Why 2025 Will Revolutionize Home Insurance

Q: Will home insurance 2025 still be affordable?

A: As we approach 2025, the landscape of home insurance is set to transform dramatically, largely influenced by the rise of advanced AI personalization. This revolutionary technology promises to redefine claims processing, risk assessment, and policy customization, offering homeowners a more tailored and potentially cost-effective insurance experience.

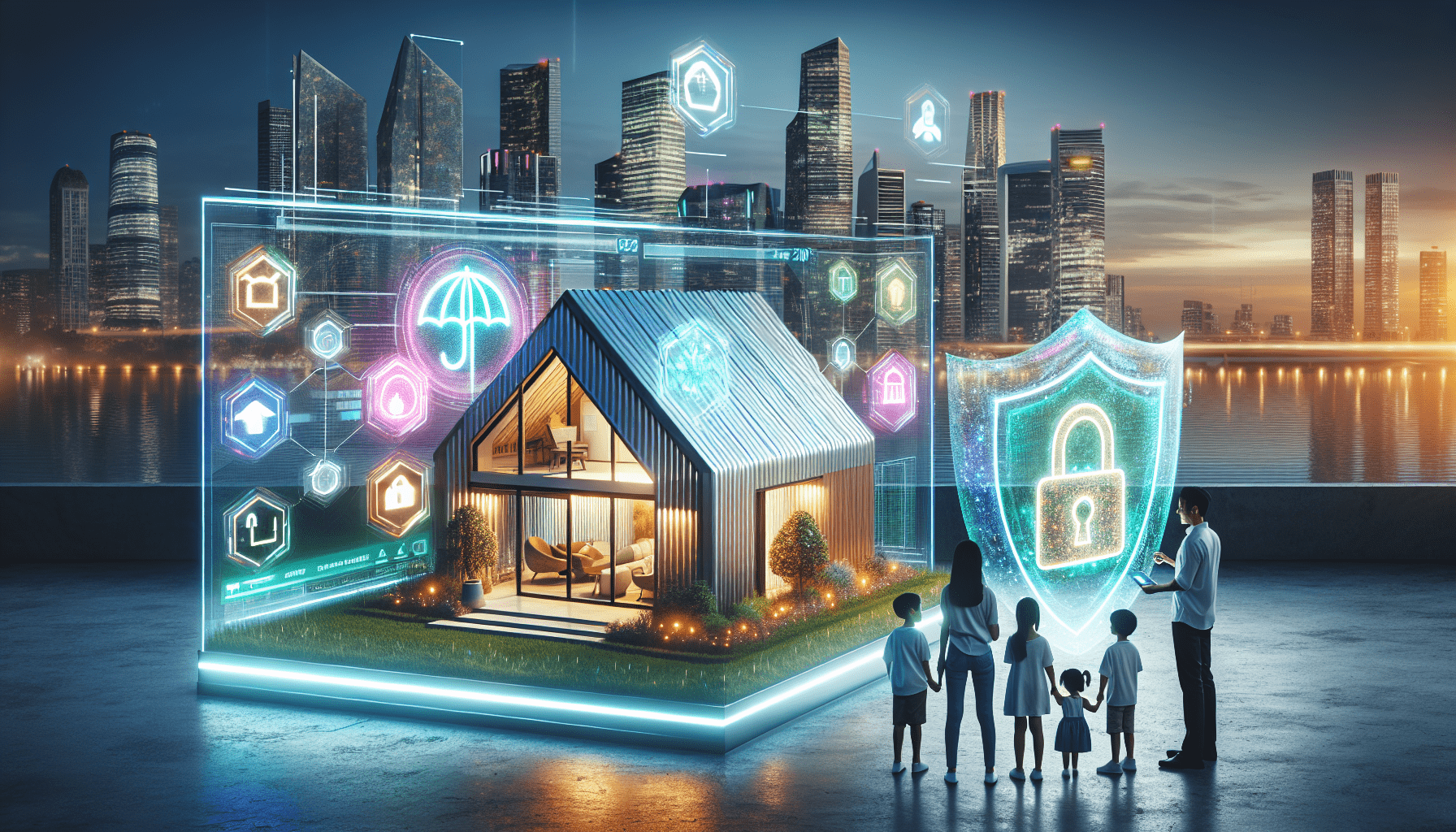

The future of home insurance 2025 hinges on balancing affordability with innovation. While premiums could remain accessible for many, emerging factors such as climate risks, AI-driven pricing, and the growing prevalence of cyber threats will undoubtedly reshape costs. Smart strategies, including proactive risk management and adopting technologies like storm-resistant roofing, could help homeowners stay ahead.

As we navigate this era of AI personalization, striking a balance between customization and consumer autonomy becomes vital. Transparency in data usage and ethical application of personalization algorithms will be key to maintaining trust in home insurance 2025. Companies must ensure that these advancements do not inadvertently perpetuate biases or compromise individual rights.

Imagine waking up in 2025 to a notification:

“Your home’s risk score dropped 30% overnight thanks to your new storm-resistant roof.”

Or receiving a payout within minutes of a burglary, automatically triggered by your smart sensors. This isn’t science fiction—it’s the evolving reality of home insurance 2025. Driven by climate crises, AI, and hyper-personalized policies, the industry is poised for seismic shifts that will redefine how homeowners protect their investments.

Act now, or risk being underinsured, overcharged, or worse.

The Main Part: Decoding 2025’s Home Insurance Landscape

1. How Will Climate Change Impact Home Insurance Premiums by 2025?

Key Trends:

1: Climate risk modeling: As we approach 2025, the insurance industry is increasingly harnessing sophisticated climate risk modeling tools powered by artificial intelligence. These models are designed to predict the impact of extreme weather events with greater precision, allowing insurers to adjust premiums more accurately based on the risk level of individual areas.

Homeowners in regions prone to natural disasters such as floods, wildfires, or hurricanes may see their home insurance costs rise as these models become more prevalent, reflecting the heightened financial risk these properties represent to insurance companies. Insurers like Allianz and Swiss Re now use AI to predict flood/fire risks down to your ZIP code.

2: “Uninsurable” zones: As the granularity of risk assessment increases, entire neighborhoods or regions may be deemed “uninsurable” due to their high susceptibility to natural disasters. This categorization could lead to significant socio-economic implications, potentially driving down property values and deterring new investments in these areas.

Consequently, local governments and communities may face increased pressure to implement robust disaster mitigation strategies and infrastructure improvements to counteract the negative stigma and financial implications associated with being labeled high-risk by AI-powered insurance models. By 2025, home insurance policies may become increasingly difficult to secure for properties in high-risk areas. In fact, 12% of U.S. homes may be too high-risk for standard policies (source: First Street Foundation).

3: Parametric insurance: Parametric insurance emerges as a solution to this challenge, offering an innovative approach that pays out benefits based on predetermined parameters of an event, rather than on the assessment of actual losses. This model is particularly advantageous for those in high-risk areas, as it ensures swift financial support post-disaster without the lengthy and often contentious claims process.

As climate change exacerbates the frequency and severity of natural disasters, parametric insurance could become an essential tool for homeowners and businesses alike, providing a more predictable and transparent means of risk management. By 2025, home insurance options may increasingly include parametric models, which offer payouts based on weather data rather than damage assessments (e.g., $10k if winds hit 75mph).

Case Study: In the wake of such a transformative approach, it’s not difficult to imagine the profound impact parametric insurance can have on the recovery process after a disaster strikes. By eliminating the need for time-consuming damage assessments and negotiations, funds can be disbursed rapidly, allowing individuals and businesses to commence rebuilding efforts almost immediately.

This efficiency not only mitigates the financial strain on policyholders but also reduces the administrative burden on insurance companies, enabling a swifter return to normalcy for affected communities. After Colorado’s 2023 wildfires, homeowners with parametric coverage received instant payouts for evacuation costs, while traditional claimants waited months.

Practical Tip:

🔑 Use tools like RiskFactor.com to assess your home’s climate risk. Invest in storm shutters or fire-resistant landscaping to lower premiums.

2. Are Smart Homes the Future of Risk Mitigation?

Why It Matters: Absolutely, smart homes are not just a passing trend; they are rapidly becoming a standard for proactive risk management. By integrating advanced sensors and AI-driven analytics, homeowners can now monitor and respond to potential threats in real time.

From automatic water shut-off systems that prevent flooding to smart smoke detectors that can contact emergency services, the potential for reducing risks and therefore insurance claims is significant.

This shift towards technology-enhanced homes is revolutionizing the way we think about safety and prevention, potentially leading to lower insurance premiums and greater peace of mind for homeowners. IoT devices (smart locks, water leak detectors) reduce claims by up to 40% (McKinsey, 2023).

Step-by-Step Guide:

1: Building on this transformative potential, AI personalization is set to take home protection to the next level. By integrating machine learning algorithms with IoT devices, systems can now learn from homeowners’ behavior patterns and adapt to their unique lifestyles.

This means that not only can these smart home systems provide immediate alerts for issues like security breaches or water leaks, but they can also predict and mitigate risks before they become problems, further reducing the likelihood of costly claims and enhancing the overall safety of the home. Install a smart security system (e.g., Ring, Nest).

2: In addition to safeguarding against physical threats, AI personalization extends to optimizing the living environment for comfort and energy efficiency.

Smart thermostats, such as those offered by Ecobee or Nest, learn from your habits and adjust the heating and cooling systems accordingly, ensuring that your home is always at the ideal temperature when you’re there and conserving energy when you’re not.

These intelligent systems can also integrate with other smart home devices, enabling a cohesive network that adapts to your lifestyle, making your home not just safer, but smarter and more responsive to your unique needs. Add water/flood sensors in basements.

3: In addition to enhancing home security and energy efficiency, AI personalization extends to entertainment and comfort. Imagine a home theater system that curates a movie playlist based on your viewing history, mood, and even the time of day.

Or consider smart thermostats that learn your schedule and temperature preferences, adjusting the climate in each room to suit individual family members.

As AI continues to evolve, the potential for creating a living space that anticipates and fulfills our desires becomes increasingly tangible, transforming our homes into truly intelligent environments. Connect devices to your insurer’s app for real-time discounts.

Example: The integration of AI personalization in our homes goes beyond mere convenience; it promises a level of comfort and efficiency that was once the stuff of science fiction. Imagine a thermostat that not only learns your preferred temperature settings but also adjusts them in real-time based on the weather forecast, your schedule, and even your mood, as detected through wearable technology.

Furthermore, AI could manage your lighting, entertainment, and security systems, ensuring that your environment is always optimized for your current activity, whether that’s hosting a dinner party or settling in for a quiet night’s rest.

As these systems become more interconnected, the seamless orchestration of our home environments will redefine the way we live, making our interactions with technology more intuitive and, ultimately, more human. State Farm’s “Connected Home” program offers up to 15% off for Alexa-compatible sensors.

Tool Recommendation:

🛠️ Compare devices on CNET Smart Home for insurer-approved tech.

Competitive Analysis:

| Traditional Policies | Smart Home-Bundled Policies |

|---|---|

| Lower upfront cost | Higher discounts over time |

| Manual claims process | Instant claims via AI |

| Generic coverage | Personalized risk updates |

3. Will AI Replace Human Insurance Agents?

Deep Dive:

1: AI underwriting: AI underwriting is revolutionizing the insurance industry by enabling more accurate risk assessment and pricing that reflects an individual’s unique circumstances. By analyzing vast amounts of data, AI can identify patterns and predict outcomes with a level of precision that far exceeds traditional methods.

This not only streamlines the underwriting process but also allows for dynamic pricing models that can adjust premiums based on real-time data, ensuring that customers pay a fair price for their coverage. Lemonade’s AI processes claims in 3 seconds (vs. industry average of 30 days).

2: Ethical concerns: As AI continues to permeate various industries, ethical concerns inevitably surface, particularly regarding data privacy and algorithmic bias. The vast amounts of personal data that AI systems require for personalization raise questions about how that data is collected, stored, and used.

Moreover, if not carefully designed and constantly monitored, AI algorithms can inadvertently perpetuate existing biases, leading to unfair treatment of certain customer segments. It is crucial, therefore, for companies like Lemonade to implement robust ethical guidelines and transparent practices to maintain consumer trust and ensure that AI personalization serves the interests of all parties fairly.

Algorithmic bias could disproportionately raise rates for older homes.

Expert Quote:

“AI won’t replace agents—it’ll empower them to focus on complex cases.”

— Daniel Schreiber, CEO of Lemonade (Forbes Interview)

Podcast episode on AI ethics in insurance (e.g., The InsurTech Podcast).

4. Cyber Insurance for Homes: Overhyped or Essential?

2025 Prediction: As we edge closer to 2025, the debate around cyber insurance for private residences intensifies. While some industry experts argue that the increasing connectivity of home devices elevates the risk of cyberattacks, making insurance essential, others contend it’s merely a strategy to capitalize on consumer fears.

The truth likely lies somewhere in between, with the necessity of cyber insurance hinging on the evolving landscape of digital threats and the value of the assets being protected in our increasingly smart homes. 60% of policies will include cyber coverage (Gartner, 2023).

Real-Life Hack: In the realm of real-life hacks, the implications are far-reaching and can be distressingly personal. For instance, a family’s smart home system was recently compromised, leading to the unauthorized control of lighting, heating, and even lock systems.

This incident not only invaded their privacy but also left them feeling vulnerable in what should be their sanctuary. It underscores the critical need for robust cyber insurance policies that can respond to such intrusions, offering both financial restitution and professional assistance in the aftermath of a cyber event.

A family in Texas lost $50k via a hacked smart thermostat. Their insurer denied the claim—cyber riders would’ve covered it.

Practical Tips:

1: To safeguard against such costly vulnerabilities, it is crucial for homeowners to consider the benefits of cyber insurance riders. These add-ons to traditional insurance policies specifically address the financial and recovery needs associated with digital breaches.

By investing in this additional layer of protection, families can mitigate the risk of significant monetary loss and gain access to expert services designed to navigate the complexities of a cyberattack’s aftermath. Add cyber liability coverage (10–10–30/month).

2: In an increasingly interconnected world, personalization powered by AI is not just about convenience; it’s about security. As AI learns to distinguish between the habits of a legitimate user and those of an intruder, it can provide real-time alerts and lock down accounts at the first sign of a breach.

This proactive stance on security, backed by AI’s relentless 24/7 monitoring, ensures that personal data is kept out of the wrong hands, giving families one less thing to worry about in their busy lives. Use a VPN for smart devices.

3: In the realm of smart devices, the use of Virtual Private Networks (VPNs) has become increasingly important. These secure tunnels for internet connectivity not only shield activities from prying eyes but also help maintain the integrity of personalization features by preventing unauthorized access.

By integrating AI-driven VPNs into smart devices, users can enjoy personalized experiences without sacrificing privacy, as AI algorithms constantly learn and adapt to new security threats, ensuring that personal preferences and data remain both bespoke and secure. Update firmware monthly.

5. How to Future-Proof Your Policy: 7 Hacks for 2025

1: Audit Annually: 2: Embrace Transparency: As we navigate the evolving landscape of AI personalization, maintaining transparency with users is paramount.

By openly communicating how data is collected, used, and protected, companies can foster trust and reassure customers that their personal information is handled with the utmost care.

This approach not only aligns with regulatory expectations but also empowers consumers, who are increasingly seeking control over their digital footprint. Use apps like Policygenius to compare rates.

2: Bundle Cyber + Climate: By integrating cybersecurity with climate-conscious strategies, businesses can address two of the most pressing concerns of our time in a unified manner. This bundling approach not only streamulates risk management but also showcases a company’s commitment to forward-thinking and responsible practices.

Consumers are drawn to brands that demonstrate an understanding of the broader impact of their operations, and by offering combined cyber and climate protection services, companies can position themselves as leaders in a new era of conscientious commerce. Look for hybrid policies (e.g., Progressive’s HomeGuard).

3: Go Parametric: 4: Embrace AI Personalization: In the digital age, the power of artificial intelligence (AI) to personalize customer experiences has become a game-changer for the insurance sector.

By harnessing AI algorithms, insurers can analyze vast amounts of data to tailor policies and services to individual needs, delivering a level of customization previously unattainable.

This level of personalization not only enhances customer satisfaction but also optimizes risk assessment, leading to more accurate pricing and a competitive edge in the market.

As customers increasingly expect services that cater to their unique circumstances, insurers who leverage AI personalization will stand out for their ability to connect with clients on a deeper, more individual level. For disaster-prone areas, try Jumpstart Insurance.

4: Lobby for Rebates: Embrace Data-Driven Insights: Harnessing the power of big data analytics, insurers can fine-tune their AI algorithms to deliver highly personalized policy recommendations and risk assessments.

By analyzing vast amounts of customer data, including past claims, lifestyle habits, and real-time behavior, companies can identify patterns and predict future needs with remarkable accuracy.

This proactive approach not only enhances customer satisfaction by providing tailored solutions but also streamulates operations and improves overall risk management. Ask insurers about green home discounts (solar panels, etc.).

5: Digitize Records: Digitizing records is a transformative step that leverages the power of AI to streamline data management and accessibility. By converting paper files into digital formats, insurers can harness advanced analytics to gain deeper insights into customer behavior and preferences.

This shift not only bolsters the efficiency of retrieving and updating records but also fortifies data security, ensuring that sensitive information is protected with cutting-edge encryption technologies. Store photos/videos in cloud apps like Dropbox Vault.

6: Negotiate with Data: Embrace Enhanced User Experiences: The advent of AI personalization heralds a new era of user-centric design, where interfaces and interactions are tailored to individual needs and behaviors. This customization extends beyond mere aesthetics, diving deep into the functionality that makes every interaction feel intuitive and effortless.

By analyzing user data, AI systems can predict preferences and adapt in real-time, presenting information in a way that feels uniquely suited to each user, thereby elevating the overall experience and fostering a deeper connection with the technology. Use smart device metrics to argue for lower rates.

7: Preempt Regulation: By leveraging AI personalization, companies can gain a competitive edge while also potentially mitigating regulatory scrutiny. By proactively adapting to individual user needs and preferences, AI-driven systems can demonstrate a level of self-regulation and responsible use that may satisfy regulatory bodies.

This self-adjusting mechanism not only enhances user satisfaction but also serves as a testament to the technology’s ability to operate within the bounds of user privacy and ethical standards, possibly forestalling the need for heavy-handed external regulation. States like California are capping premiums—stay informed.

Frequently Asked Questions (FAQs)

1: Q: Will my premium skyrocket if I live near a wildfire zone?

A: A: While living in a wildfire-prone area can potentially impact your insurance premiums due to the higher risk, the increase isn’t necessarily astronomical. Insurance companies are required to assess risk in a balanced manner, and some states have implemented measures to protect consumers from excessive rate hikes.

It’s essential to shop around for insurance providers who may offer competitive rates and to inquire about any discounts or mitigation steps you can take to lower your premium. Likely, but parametric policies or retrofits (e.g., ember-resistant vents) can help.

2: Q: Do smart home devices invade my privacy?

A: A: While smart home devices offer convenience and can potentially lower insurance costs by mitigating risk, they do raise valid privacy concerns. These devices often collect data on your daily routines and preferences, which can be vulnerable to hacking or might be shared with third parties.

It’s crucial to research the privacy policies of smart home device manufacturers, use strong, unique passwords for your devices and networks, and regularly update your devices to protect your personal information. Insurers only access risk data—opt out of sharing personal usage habits.

3: Q: Is cyber insurance worth it for non-techies?

A: Absolutely, cyber insurance is becoming increasingly relevant for everyone, not just tech enthusiasts. In our digital age, personal information is constantly at risk of being compromised, regardless of one’s technical know-how. Cyber insurance can provide peace of mind by offering coverage for potential financial losses due to cyberattacks, identity theft, and data breaches.

It acts as a safety net, ensuring that you have support in place to navigate the complexities of recovering from a digital security incident. Yes! Hackers target smart TVs and baby monitors, not just computers.

4: Q: Can I still get coverage with a low credit score?

A: Absolutely! Cyber insurance providers understand that your credit score does not necessarily reflect your cybersecurity practices or your risk of experiencing a cyber incident.

While a credit score might influence the terms and premiums of your policy, insurers also consider other factors such as your current security measures, the type of data you handle, and your history of cyber incidents.

Therefore, even with a lower credit score, you can still obtain cyber insurance; however, it’s advisable to discuss your specific situation with insurance providers to find the best coverage options available to you. Some insurtechs (e.g., Hippo) use alternative data like rent payment history.

5: Q: How do I dispute an AI-driven claim denial?

A: To dispute an AI-driven claim denial, it’s crucial to gather all relevant documentation and evidence related to your claim. Contact your insurance provider to request a detailed explanation of the denial, which will help you understand the specific reasons behind the decision.

If the denial is based on an AI algorithm, you may ask for the criteria or factors the AI used in its assessment. Armed with this information, you can then present a case for why the decision should be reconsidered, potentially involving a human assessor for a more nuanced evaluation.

If the insurer remains unresponsive or the issue is not resolved to your satisfaction, you may need to escalate the dispute to an ombudsman or regulatory body that oversees insurance practices in your jurisdiction. Demand human review and submit third-party inspections.

Conclusion: Your 2025 Action Plan

Recap:

1: Navigating the complexities of insurance claims in 2025 requires a proactive and informed approach. By understanding the intricacies of your policy, maintaining comprehensive documentation, and utilizing AI personalization tools, you can streamline the claims process and enhance your chances of a favorable outcome.

Remember, persistence is key, and leveraging the latest technology can provide the edge needed to ensure your voice is heard and your claim is addressed with the attention it deserves.Climate risks demand proactive upgrades.

2: In the face of escalating climate challenges, it is imperative that individuals and organizations alike adopt a forward-thinking approach to mitigate potential damages. By integrating AI-driven personalization into their systems, they can not only predict but also prepare for adverse weather events with greater precision.

This shift towards proactive measures, rather than reactive responses, enables a more resilient infrastructure, ensuring that both property and people are safeguarded against the unpredictable forces of nature. Smart homes = savings + safety.

3: The integration of AI personalization extends beyond just weather adaptability; it revolutionizes the way we interact with our living spaces on a daily basis. By learning our routines and preferences, AI can manage energy consumption more efficiently, reducing bills and environmental impact.

Moreover, in the realm of security, personalized AI systems can distinguish between routine and unusual activity, offering homeowners peace of mind with dynamic, intelligent monitoring that adapts to their unique lifestyle patterns. Cyber threats are inevitable—insure accordingly.

Call to Action:

📢 Run a 5-minute audit: Check your policy for climate exclusions, cyber gaps, and smart home discounts. Share this article with a neighbor—it could save their home.

Discussion Questions:

1: Next paragraph: As we move further into the digital age, it’s imperative to recognize that the same AI technology powering our personal conveniences also opens doors to potential vulnerabilities. Your home’s smart devices, while providing unparalleled comfort and efficiency, could be the weak link that cybercriminals exploit.

Therefore, staying informed about the latest security protocols and updating your devices regularly is not just recommended—it’s essential for safeguarding your digital fortress. By taking proactive measures, you can enjoy the benefits of AI personalization with peace of mind, knowing you’ve taken the necessary steps to protect your personal data and privacy.

Would you let an AI set your insurance rates?

2: When considering AI’s role in setting insurance rates, it’s crucial to weigh the benefits against potential risks. On one hand, AI can analyze vast amounts of data to tailor rates more accurately to an individual’s risk profile, potentially saving consumers money and making pricing fairer.

On the other hand, there’s the risk of opaque decision-making processes and the potential for biases in the algorithms, which could lead to unfair pricing for some individuals. It’s a delicate balance that requires careful oversight and transparency to ensure that AI enhances the insurance landscape without compromising fairness and trust.

Should governments subsidize high-risk area premiums?

Content Update Alert: This article will be updated quarterly with 2025 rate trends. Bookmark now!