.

This helps companies customize their messages and services for each person, creating a highly personalized experience.

As a result, customers are more likely to feel a connection to the brand, seeing it as an entity that truly “gets” them and their unique needs. This level of personalization is not just the future of customer service; it’s rapidly becoming the standard expectation. Have you ever been underinsured? Share your story below.