Disaster-Proof Your Home:

Hey there! Imagine this: You’re chilling at your residence, sipping in your favorite drink, when BAM! A storm hits. Are you and your cozy abode prepared to face the wrath of Mother Nature? If you are scratching your head, don’t fret. Let’s dive into some savvy methods to disaster-proof your property, so you possibly can calm down realizing you have bought this!

Why Disaster-Proofing Matters

Picture this: You’re constructing a sandcastle, and a wave comes crashing in. Poof, it is gone! That’s your property without correct disaster-proofing. Natural disasters like hurricanes, floods, and earthquakes can wreak havoc on houses. But with a number of sensible strikes, you possibly can preserve your property standing tall.

Real-Life Example: The Johnsons’ Story

Meet the Johnsons. After Hurricane Sandy hit, they realized their residence wanted a critical improvement. With some strategic enhancements, they not solely protected their property but additionally elevated its worth. Lesson realized: Better protected than sorry!

Step-by-Step Guide to Disaster-Proofing

1. Secure the Roof: It’s More Than Just a Hat!

Your roof is just like the superhero cape of your property. Make sure it is in prime form to shield in opposition to heavy winds and rain. Consider strengthened shingles and an expert inspection.

Fun Fact: Why Roofs Matter

Roofs have been around since historic instances and for good cause. They protect us from the weather, very like a turtle’s shell!

2. Fortify Those Windows and Doors

Windows and doorways are just like the eyes and mouth of your property. Keep them safe with storm shutters or impact-resistant glass. Trust me, your future self will thank you.

Quick Tip:

- Use high-impact resistant home windows

- Install storm shutters

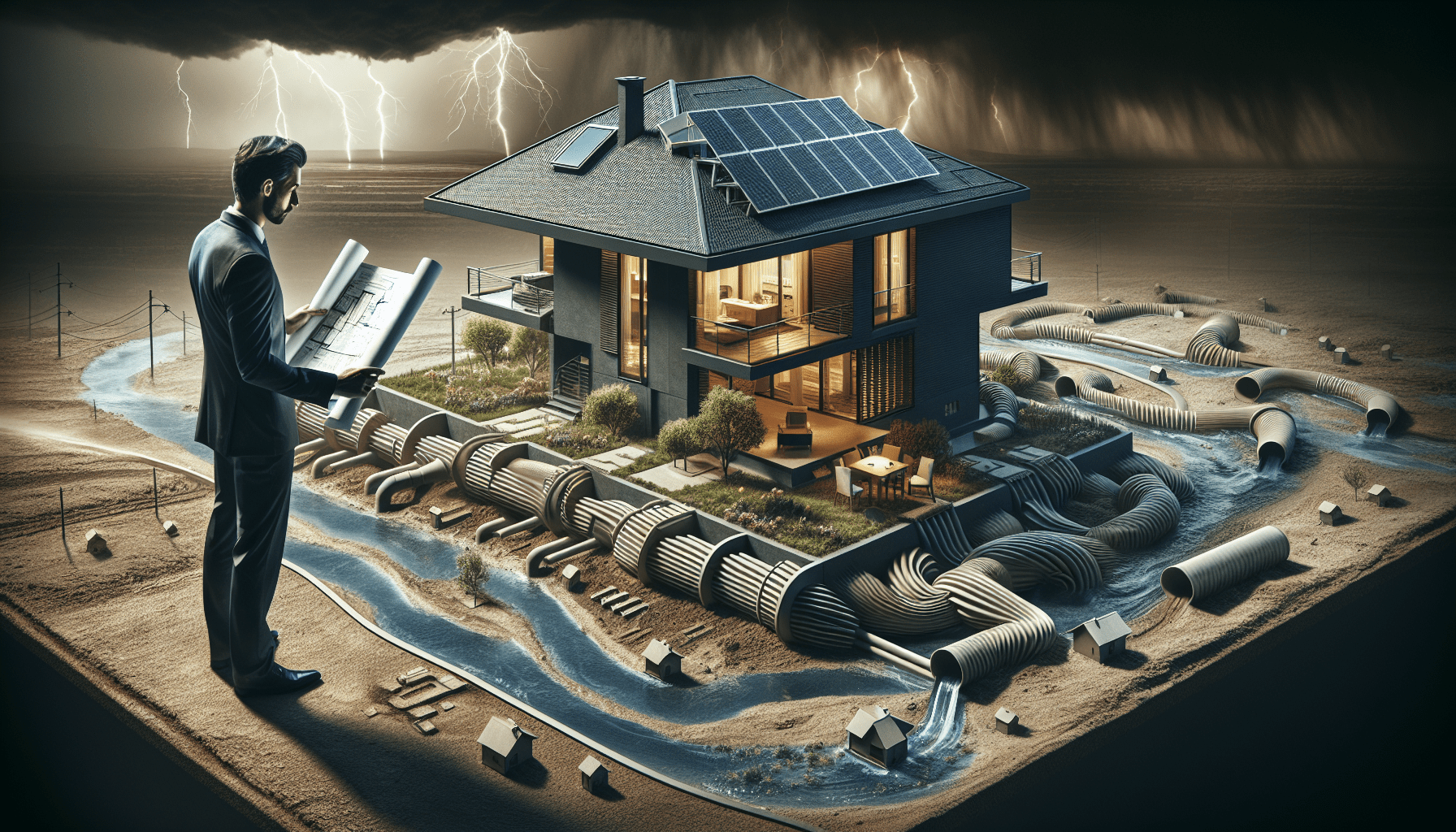

3. Elevate Those Utilities

Floods might be sneaky, creeping up once you least count on it. Elevate your utilities, like HVAC programs and electrical panels, to preserve them dry and purposeful.

Did You Know?

Raising your utilities can scale back flood insurance coverage premiums. Cha-ching!

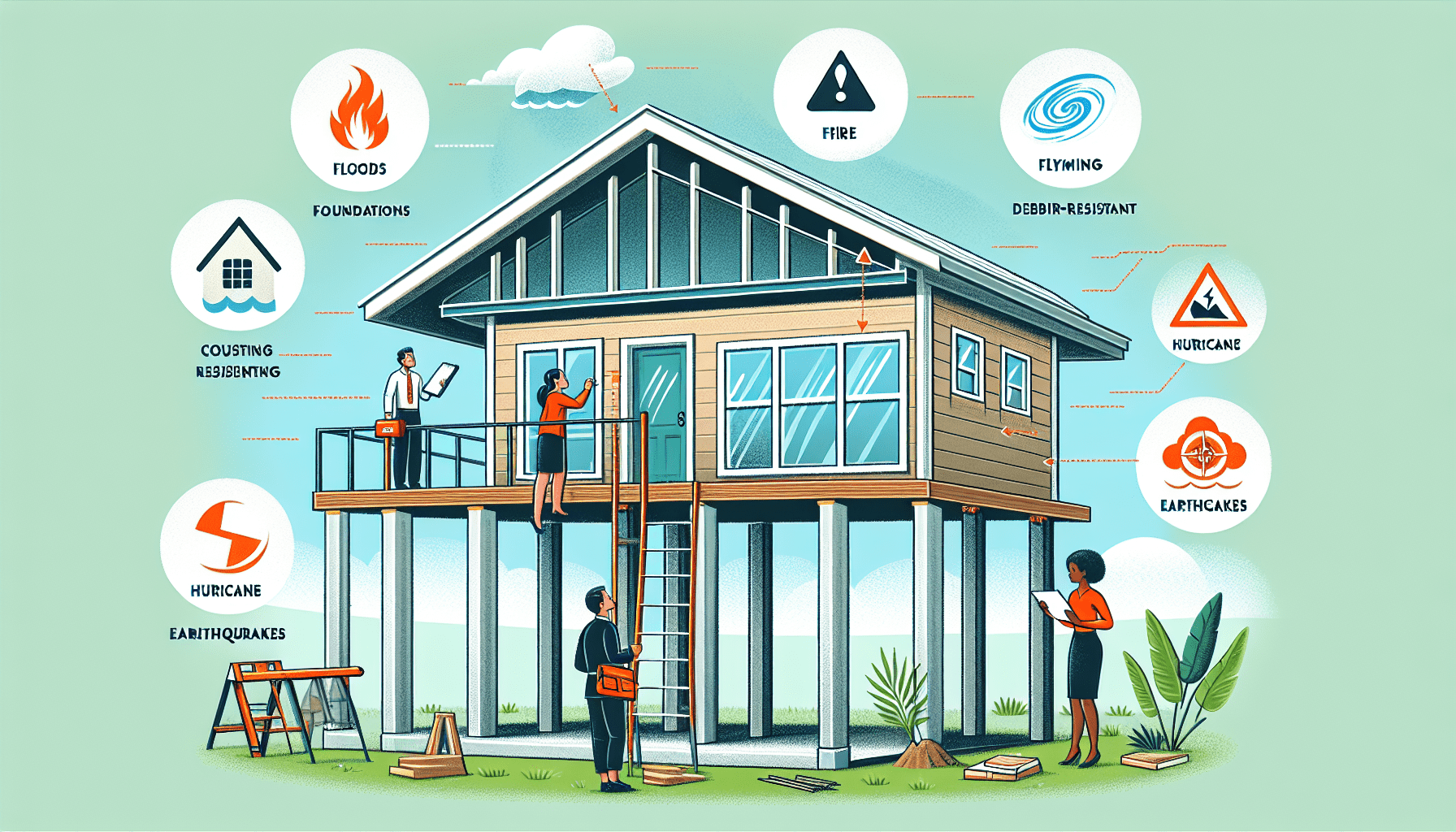

4. Reinforce Foundations

Think of your property’s basis as its spine. A powerful basis equals a secure residence. Consider retrofitting for earthquakes or including waterproofing layers.

Table: Types of Foundation Reinforcements

| Type | Benefit |

|---|---|

| Seismic Retrofitting | Earthquake resistance |

| Waterproofing | Flood safety |

| Foundation Bolting | Increased stability |

Interactive Quiz: Is Your Home Disaster-Ready?

Take this fast quiz to see how ready your property is for a pure catastrophe. [Start Quiz]

FAQs: Disaster-Proofing Your Home

Q: What are the prices related to disaster-proofing?

A: Costs can range broadly based on the upgrades wanted. Investing in key areas can prevent cash in the long term.

Q: How typically ought to I examine my disaster-proofing measures?

A: Annual inspections are a great rule of thumb to guarantee the whole lot’s in tip-top form.

Q: Can disaster-proofing enhance my residence’s resale worth?

A: Absolutely! Many consumers are prepared to pay extra for a house that is well protected in opposition to pure disasters.

External Resources for More Information

Final Thoughts

Disaster-proofing your property is akin to having an insurance coverage plan for peace of mind. It’s about being proactive rather than reactive. Whether it’s securing your roof or elevating your utilities, every step is crucial. Let’s take action and ensure your property is ready for anything that comes its way!