Bodily vs Personal Injury

The confusion between bodily injury and personal injury has cost businesses and individuals millions in misunderstood claims, inadequate insurance coverage, and legal complications. In 2025, with evolving liability laws and insurance regulations, understanding these distinctions isn’t just helpful—it’s essential for protecting your assets and making informed decisions.

Whether you’re a business owner evaluating insurance policies, a professional dealing with workplace incidents, or someone navigating the aftermath of an accident, the differences between these two legal concepts can significantly impact your financial future and legal obligations.

This comprehensive guide breaks down the seven fundamental differences between bodily injury and personal injury, providing you with the knowledge needed to navigate these complex legal waters confidently.

What Is Bodily Injury? The Physical Harm Definition

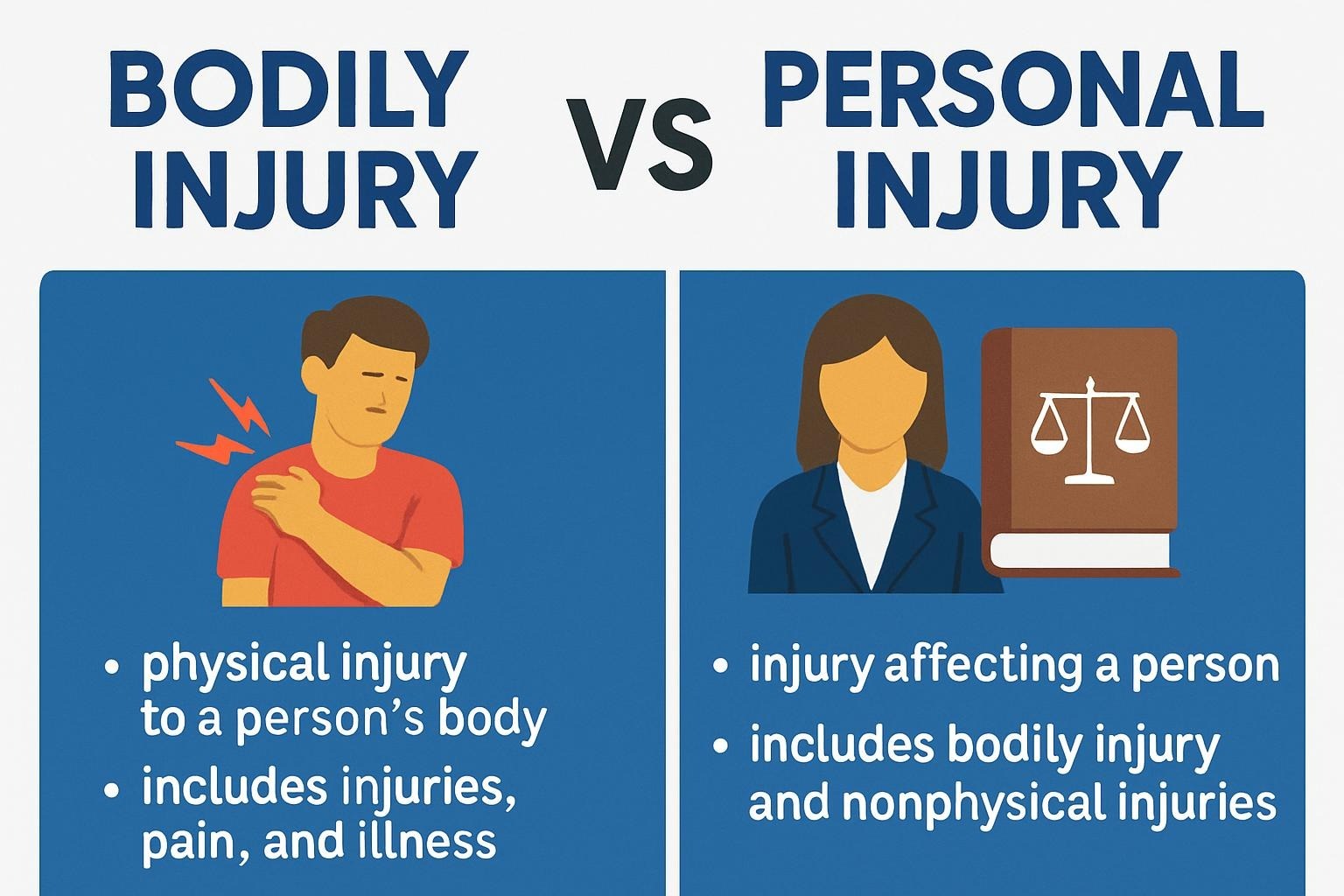

Bodily injury refers specifically to physical harm inflicted on a person’s body. This legal term encompasses visible, measurable damage to the human body, including cuts, bruises, broken bones, burns, and other physical trauma. The key characteristic of bodily injury is its tangible, physical nature.

In legal and insurance contexts, bodily injury claims focus exclusively on the direct physical consequences of an incident. This includes immediate injuries sustained at the time of an accident, as well as physical complications that develop as a direct result of the initial trauma.

Common Examples of Bodily Injury

Medical professionals and legal experts typically categorize bodily injuries into several types:

Immediate Physical Trauma: Cuts requiring stitches, broken bones, sprains, burns, and lacerations fall into this category. These injuries are typically visible and require immediate medical attention.

Internal Injuries: Damage to internal organs, internal bleeding, or trauma that isn’t immediately visible but causes physical harm to the body’s systems.

Permanent Physical Impairment: Loss of limb function, scarring, disfigurement, or chronic physical conditions resulting from an accident.

The documentation for bodily injury claims typically requires medical records, physician reports, and evidence of physical treatment received. Insurance adjusters can often verify these claims through medical documentation and physical examination.

What Is Personal Injury? The Broader Legal Umbrella

Personal injury represents a much broader legal concept that encompasses bodily injury but extends far beyond physical harm. Personal injury includes any wrong or damage done to another person’s body, property, rights, or reputation. This comprehensive term covers both tangible and intangible harms.

The personal injury category recognizes that accidents and incidents can cause various types of damage beyond physical harm. This includes emotional trauma, financial losses, damage to reputation, and interference with personal relationships or professional opportunities.

The Comprehensive Scope of Personal Injury

Personal injury law acknowledges that human beings can be harmed in multiple ways, not just physically. Modern personal injury cases often involve complex combinations of different types of damages.

Economic Damages: Lost wages, medical expenses, property damage, and other quantifiable financial losses resulting from an incident.

Non-Economic Damages: Pain and suffering, emotional distress, loss of enjoyment of life, and damage to personal relationships that cannot be easily quantified with a dollar amount.

Punitive Damages: In cases involving particularly egregious conduct, courts may award punitive damages designed to punish the wrongdoer and deter similar behavior.

The evolution of personal injury law reflects society’s growing understanding of how incidents can impact every aspect of a person’s life, not just their physical well-being.

The 7 Key Differences Between Bodily Injury and Personal Injury

Difference #1: Scope of Coverage

The most fundamental difference lies in the breadth of what each term covers. Bodily injury maintains laser focus on physical harm to the human body, while personal injury casts a much wider net.

Bodily injury claims are limited to medical expenses, physical therapy costs, and compensation for physical pain and suffering directly related to bodily harm. Insurance policies covering bodily injury typically specify coverage limits for medical treatment and physical rehabilitation.

Personal injury claims can include property damage, lost income, emotional distress, damage to reputation, and various other non-physical harms. This broader scope often results in higher settlement amounts and more complex legal proceedings.

Professional Tip: When reviewing insurance policies, pay close attention to whether coverage is limited to “bodily injury” or includes broader “personal injury” protection. This distinction can mean the difference between adequate coverage and significant out-of-pocket expenses.

Difference #2: Legal Standards and Burden of Proof

The legal standards for proving bodily injury versus personal injury claims differ significantly in complexity and evidence requirements.

Bodily injury cases typically require straightforward medical documentation. X-rays showing broken bones, medical records documenting treatment, and physician testimony about physical limitations provide clear evidence of bodily harm.

Personal injury cases often involve more subjective elements that are harder to prove in court. Demonstrating emotional distress, quantifying loss of enjoyment of life, or proving damage to reputation requires different types of evidence and expert testimony.

Evidence Requirements for Bodily Injury:

- Medical records and bills

- Diagnostic imaging results

- Physician reports and testimony

- Physical therapy documentation

- Employment records showing time missed due to physical limitations

Evidence Requirements for Personal Injury:

- All bodily injury evidence (if applicable)

- Psychological evaluations and treatment records

- Employment records showing career impact

- Financial documentation of economic losses

- Expert testimony on various damages

- Witness statements about life changes

Difference #3: Insurance Coverage Distinctions

Insurance policies often treat bodily injury and personal injury coverage as separate components with different limits and exclusions.

Bodily injury coverage typically appears in liability insurance policies with specific dollar limits per person and per incident. These limits apply only to physical injuries and related medical expenses.

Personal injury coverage may be offered as an additional rider or separate policy component, often with different limits and a broader range of covered incidents. Some policies exclude certain types of personal injury claims, such as those involving employment disputes or professional liability.

Warning: Many standard business liability policies provide bodily injury coverage but limited personal injury protection. Review your coverage carefully to ensure adequate protection for your specific risk profile.

Difference #4: Compensation and Damages

The potential compensation differs dramatically between bodily injury and personal injury claims due to the scope of damages considered.

Bodily injury compensation focuses on medical expenses, physical rehabilitation costs, and pain and suffering directly related to physical harm. These damages are often easier to calculate based on actual medical bills and established formulas for pain and suffering.

Personal injury compensation can include a much broader range of damages, often resulting in higher settlement amounts. Economic damages might include lost business opportunities, damage to professional reputation, or long-term impact on earning capacity that extends far beyond medical expenses.

Calculation Methods:

Bodily Injury: Medical expenses + Lost wages + Physical pain and suffering (often calculated using multipliers of medical expenses)

Personal Injury: All bodily injury damages + Emotional distress + Loss of consortium + Punitive damages + Economic impact + Property damage

Difference #5: Time Limitations and Statute of Limitations

Different statutes of limitations often apply to bodily injury versus broader personal injury claims, affecting when legal action must be initiated.

Bodily injury claims typically have straightforward time limits that begin running from the date of injury or when the injury was discovered. These time frames are usually clearly defined in state statutes.

Personal injury claims may have more complex timing issues, especially when different types of damages become apparent at different times. Emotional distress or reputational damage might not be immediately apparent, potentially affecting when the statute of limitations begins running.

State Variations: Statute of limitations periods vary by state and type of claim. Some states allow 2-3 years for bodily injury claims while providing different time frames for other personal injury components.

Difference #6: Settlement Negotiations and Resolution

The negotiation process and resolution strategies differ significantly between bodily injury and personal injury cases.

Bodily injury cases often follow more predictable settlement patterns based on medical expenses, clear physical limitations, and established precedents for similar injuries. Insurance adjusters can more easily evaluate these claims using standard formulas and medical documentation.

Personal injury cases involve more subjective elements that can make settlement negotiations more complex and unpredictable. The inclusion of emotional distress, reputational damage, and other intangible harms requires more nuanced negotiation strategies.

Settlement Timeline Differences:

- Bodily injury cases often resolve within 6-18 months

- Personal injury cases may take 1-3 years or longer due to complexity

Difference #7: Professional and Business Implications

The implications for businesses and professionals differ substantially depending on whether an incident results in bodily injury or broader personal injury claims.

Bodily injury incidents primarily impact businesses through workers’ compensation claims, customer safety issues, and premises liability. The focus remains on physical safety measures and medical response protocols.

Personal injury risks for businesses extend to employment practices, professional services, advertising practices, privacy violations, and various other operational areas. This broader risk profile requires more comprehensive risk management strategies.

Business Risk Management Considerations:

Bodily Injury Focus: Safety protocols, premises maintenance, product safety, employee training on physical hazards

Personal Injury Focus: All bodily injury considerations plus employment practices, privacy protection, professional standards, communication protocols, reputation management

Industry-Specific Applications and Considerations

Healthcare Sector

Healthcare professionals face unique challenges in distinguishing between bodily injury and personal injury claims. Medical malpractice cases often involve both physical harm and broader personal injury elements.

Bodily injury in healthcare typically involves surgical complications, medication errors causing physical harm, or accidents in medical facilities. These cases focus on the direct physical consequences of medical treatment.

Personal injury claims in healthcare can include emotional distress from privacy violations, damage to reputation from medical errors, financial losses from delayed or improper treatment, and various other non-physical harms.

Business and Professional Services

Professional service providers must understand how their work might generate both bodily injury and personal injury liability.

Bodily injury risks for professionals are often limited to premises liability or physical safety issues in their offices or work sites.

Personal injury risks extend to professional negligence, privacy violations, defamation, breach of fiduciary duty, and other harm to clients’ interests that don’t involve physical injury.

Technology and Digital Services

The technology sector faces evolving personal injury risks that rarely involve traditional bodily injury.

Bodily injury claims in technology are typically limited to workplace safety issues or defective products that cause physical harm.

Personal injury claims can involve privacy violations, cybersecurity breaches, defamation through digital platforms, interference with business relationships, and various other harms enabled by technology.

Insurance Strategy: Optimizing Coverage for Both Types of Claims

Assessing Your Risk Profile

Determining appropriate insurance coverage requires understanding your specific exposure to both bodily injury and personal injury claims.

Risk Assessment Questions:

- Do you interact with the public in physical locations?

- Does your business involve physical products or services?

- Do you handle confidential information or personal data?

- Could your professional advice or services impact clients’ financial interests?

- Do you engage in advertising or public communications?

Coverage Gap Analysis

Many individuals and businesses discover coverage gaps only after experiencing a claim. Conducting regular insurance reviews helps identify potential shortfalls.

Common Coverage Gaps:

- Adequate bodily injury coverage but insufficient personal injury protection

- Professional liability coverage that excludes certain types of personal injury claims

- General liability policies with personal injury exclusions

- Insufficient coverage limits for the severity of potential claims

Emerging Trends in Insurance Coverage

Insurance markets continue evolving to address changing risk landscapes and legal precedents.

2025 Trends:

- Increased focus on cyber-related personal injury claims

- Enhanced coverage for emotional distress and mental health impacts

- More specific exclusions for certain types of personal injury claims

- Integration of bodily injury and personal injury coverage in comprehensive policies

Legal Precedents and Recent Developments

Landmark Cases Shaping Current Law

Recent legal developments continue refining the boundaries between bodily injury and personal injury claims.

Courts increasingly recognize the interconnected nature of physical and emotional harm, leading to more comprehensive approaches to damages in personal injury cases. This trend affects how attorneys structure claims and how insurance companies evaluate settlements.

Regulatory Changes Affecting Claims

State regulations and federal guidelines continue evolving to address changing social attitudes toward different types of harm and compensation.

Recent Regulatory Trends:

- Expanded recognition of emotional distress claims

- Enhanced protections for privacy-related personal injury

- Stricter standards for proving certain types of damages

- Modified statute of limitations for specific claim types

Practical Steps for Protection and Compliance

For Business Owners

Implementing comprehensive risk management strategies requires understanding both bodily injury and personal injury exposures.

Essential Business Protections:

- Regular safety audits and hazard assessments

- Comprehensive insurance coverage review

- Employee training on safety and liability issues

- Clear policies for handling incidents and claims

- Professional consultation on risk management strategies

For Professionals

Individual professionals need tailored approaches to managing liability exposure.

Professional Protection Strategies:

- Professional liability insurance appropriate to your field

- Clear client communication and documentation practices

- Understanding of your industry’s specific liability risks

- Regular review of insurance coverage adequacy

- Consultation with legal and insurance professionals

Documentation and Record-Keeping

Proper documentation serves as crucial protection regardless of whether incidents involve bodily injury or broader personal injury claims.

Essential Documentation Practices:

- Incident reports with detailed factual information

- Witness statements and contact information

- Photographic evidence when appropriate

- Medical documentation for any physical injuries

- Communication records with all parties involved

- Insurance notification and claim documentation

Future Implications and Evolving Standards

Technology’s Impact on Liability

Advancing technology continues creating new categories of potential harm that blur traditional boundaries between bodily injury and personal injury.

Virtual reality injuries, cybersecurity breaches causing emotional distress, and AI-related harms represent emerging areas where traditional legal categories may prove inadequate.

Changing Social Attitudes

Society’s evolving understanding of different types of harm affects legal standards and jury expectations in both bodily injury and personal injury cases.

Increased awareness of mental health issues, recognition of emotional trauma, and changing attitudes toward privacy rights all influence how courts and juries evaluate claims.

Expert Recommendations and Best Practices

Immediate Actions for Better Protection

Priority Actions:

- Review current insurance coverage with qualified professionals

- Assess specific risk factors for your situation

- Implement appropriate safety and risk management protocols

- Establish clear incident response procedures

- Ensure adequate documentation practices

Long-term Strategic Considerations

Strategic Planning Elements:

- Regular review and updating of insurance coverage

- Ongoing risk assessment and management

- Professional development in relevant legal and safety areas

- Building relationships with qualified legal and insurance professionals

- Staying informed about evolving legal standards and regulations

Frequently Asked Questions

Can a single incident involve both bodily injury and personal injury claims?

Yes, many incidents result in both types of claims. For example, a car accident might cause physical injuries (bodily injury) while also resulting in emotional trauma, lost wages, and property damage (additional personal injury elements). The distinction affects how different aspects of the claim are evaluated and compensated.

Does workers’ compensation cover personal injury or just bodily injury?

Workers’ compensation primarily covers bodily injury and related wage replacement. However, some states include limited personal injury elements such as emotional distress in specific circumstances. Additional personal injury protection may require separate coverage or legal action outside the workers’ compensation system.

How do insurance companies evaluate personal injury claims compared to bodily injury claims?

Insurance companies use more straightforward formulas for bodily injury claims based on medical expenses and established pain and suffering calculations. Personal injury evaluation involves more subjective analysis of emotional distress, reputational damage, and other intangible harms, often requiring expert testimony and more complex settlement negotiations.

Are there different legal professionals for bodily injury versus personal injury cases?

While the same attorneys often handle both types of cases, some lawyers specialize in specific areas. Personal injury attorneys typically handle both bodily injury and broader personal injury claims, while some professionals focus on specific areas like medical malpractice, employment law, or defamation cases.

What should I do immediately after an incident that might involve either type of claim?

Seek immediate medical attention for any physical injuries, document the incident thoroughly with photos and witness information, report the incident to relevant authorities and insurance companies, avoid admitting fault or discussing details beyond factual reporting, and consult with qualified legal and insurance professionals to understand your rights and obligations.

How do statutes of limitations differ between bodily injury and personal injury claims?

While specific time limits vary by state, bodily injury claims typically have clear start dates from the injury occurrence or discovery. Personal injury claims may have more complex timing issues, especially when different types of harm become apparent at different times. Some elements like defamation may have shorter time limits, while others like fraud discovery may have longer periods.

Conclusion: Making Informed Decisions in Complex Legal Territory

Understanding the seven key differences between bodily injury and personal injury provides essential knowledge for navigating today’s complex legal and insurance landscape. These distinctions affect everything from insurance coverage decisions to legal strategy and financial protection.

The scope of coverage, legal standards, insurance implications, compensation structures, time limitations, settlement processes, and professional implications all differ significantly between these two legal concepts. Recognizing these differences enables better decision-making in insurance purchases, risk management, and incident response.

As legal standards continue evolving and new types of harm emerge from technological and social changes, staying informed about these distinctions becomes increasingly important. Whether you’re a business owner, professional, or individual seeking protection, understanding these concepts helps ensure adequate coverage and appropriate response to potential claims.

The investment in proper insurance coverage, risk management strategies, and professional guidance pays dividends when incidents occur. By recognizing the broader scope of personal injury compared to bodily injury, you can make more informed decisions that protect your financial interests and legal obligations.

Professional Recommendation: Regularly review your insurance coverage and risk management strategies with qualified professionals who understand these distinctions. The evolving legal landscape and changing risk profiles require ongoing attention to ensure continued adequate protection.

Author Information

👤 Mr. James Mitchell

Mr. Mitchell is a legal risk management consultant with 12 years specializing in insurance liability and personal injury law. A Georgetown Law JD graduate, he has worked with Fortune 500 companies and contributes to the American Bar Association Journal and Risk Management Magazine.

Find him on: LinkedIn | Twitter | ResearchGate

Downloadable Resource: [Free Bodily vs Personal Injury Assessment Checklist] – Evaluate your specific risk factors and insurance coverage needs with this comprehensive 15-point assessment tool designed for professionals and business owners.

This article provides general information and should not be considered legal advice. Consult with qualified legal and insurance professionals for guidance specific to your situation.