Can the Right Insurance Save You from Skyrocketing Medical Costs?

In an era where medical expenses are climbing alarmingly, securing the right insurance policy isn’t just a safety net—it’s a financial strategy. The key lies in understanding your health needs and risks and finding a policy tailored to cover those specifics without paying for unnecessary extras.

By carefully reviewing plans and considering deductibles, co-pays, and coverage limits, you can protect yourself from the financial strain of medical expenses. For example, a routine surgery could cost $50,000. Without insurance, this could drain your savings completely.

With the *wrong* insurance, you still pay a 50,000 bill. Without insurance, your savings vanish. With the ∗wrong∗ insurance, you still pay 15,000. But with the right coverage? Just 500. ∗∗Rising medical costs∗∗ are a global crisis—U.S. healthcare spending hit 500. ∗∗Rising medical costs∗∗ are a global crisis—U.S. healthcare spending hit 4.5 trillion in 2022 (CDC).

Yet, strategic insurance choices can shield you. This guide reveals how to beat rising medical costs with the right insurance, blending expert analysis, real-life examples, and myth-busting truths.

Why Are Medical Costs Rising? The Crisis Explained

Understanding the root causes of escalating medical costs is essential to navigate the healthcare landscape effectively. Factors such as advanced medical technologies, an aging population, and the high cost of prescription drugs all contribute to the surge in expenses.

Complex billing and administrative tasks in healthcare often lead to inefficiencies, driving up patient costs.

By analyzing these aspects, we can discover how insurance planning helps reduce financial strain, ensuring access to essential medical care without risking financial security. Healthcare costs rise three times faster than wages (Kaiser Family Foundation), driven by factors such as:

1: Advanced treatments: Advanced treatments, while beneficial for patient outcomes, often come with hefty price tags due to the research, development, and technology involved in bringing these innovations to market. As insurance companies grapple with these rising costs, premiums and out-of-pocket expenses for consumers inevitably climb.

Strategic insurance planning should address present medical needs while preparing for future treatments. Policies must stay comprehensive to cover advanced therapies without becoming too costly for policyholders. Innovations in medicine and technology often raise costs.

2: Administrative Waste: Personalized Care Plans: AI helps reduce waste in healthcare by creating custom care plans for each patient. It analyzes medical data, like genetics and lifestyle, to design treatments that fit individual needs.

This approach improves the effectiveness of treatments but also minimizes unnecessary procedures and tests, potentially reducing overall healthcare expenses. According to JAMA, 30% of U.S. healthcare spending is attributed to bureaucracy.

3: Chronic diseases: Chronic diseases, such as diabetes, heart disease, and cancer, often require long-term management and care. AI-driven personalization in healthcare can lead to more effective monitoring and management of these conditions by analyzing patient data to predict and prevent complications.

With the power of machine learning, AI systems can identify patterns that may indicate a need for intervention, enabling healthcare providers to tailor their approach to each individual’s unique health profile and lifestyle, thus improving patient outcomes and quality of life. 60% of Americans have at least one chronic condition (CDC).

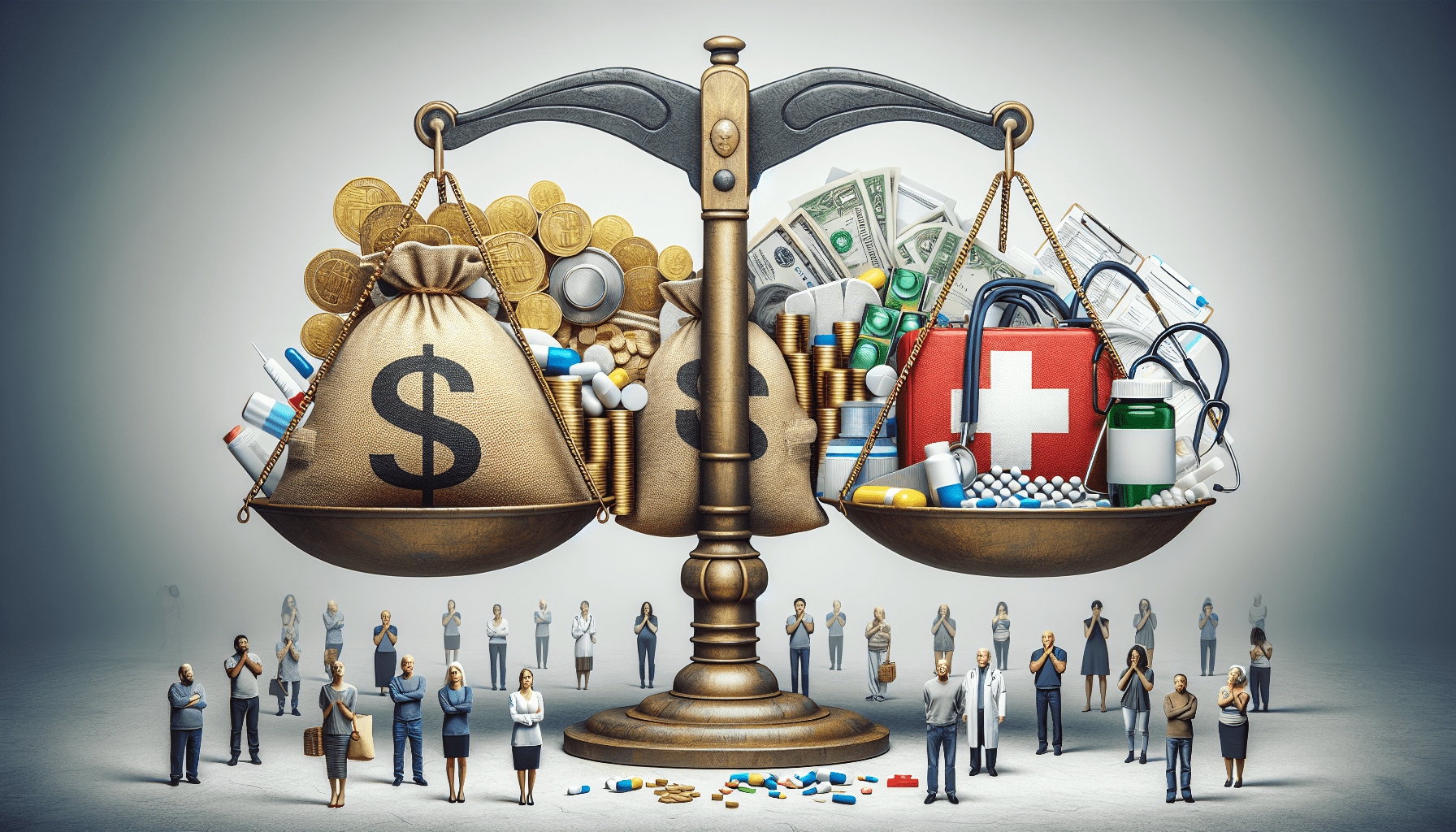

How Insurance Mitigates Financial Risk

AI personalization has become essential in insurance, helping reduce financial risk for both companies and customers. By examining large amounts of data, AI can accurately forecast health events, allowing insurers to set premiums tailored to individual risk levels.

This helps customize insurance plans to fit policyholder needs, prevent fraud, and reduce unnecessary claim payments. These actions support a more reliable and efficient healthcare system.

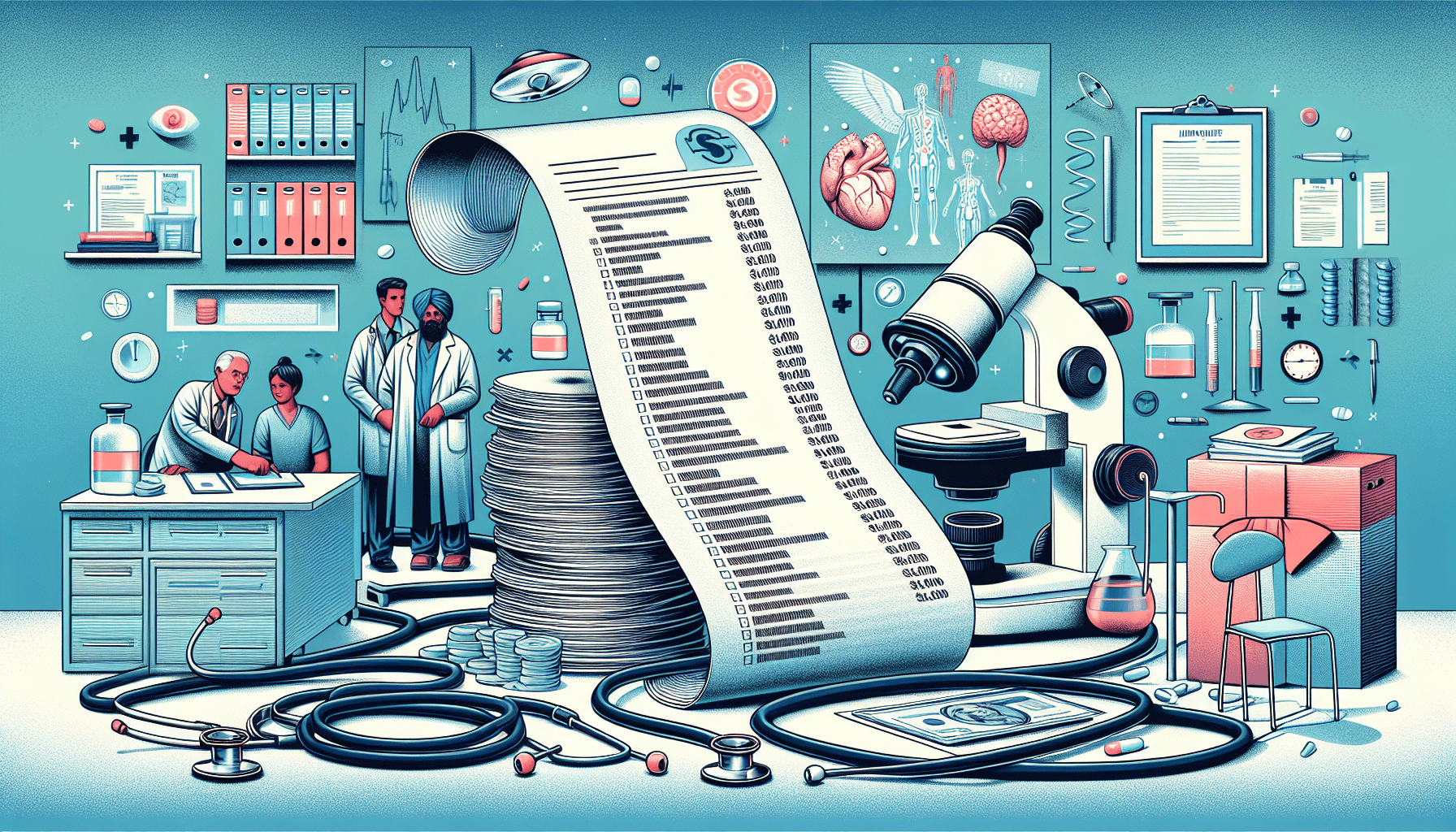

Insurance acts as both a safety net and a bargaining tool. Providers typically offer insurers lower rates than they do for uninsured patients. For example, an MRI might cost $3,000 without insurance but just $500 with coverage.

Debunking 3 Myths About Health Insurance

🔍 Myth 1: “Young, healthy people don’t need insurance.”

Truth: While it’s true that younger individuals may not require medical services as frequently as older adults, accidents and unexpected illnesses can occur at any age. Without insurance, the financial burden of even a single emergency room visit can be overwhelming.

Health insurance usually covers preventive care for free, helping to catch health problems early and avoid serious issues later. Unexpected events like accidents or illnesses can lead to financial ruin.

Myth 2: “All plans cover emergencies.”

Truth: Most health insurance plans include emergency coverage, but the definition of an “emergency” and the services covered can differ widely. Review your plan carefully to know exactly what it considers an emergency and what it will pay for.

Without this knowledge, you might end up with surprise bills for services you thought were fully covered, like ambulance rides or emergency room charges that could be only partially paid or tied to high deductibles. Short-term plans usually don’t cover pre-existing conditions.

🔍 Myth 3: “High-deductible plans are always the most affordable choice.”

Truth: While high-deductible plans often feature lower monthly premiums, they can lead to significant costs if you require frequent or unexpected medical attention. These plans are typically a better fit for individuals who seldom access healthcare services, but may not be the best option for those with recurring or unpredictable healthcare needs.

Consider your healthcare needs and budget before choosing a high-deductible plan. These plans have lower premiums but might lead to higher overall costs due to increased out-of-pocket expenses.

Types of Health Insurance Plans: Which One Beats Costs Best?

1. Employer-Sponsored Insurance (ESI)

- Pros: Employer-Sponsored Insurance (ESI) is often considered the gold standard for health coverage due to its comprehensive nature and cost-sharing between employer and employee. One of the primary advantages of ESI is the tax benefit, as premiums are typically paid with pre-tax dollars, reducing taxable income for employees.

- Companies often secure discounted rates from insurance providers, cutting costs for employees. Payroll deductions make payments easy, while employer subsidies and group pricing add further savings.

- Cons: One downside of employer-provided insurance is the lack of flexibility. Employees are often limited to the plans chosen by their employer, which may not fully meet their health requirements or preferences.

- When employees leave their jobs, they often face the risk of losing health coverage, leading to potential gaps in insurance and financial strain. Additionally, employer-sponsored insurance can create “job lock,” where individuals feel compelled to stay in positions solely to retain their benefits, limiting career mobility and flexibility.

2. ACA Marketplace Plans

- Pros: The ACA Marketplace Plans offer a level of choice and flexibility previously unavailable to many Americans. Individuals can shop for plans that better suit their needs and budgets, with the added benefit of subsidies for those who qualify based on income.

- This allows consumers to choose plans tailored to their needs, balancing premiums, deductibles, and coverage options, moving away from the one-size-fits-all model of employer-based insurance. Subsidies are available for incomes up to 400% of the poverty level.

- Cons: However, while AI-driven personalization offers tailored options, it raises concerns about data privacy and security. As consumers input sensitive information to receive personalized insurance plans, the risk of data breaches and misuse of personal data increases.

- Therefore, insurance companies must invest heavily in robust cybersecurity measures and transparent data practices to ensure that the convenience of personalization does not come at the cost of consumer trust and safety. Narrow networks in some states.

3. Health Savings Accounts (HSAs)

- Tax-free savings: Health Savings Accounts (HSAs) offer a compelling financial tool for individuals looking to manage their healthcare expenses. Contributions to these accounts are tax-deductible, but the funds can grow tax-free and be withdrawn without penalty for qualified medical expenses.

- This triple tax advantage positions HSAs as a prudent choice for consumers seeking immediate and long-term benefits, allowing them to save for future health needs while providing a buffer against current medical costs. Tax benefits (Investopedia).

- Eligibility: To open an HSA, you must be enrolled in a high-deductible health plan (HDHP) with lower premiums than standard health plans. However, not all HDHPs qualify for HSAs, so eligibility comes first.

- Additionally, enrollees cannot be claimed as a dependent on someone else’s tax return not be covered by any other non-HDHP health plan, ensuring that the HSA remains a dedicated resource for qualifying medical expenses. Must pair with a high-deductible health plan (HDHP).

Table: Plan Comparison

| Plan Type | Avg. Monthly Premium | Avg. Deductible | Best For |

|---|---|---|---|

| HMO | $450 | $1,500 | Budget-conscious families |

| PPO | $600 | $2,000 | Flexibility seekers |

| HDHP+HSA | $300 | $5,000 | Young, healthy individuals |

Top 3 Google Searches on Health Insurance (Answered)

🔍 “How to lower health insurance premiums?”

✅ To lower your health insurance premiums, consider several practical strategies. First, shop around during open enrollment to compare plans and find one that balances coverage with affordable premiums.

Additionally, maintaining a healthy lifestyle can qualify you for discounts, and for some plans, increasing your deductible can significantly reduce your monthly payments.

Always make sure to review your options annually, as life changes may affect your insurance needs and potential savings. Bundle plans, opt for higher deductibles, or qualify for ACA subsidies.

🔍 “What’s the penalty for not having insurance?”

✅ The penalty for going without insurance varies depending on where you live and the specific laws in place. For instance, while the federal mandate penalty for not having health insurance was effectively eliminated in 2019, some states have their mandates with associated fines.

It’s crucial to stay informed about the regulations in your state to avoid unexpected penalties and to ensure you’re covered in case of medical emergencies or routine health care needs. Federally, $0 since 2019, but some states (e.g., Massachusetts) still impose fines.

🔍 “Can I switch plans mid-year?”

✅ Certainly, the ability to switch plans mid-year is typically restricted to specific circumstances known as qualifying life events. These events can include situations such as a change in marital status, having a baby, or losing other health coverage.

It’s essential to review your current health insurance policy and understand the Special Enrollment Period (SEP) criteria, as this is the window during which you can make changes outside of the usual open enrollment period. Only during Open Enrollment or after qualifying life events (marriage, job loss).

5 Cost-Saving Strategies to Beat Medical Bills

1: Preventive Care: Engaging in regular preventive care is not only crucial for maintaining your health but also for managing your medical expenses. By catching potential health issues early through routine check-ups and screenings, you can avoid the need for more extensive and expensive treatments down the line.

Furthermore, many insurance plans cover preventive services at little or no cost to you, making it a financially savvy choice to schedule those annual physicals and recommended tests. Annual checkups are 100% covered under ACA plans.

2: Negotiate Bills: 3: Understand Your Policy: It’s essential to become well-versed with the details of your insurance policy to avoid surprise expenses. Knowing what is covered, the deductibles, out-of-pocket maximums, and the network of preferred providers can help you make informed decisions about your healthcare.

By understanding your benefits and the terms of your coverage, you can plan your medical visits strategically, ensuring that you’re getting the most out of your insurance plan without incurring unnecessary costs. Use tools like Healthcare Bluebook to challenge overcharges.

3: Generic Drugs: When possible, opt for generic drugs over brand-name prescriptions. Generics contain the same active ingredients as their brand-name counterparts and are regulated by the FDA to ensure they meet the same quality and performance standards.

By choosing generics, you can significantly reduce your out-of-pocket expenses for medications, as they are often sold at a fraction of the cost of brand-name drugs. Always consult with your healthcare provider to ensure that a generic alternative is suitable for your treatment plan. Save 85% vs. brand names (FDA).

4: Telemedicine: 50 vs. 50 vs. Utilizing telemedicine services can be a cost-effective alternative to traditional in-person doctor visits. With the advancement of technology, virtual consultations are becoming increasingly accessible, offering a convenient and often lower-cost option for patients.

By opting for telemedicine, you can save on travel expenses and time, making it a 50/50 choice for both your health and your wallet when compared to conventional healthcare services. 50.50.150 for in-person visits.

5: Appeal Denials: Navigating the complexities of insurance coverage can be a daunting task, particularly when it comes to appealing denials. Telemedicine services, while generally covered by many insurance plans, can sometimes fall into gray areas, leading to denied claims.

It’s crucial to understand your policy and the reasons for denial, as this knowledge can empower you to effectively dispute the decision and advocate for your right to accessible healthcare options. 50% of appeals succeed (Kaiser Health News).

Case Study: How Sarah Saved $12,000 with an HSA

Navigating the complexities of healthcare financing can be daunting, but with the right approach, significant savings are possible. Sarah’s case is a testament to the power of being informed and proactive.

By meticulously researching her healthcare plan, understanding the benefits of a Health Savings Account (HSA), and taking full advantage of tax deductions and direct negotiations with healthcare providers, Sarah was able to reduce her out-of-pocket expenses dramatically.

Her success underscores the importance of patients taking charge of their healthcare finances and exploring all available avenues to minimize costs.

Sarah, 28, chose an HDHP+HSA. She contributed 3,000 3,000 annually, reducing taxable income. When she broke her ankle, her 3,000 annual reduced taxable income. When she broke her ankle, her $6,000 bill was covered by HSA funds—tax-free. Over 5 years, she saved $12,000 vs. a traditional plan.

Box 3: 5 Expert Tips to Optimize Your Coverage

💡 Tip 1: Understanding your healthcare needs is crucial to optimizing your HSA contributions. Estimate your annual medical expenses and adjust your contributions accordingly to ensure you have enough funds to cover unexpected medical costs without overfunding your account.

Remember, unused HSA funds roll over year to year, so it’s better to err on the side of caution and have a little extra than to find yourself short in the event of an emergency. Audit your plan annually—life changes impact needs.

💡 Tip 2: Consider the tax advantages of your HSA when planning your contributions. Contributions are tax-deductible, and the account’s growth is tax-free, as are withdrawals for qualified medical expenses. By maximizing your contributions within the legal limits, you can reduce your taxable income while building a robust safety net for health-related costs.

It’s a savvy financial strategy to review your tax situation each year with a professional to ensure you’re making the most of these benefits, especially if your income or tax laws have changed. Use in-network providers to avoid surprise bills.

💡 Tip 3: 💡 Tip 4: Maximize your Health Savings Account (HSA) or Flexible Spending Account (FSA) contributions to further reduce your taxable income. These accounts allow you to set aside pre-tax dollars for medical expenses, effectively lowering your overall tax burden.

Just remember to keep track of your expenditures and stay within the contribution limits, as unused funds in an FSA may be forfeited at the end of the year, while HSA funds roll over and can even be invested, growing tax-free for future medical costs. Maximize HSA contributions—it’s a retirement health fund.

The Future of Health Insurance: Trends to Watch

1: AI-Driven Personalization: AI-driven personalization in health insurance is set to revolutionize the way policies are tailored to individual needs. By leveraging vast datasets and predictive analytics, insurers can offer plans that are customized to the unique health profiles and risk factors of each customer.

This means more accurate pricing, improved patient outcomes, and a more efficient healthcare system overall, as AI algorithms help to identify potential health issues before they become serious, allowing for proactive management and care. Startups like Oscar Health use AI to match users with ideal plans.

2: Price Transparency Laws: The implementation of price transparency laws is another stride toward patient empowerment in healthcare. By mandating that providers disclose the cost of medical services upfront, patients can make more informed decisions about their care.

This level of transparency not only helps to reduce surprise billing but also encourages competition among providers, potentially driving down the costs of healthcare services.

As a result, patients can better manage their medical expenses and choose care options that align with both their health needs and financial constraints. Hospitals must now publish negotiated rates (CMS).

3: Telehealth Expansion: Telehealth expansion has seen an unprecedented rise, particularly spurred by the global pandemic. This digital transformation of healthcare has made it possible for patients to receive medical consultations and follow-up care without the need to travel, thus saving time and reducing the risk of exposure to illnesses.

Moreover, AI personalization within telehealth platforms ensures that patients receive tailored advice and care plans, improving the overall effectiveness of treatments and enhancing patient satisfaction.

With AI-driven analytics, telehealth services can also predict patient needs and provide preemptive care suggestions, further revolutionizing the patient experience. 80% of employers offer virtual care (Forbes).

Moreover, the integration of AI personalization in telehealth extends beyond predictive analytics. It allows for the customization of health plans and programs to fit individual patient profiles, taking into account their medical history, lifestyle, and even genetic predispositions. This level of tailoring not only improves patient adherence to treatment plans but also enhances the precision of health monitoring and management.

Consequently, healthcare providers can deliver more effective and efficient care, while patients benefit from a healthcare journey that is uniquely theirs, leading to better health outcomes and a more engaging healthcare experience. Warren Buffett famously said, “Health is wealth.” Pairing that wisdom with smart insurance choices ensures both remain intact.

FAQs: Your Questions, Answered

Q: Can I keep my doctor with an HMO?

A: Certainly! Continuing from where the article left off: With an HMO, your ability to keep your current doctor depends on whether they are part of the HMO’s network. Most HMO plans require you to select a primary care physician (PCP) from within their network, and if your current doctor is not a part of that network, you may need to choose a new one.

However, it’s always worth checking with the HMO, as some may offer options to include out-of-network doctors at a higher out-of-pocket cost, ensuring you can maintain your existing doctor-patient relationship. Only if they’re in-network. Verify before enrolling.

Q: Are short-term plans worth it?

A: Short-term health plans can be a viable solution for those in transition, such as between jobs or waiting for new coverage to start. However, they often provide less comprehensive coverage compared to standard health insurance plans and may not cover pre-existing conditions.

It’s essential to carefully review the terms and coverage limits of short-term plans to ensure they meet your healthcare needs and understand that they are not meant to be a long-term insurance solution. For some <3 Months, yes. Long-term, they lack critical coverage.

Q: How do I qualify for Medicaid?

A: To qualify for Medicaid, eligibility is primarily based on your income level and family size, relative to the federal poverty level. Additionally, factors such as disability, pregnancy, age, and whether you have dependents can influence your eligibility.

It’s important to check with your state’s Medicaid program, as each state has its own specific criteria and application process. Remember, even if you’ve been denied Medicaid benefits in the past, changes in your circumstances or updates to eligibility requirements could mean you’re now eligible. Income ≤ ≤138% of the federal poverty level (varies by state).

Conclusion: Take Control of Your Healthcare Costs

Navigating the complexities of healthcare can be daunting, but being proactive about your Medicaid eligibility can make a significant difference in managing your medical expenses. It’s essential to stay informed about the specific requirements in your state, as they can fluctuate with policy changes and economic shifts.

By regularly reviewing your status and reaching out to local agencies for assistance, you can ensure that you’re taking full advantage of the support available to you and your family, ultimately taking control of your healthcare costs and well-being.

Rising medical costs are inevitable, but financial ruin isn’t. By choosing the right insurance, auditing plans yearly, and leveraging tools like HSAs, you turn vulnerability into power. Act now: Compare plans at Healthcare.gov, consult a broker, or maximize your HSA.

Discussion Question: Navigating the healthcare landscape can be daunting, but it’s essential to remember that knowledge is your best defense. Staying informed about policy changes and new healthcare options can save you from unexpected expenses down the line.

Don’t hesitate to reach out to healthcare advocates or financial advisors who specialize in healthcare planning; their expertise can provide clarity and help tailor a strategy that fits your unique situation and secures your financial health. What’s your biggest hurdle in choosing health insurance?

Note: This article will be updated biannually to reflect regulatory changes and cost trends. For personalized advice, consult a licensed insurance broker.