How Freeway Insurance Can Help You Save Money and Protect Your Assets

Introduction to Freeway Insurance

As an accountable adult, it is very important to guard your belongings and ensure the financial security of yourself and your loved ones. One of the only methods to understand that is by the use of insurance coverage. However, discovering an appropriate insurance coverage provider is mostly a frightening course of action.

That’s the place Freeway Insurance is out there. With its in-depth number of insurance protection decisions and distinctive buyer help, Freeway Insurance is the wise choice for saving money and defending your belongings.

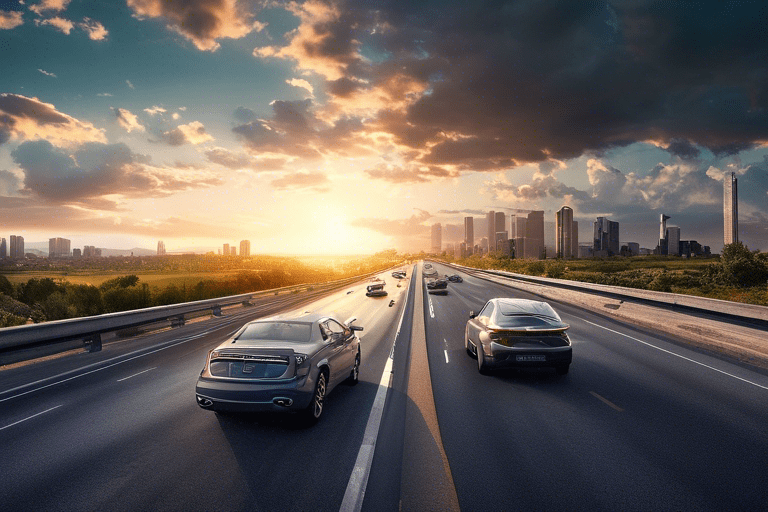

The Importance of Having Insurance Coverage

Having insurance coverage safety is not simply a licensed requirement in plenty of circumstances; it is also an essential aspect of financial planning. Life is unpredictable, and accidents, pure disasters, and sudden events can happen at any time.

Without insurance coverage, the financial burden of these incidents may very well be overwhelming and even end in a chapter. Insurance gives you peace of mind, letting you recognize that you’re justly protected financially in case of any unfortunate events.

Freeway Insurance understands this significance and affords quite a lot of insurance coverage choices to cater to your explicit needs.

Insurance Types That Freeway Insurance Offers

Freeway Insurance supplies a complete variety of insurance coverage choices to cover all elements of your life. Whether you need auto insurance coverage protection, dwelling insurance coverage protection, renters insurance protection, or even motorcycle insurance coverage protection, Freeway Insurance has got you covered.

They also present specialized insurance coverage protection for industrial cars, watercraft, and more. With their in-depth neighborhood of insurance coverage protection suppliers, Freeway Insurance can discover the very best protection at one of the best costs. By choosing Freeway Insurance, you may rest assured that you’ve got appropriate insurance coverage to guard your belongings.

Benefits of Choosing Freeway Insurance

When it involves insurance coverage protection, there are several benefits to choosing Freeway Insurance. Firstly, their employees of expert professionals are dedicated to discovering the easiest safety at the cheapest value.

They take the time to know your wants and tailor insurance protection and insurance policies accordingly. Secondly, Freeway Insurance works with a big neighborhood of insurance coverage protection suppliers, offering you access to various decisions to pick from. This ensures that you simply get the safety that matches your needs fully.

Lastly, their distinctive buyer help ensures that you have a seamless experience all via the insurance coverage protection course, from buying a quote to making a declaration.

How to Find a Freeway Insurance Location Near You

Finding a Freeway Insurance location near you is quick and easy. Simply go to their website and use the useful location finder instrument. Enter your zip code or metropolis, and the instrument will give you a listing of nearby Freeway Insurance offices. You might uncover their contact knowledge and office hours, making it useful to reach out to them or go to them individually.

Finding a Freeway Insurance location near you ensures that you’ve fast entry to their suppliers and might acquire customized assistance each time you need it.

Contacting Freeway Insurance Customer Service

If you have received any questions or need assistance, Freeway Insurance’s devoted buyer-help employees are at all times ready to help. You can attain them by phone, e-mail, and even by the use of their website’s stay-chat feature.

Their nice and educated representatives could be discovered to answer your queries and current steering and help you discover appropriate insurance coverage protection.

Whether you want to help understand your protection, make modifications to your safety, or submit a claim, Freeway Insurance’s buyer-help employees are there to help you every step of the way.

Reading and Understanding Freeway Insurance Reviews

Before making any picks, it’s at all times useful to listen to others who’ve had experiences with the corporation. Reading Freeway Insurance critiques can present useful insights into the usuals of their suppliers and the experiences of their shoppers.

You can uncover critiques on their website, social media platforms, and different evaluation websites. Take into consideration each constructive and adverse criticism to acquire a well-rounded viewpoint. Keep in mind that everyone’s experience may be different; nonetheless, finding out critiques can give you a traditional idea of what to anticipate from Freeway Insurance.

How to Get a Quote from Freeway Insurance

Getting a quote from Freeway Insurance is quick and easy. You can go to their website and use their online quote instrument, which helps you to enter your knowledge and acquire a personalized quote instantly. Alternatively, you may name their toll-free quantity and converse with one of their insurance coverage protection specialists.

They will gather the required knowledge from you and give you a quote based totally on your explicit needs and circumstances. Getting a quote from Freeway Insurance is step one in securing the insurance coverage you need to protect your belongings.

Making Payments and Managing Your Freeway Insurance Policy

Once you have obtained insurance coverage protection from Freeway Insurance, managing your protection and making funds is hassle-free. Freeway Insurance gives numerous handy fee choices, along with online funds, computerized funds, and funds by phone.

Their user-friendly online portal lets you enter your protection knowledge, make modifications to your safety, and take a look at your price historical past. With Freeway Insurance, managing your protection is straightforward, allowing you to focus on what issues most: defending your belongings.

Additional Services and Resources Provided by Freeway Insurance

In addition to insurance coverage protection, Freeway Insurance gives quite a lot of extra suppliers and belongings that can assist you. They present assistance with SR-22 filings, which could be required for certain drivers. Freeway Insurance additionally offers roadside assistance applications to give you peace of mind while on the freeway.

Also, their website is a helpful resource for insurance-related knowledge, which includes articles and guides that will help you make educated picks about your safety. Freeway Insurance goes above and beyond to just remember to’ve received all the help you need regarding defending your belongings.

Conclusion: Why Freeway Insurance is the Smart Choice for Saving Money and Protecting Your Assets

To sum up, freeway insurance is the sensible choice when it comes to saving money and defending your belongings. With their huge choice of insurance coverage protection decisions, aggressive costs, and distinctive buyer help, they provide the right combination of affordability and top quality.

Whether you need auto insurance protection, dwelling insurance coverage protection, or each different form of safety, Freeway Insurance has the expertise and belongings to satisfy your needs. Don’t leave your financial security to chance; select Freeway Insurance and have peace of mind knowing that your belongings are protected.