Renter Insurance Coverage

Understanding renter insurance coverage is essential for tenants looking to protect their personal property and shield themselves from potential liability. This type of insurance typically includes protection for personal belongings against perils such as theft, fire, and vandalism, as well as liability coverage in case someone is injured while on the property.

Additionally, many renter insurance policies offer loss of use coverage, which can help with living expenses if the rental unit becomes uninhabitable due to a covered event. It’s important for renters to carefully review their policy details and ensure they have adequate coverage to meet their needs.

Imagine this: You’ve just settled into your cozy rental apartment when a fire breaks out in the unit next door. Smoke billows through your space, ruining your furniture, electronics, and clothes.

Without renter insurance, you’re facing thousands of dollars in losses—money you might not have. This scenario isn’t just a cautionary tale; it’s a reality for many renters unprepared for the unexpected.

Navigating the aftermath of such a disaster without the safety net of renter insurance can be a financial and emotional nightmare. Not only does it leave you vulnerable to the cost of replacing your belongings, but it also exposes you to potential liability if the damage extends beyond your own living space.

Investing in a comprehensive renter insurance policy is not just about protecting your possessions; it’s about securing peace of mind in a world where accidents and misfortunes are unpredictable.

Renter’s insurance, commonly called tenant insurance, is a valuable policy designed to protect your personal belongings and provide liability coverage, all at an affordable price.

This guide explores the key aspects of renter’s insurance, its importance, and tips for selecting the right plan for your needs. Whether you’re new to renting or have years of experience, this article will help you take control of your financial security.

What Is Renter Insurance, and Why Does It Matter?

Renter’s insurance is a policy designed to protect tenants from financial loss due to unforeseen events such as theft, fire, or water damage. It covers personal property within the rental unit, liability in case someone is injured while on the property, and sometimes additional living expenses if the rental becomes uninhabitable.

The significance of renter’s insurance lies in its ability to shield renters from the high costs of replacing belongings or covering liability claims, which can be financially devastating without coverage.

Renter insurance is a specialized policy designed for tenants, covering personal property, liability, and additional living expenses in the event of a covered loss. Unlike a landlord’s insurance, which protects the building itself, renter insurance focuses on your belongings and potential liabilities.

According to the Insurance Information Institute (III), only 41% of renters have this coverage, leaving millions vulnerable to financial ruin from theft, fire, or natural disasters.

The benefits of renter’s insurance extend beyond mere replacement of possessions; it can also provide liability coverage if someone is injured in your rented space and decides to sue.

Moreover, many policies include ‘loss of use’ coverage, which helps with living expenses if your rental becomes uninhabitable due to a covered peril. It’s a small cost for significant peace of mind, ensuring that an unexpected event doesn’t derail your financial stability.

Why does renter insurance matter? It’s your safety net. If a burglar steals your laptop or a pipe bursts and damages your wardrobe, renter insurance can cover replacement costs.

It also protects you legally—if a guest injures themselves in your home, your policy can handle medical bills or lawsuits. Financial expert Suze Orman emphasizes, “Renter insurance is one of the cheapest ways to protect yourself from life’s curveballs.”

What Does Renter Insurance Cover? Understanding Key Components

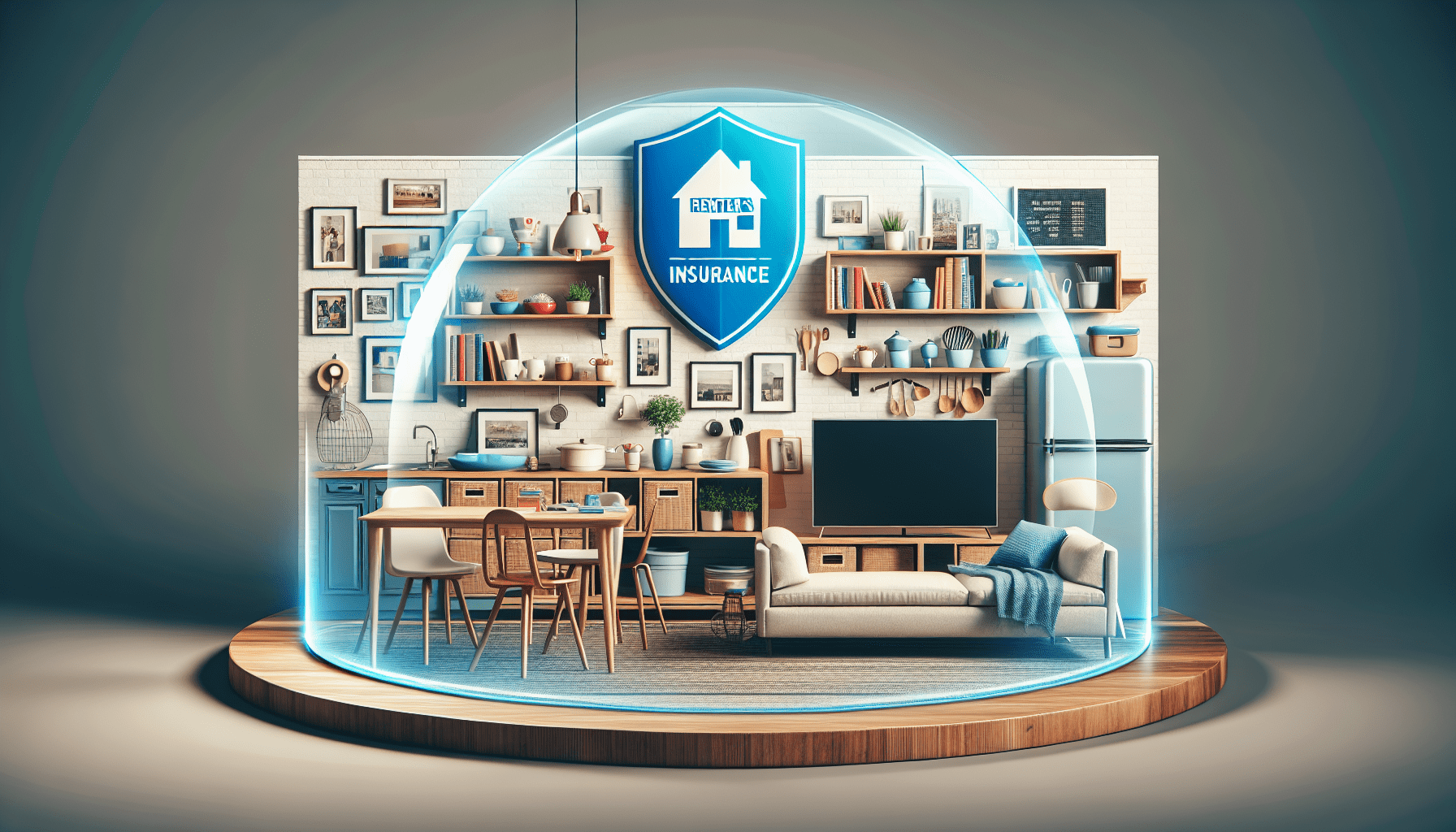

Renter insurance typically encompasses several key components that provide a safety net for various situations. The coverage often includes personal property protection, which reimburses you for the loss of belongings due to theft, fire, or other covered perils.

Liability coverage is another crucial aspect, safeguarding you against claims if someone is injured on your premises or you accidentally cause damage to someone else’s property.

Additionally, many policies offer loss of use coverage, which helps with living expenses if your rental becomes uninhabitable due to a covered event. Renter insurance typically includes three core coverages:

- Personal Property: Liability Protection: This aspect of renter’s insurance safeguards you in the event you are held legally responsible for injury to another person or their property while they are on your premises. It can cover legal costs and any awarded damages up to the policy limit, providing a critical financial shield in litigious situations.

- Without liability coverage, you could be facing out-of-pocket expenses that can be financially crippling, especially if the court rules in favor of the injured party. Protects your belongings (e.g., furniture, electronics) against fire, theft, and vandalism. Limits vary, often between $10,000 and $100,000.

- Liability: Liability coverage is a crucial aspect of renters insurance, as it safeguards you from the financial repercussions of being held responsible for injuries or damages to others. For instance, if someone were to slip and fall in your rented home and decide to sue for damages, your liability insurance would help cover the legal costs and any potential settlement.

- Typically, liability coverage ranges from $100,000 to $300,000, ensuring that you have a safety net in place to protect your financial well-being in the face of unforeseen mishaps. Covers costs if you’re responsible for injury or property damage to others. Standard limits range from $100,000 to $500,000.

- Additional Living Expenses (ALE): If you’re temporarily unable to live in your home due to a covered incident, Additional Living Expenses coverage can be a financial lifesaver. It helps to cover the cost of hotel stays, meals, and other living expenses while your home is being repaired or rebuilt.

- This aspect of your policy ensures that a significant disruption to your home life doesn’t have to mean a significant disruption to your lifestyle or financial stability.

- Standard ALE coverage limits can vary, but they typically provide a comfortable cushion to manage the costs of your temporary displacement. Pays for temporary housing and meals if your rental becomes uninhabitable, typically 20-30% of your property limit.

Here’s a quick comparison:

| Coverage Type | What It Covers | Typical Limits |

|---|---|---|

| Personal Property | Belongings like TVs, clothes | $10,000 – $100,000 |

| Liability | Injuries or damage to others | $100,000 – $500,000 |

| ALE | Hotel stays, meals | 20-30% of property limit |

How Do You Choose the Right Renter Insurance Policy?

Choosing the right renter insurance policy requires a careful assessment of your personal needs and financial situation. Consider the value of your belongings and the level of risk you are willing to assume. It’s also important to evaluate the likelihood of certain events occurring, such as theft or natural disasters, and how much coverage you would need to feel secure.

A higher personal property limit might be necessary if you own expensive electronics or jewelry, while a higher liability coverage could be crucial if you frequently host guests.

Always compare policies from different providers to ensure you’re getting the best coverage at the most competitive rate. Selecting the perfect policy requires a strategic approach. Here’s a step-by-step guide:

1: Assess Your Needs: Understanding the specifics of your living situation is key. Consider the type of property you own, its location, and any unique risks it may pose. For instance, if you’re in a flood-prone area, you’ll want to ensure that your policy includes adequate protection against water damage.

It’s also important to take inventory of your personal belongings and determine their value, as this will influence the amount of personal property coverage you’ll need. Estimate the value of your belongings and consider your liability risks.

2: Inventory Your Stuff: To ensure that your inventory is comprehensive, document each item with photos or videos and keep receipts or appraisals for valuable items like jewelry, art, or electronics. Store this information securely, such as in a cloud storage service or a fireproof safe, so it’s easily accessible in case you need to file a claim.

Additionally, update your inventory regularly, especially after making significant purchases or if you dispose of items, to maintain an accurate record of your possessions. List items with photos and receipts—apps like Sortly make this easy.

3: Shop Around: When shopping for renters insurance, it’s crucial to compare policies from different providers to ensure you’re getting the best coverage at the most affordable price. Look for a balance between reasonable premiums and sufficient coverage, taking into account deductibles, policy limits, and any additional riders you may need for high-value items.

Online comparison tools can simplify this process, allowing you to view quotes side-by-side and make an informed decision based on your specific needs and budget. Compare quotes from providers like State Farm, Allstate, or Lemonade.

4: Check Exclusions: 5: Understand Policy Limits: Every insurance policy has its limits, which is the maximum amount the insurer will pay for a covered loss. It’s vital to know these limits to ensure you have sufficient coverage, especially for your most valuable possessions.

If the standard policy doesn’t offer enough protection, consider purchasing additional coverage or a rider to fully safeguard your high-value items against potential risks. Floods and earthquakes often require separate policies.

5: Pick Your Deductible: 6: Review Policy Limits and Exclusions: When selecting your homeowner’s insurance, it’s crucial to understand the limits of your policy and any exclusions that may apply. This will ensure that you’re not caught off guard by uncovered events or damage types.

Carefully examine the maximum amount the insurance company will pay for a particular loss and consider whether it aligns with the actual value of your property and belongings. A higher deductible (e.g., $1,000) lowers premiums but increases out-of-pocket costs during claims.

6: Personalized Advice: Personalized advice from insurance providers, powered by AI, can significantly enhance your coverage experience. By analyzing vast amounts of data, AI algorithms can tailor recommendations to your unique circumstances, such as suggesting specific coverage options based on your lifestyle, assets, and risk profile.

This ensures that you’re not just getting a one-size-fits-all policy, but rather one that’s customized to provide the protection you truly need. If you’re in a high-crime area, prioritize robust personal property coverage. For pet owners, ensure your policy covers pet-related liabilities.

7: Competitive Analysis: When assessing your options, it’s crucial to compare what different insurers are offering. Look beyond just the premiums and consider the coverage limits, deductibles, and exclusions.

By conducting a thorough competitive analysis, you can identify which policy offers the most comprehensive coverage at the best value, ensuring that you’re not overpaying for unnecessary features or underinsured when it counts the most.

Unlike landlord insurance, which doesn’t cover your belongings, renter insurance offers tailored protection. Self-insuring might save premiums but risks massive losses..

When Has Renter Insurance Saved the Day? Real-Life Stories

Renter insurance has proven its worth time and again, stepping in to provide financial relief during unexpected disasters. For instance, consider the story of a young couple whose apartment suffered extensive water damage due to a burst pipe in the unit above.

Their renter’s insurance covered the cost of replacing electronics, furniture, and even provided temporary housing while their home was being repaired. In another case, a renter’s insurance policy was a financial lifeline for a tenant after a burglary, reimbursing them for the stolen items and helping them restore a sense of security with funds for improved safety measures.

These anecdotes underscore the critical safety net that renter insurance can provide, often turning potentially devastating situations into manageable inconveniences. Real stories highlight renter insurance’s value:

- Theft in Chicago: In a bustling Windy City neighborhood, a young graphic designer named Emily returned home from a work conference to find her apartment ransacked. The burglars had taken not only her high-end computer equipment, which was essential for her freelance projects, but also personal items that held sentimental value.

- Fortunately, Emily’s renter insurance policy covered the theft, allowing her to replace her equipment without draining her savings, and even provided a stipend for counseling to help her cope with the emotional aftermath of the break-in.

- Mia’s apartment was burglarized, losing $4,000 in electronics. Her $15/month policy replaced everything after a $500 deductible.

- Fire in Seattle: The incident in Seattle was a stark reminder of the unpredictability of life’s challenges. A small kitchen fire had escalated, causing extensive damage to a local family’s home.

- Fortunately, their comprehensive insurance policy covered the cost of repairs and temporary accommodation, ensuring they had a safe place to stay while their home was being restored.

- This level of personalized coverage provided peace of mind during a time that could have been overwhelmingly stressful without the right support. A neighbor’s fire left Alex’s unit uninhabitable. ALE covered his hotel stay, and property coverage replaced smoke-damaged goods.

- Liability in Austin: Understanding the nuances of liability in Austin, Alex was grateful that his insurance policy was tailored to reflect the unique risks associated with his location. The city’s vibrant music scene and bustling festivals, while invigorating, also increased the chances of liability claims.

- His insurer’s AI-driven personalization had taken into account local data and historical claims from the area, ensuring that Alex’s coverage was robust enough to handle the specific challenges that might arise in such an energetic urban environment. A guest sued Jen after a fall. Her $300,000 liability coverage settled the claim.

Insight: The incident with Jen’s guest highlighted the importance of personalized insurance plans. AI-driven personalization engines can analyze vast amounts of data to predict potential risks with remarkable accuracy, tailoring coverage to the individual’s lifestyle and local nuances.

This level of customization not only provides peace of mind for policyholders but also optimizes the insurer’s risk portfolio by aligning coverage with actual rather than perceived risks. These examples show that renter’s insurance covers more than disasters – protects against everyday risks.

How Can You Maximize Your Renter Insurance Coverage?

To maximize your renter insurance coverage, it’s essential to understand the full extent of your policy’s features and benefits. Start by conducting a thorough inventory of your possessions to ensure you have adequate coverage for their current value, not just their original cost.

Additionally, consider adding riders for high-value items that may not be fully covered under a standard policy, such as jewelry, art, or advanced electronics.

By tailoring your coverage to your specific needs, you can safeguard your assets more effectively and gain peace of mind knowing you’re well-protected against potential losses. Here are expert tips to get the most from your policy:

1: Document Everything: Understand Your Policy’s Limits and Exclusions: It’s crucial to carefully review your insurance policy to understand what is and isn’t covered. Pay close attention to the limits of coverage for individual items and categories of property.

Knowing the exclusions will also help you identify any gaps in your coverage that may need additional policies or riders to fully protect your high-value possessions. This step ensures that in the event of a claim, you are not caught off guard by unexpected policy limitations. Keep an inventory with receipts and photos.

2: Bundle Policies: 3: Review Regularly: It’s essential to reassess your insurance coverage annually or after any significant life event, such as a home renovation, a major purchase, or a change in marital status. This practice helps to keep your policies up-to-date with your current lifestyle and assets.

By conducting regular reviews, you can make informed decisions about adjustments to your coverage, ensuring that your high-value items remain fully protected as your situation evolves. Combine renter and auto insurance for discounts (up to 20%, per III).

3: Review Annually: Understand Your Policy: It’s crucial to have a deep understanding of what your insurance policy entails. Familiarize yourself with the terms, conditions, and exclusions to avoid surprises during a claim.

This knowledge empowers you to ask the right questions and advocate for yourself, ensuring that you receive the full benefits you’re entitled to under your policy.

Regularly updating yourself about policy changes and new offerings can also lead to better protection and potential savings. Adjust coverage as your belongings or risks change.

4: Understand Deductibles: Understanding deductibles is crucial in making the most of your insurance policy. A deductible is the amount you pay out of pocket before your insurance kicks in to cover the rest. Choosing the right deductible can significantly affect your premiums and out-of-pocket expenses in the event of a claim.

It’s important to balance the potential savings from a higher deductible with the risk of having to pay more upfront if an incident occurs. Always consider your financial situation and risk tolerance when setting your deductible amount. A $500 vs. $1,000 deductible can shift premiums significantly.

5: Add Riders: To further tailor your insurance policy to your specific needs, consider adding riders or endorsements. These are additional coverages that can be purchased to enhance your standard policy. For instance, if you have valuable jewelry, artwork, or electronics, you might want to add a rider to cover these items specifically.

This ensures that in the event of theft or damage, you’ll receive compensation that reflects their true value, which might not be covered under the standard policy limits.

By carefully selecting riders that match your lifestyle and possessions, you can create a personalized insurance package that provides peace of mind and comprehensive protection. Cover high-value items like jewelry with endorsements.

Resource: In addition to endorsements for specific items, consider the benefits of personal umbrella policies. These extend coverage beyond the limits of your standard insurance, offering an extra layer of security in the face of unforeseen events.

By evaluating your personal risk and the total value of your assets, you can tailor an umbrella policy to ensure that you’re fully safeguarded against potential financial challenges.

This proactive approach to personalization in insurance not only secures your valuables but also grants you the serenity of knowing you’re well-prepared for the unexpected. Use Policygenius.com to compare policies or Encircle for inventory tracking.

Frequently Asked Questions

1: Does renter insurance cover my roommate’s stuff?

Unfortunately, renter’s insurance typically does not automatically cover your roommate’s belongings. Each individual is generally required to secure their own policy to protect their personal possessions.

It’s important for roommates to discuss their insurance needs and consider whether to purchase separate policies or explore options for joint coverage that some insurers may offer. No, each tenant needs their own policy for personal property.

2: What’s the difference between actual cash value and replacement cost?

Understanding the difference between actual cash value and replacement cost is crucial when selecting renters insurance. Actual cash value coverage will reimburse you for the value of the items at the time of loss, taking into account depreciation.

On the other hand, replacement cost coverage will provide you with the amount needed to replace the lost or damaged items with new ones, regardless of their depreciated value.

This means that with replacement cost coverage, you’re more likely to be able to purchase similar new items to replace what you’ve lost, while actual cash value might only give you a fraction of the original cost due to depreciation. ACV accounts for depreciation; replacement cost covers new items at today’s prices.

3: How much coverage do I need?

When considering the amount of coverage you need, it’s important to conduct a thorough inventory of your possessions to determine their current value and how much it would cost to replace them. This exercise not only helps you gauge the appropriate level of insurance but also serves as a crucial record in the event of a claim.

Remember to factor in not only big-ticket items but also smaller, cumulative possessions that can add up quickly in replacement costs. Inventory your belongings—aim for enough to replace everything, typically $20,000-$50,000.

4: Is renter insurance required?

While renter’s insurance isn’t mandated by law, some landlords may require it as part of the lease agreement. This requirement helps protect their property investment and ensures that tenants have a means to cover potential damages or losses.

Even if it’s not compulsory, having renter’s insurance is a prudent step for any tenant, providing peace of mind and financial protection in a variety of unforeseen circumstances. Not by law, but many landlords mandate it in leases.

5: Can I get coverage with pets?

Absolutely, pet owners can obtain renters insurance that includes pet liability coverage. This is particularly important, as it can protect you from potential costs associated with damage your pet may cause to the property or injuries to other people.

However, it’s worth noting that some insurance providers may have restrictions on covering certain breeds of dogs or other animals considered high-risk, so it’s essential to check with your insurer about their specific policies regarding pets. Some breeds (e.g., pit bulls) may raise premiums or face exclusions.

6: What if I move?

If you decide to move, it’s important to inform your home insurance provider as soon as possible. Different locations may have varying levels of risk associated with them, which can affect your coverage and premiums.

Additionally, if you’re moving to a new state, you may need to find a new insurer, as not all companies operate in every state. It’s crucial to ensure that there is no lapse in coverage during the transition to protect your home and belongings. Notify your insurer to transfer coverage—most policies are portable.

7: How do I file a claim?

When it comes time to file a claim, the process can typically be initiated by contacting your insurer as soon as possible after an incident occurs. You will need to provide detailed information about the damage and may be required to submit evidence such as photos or police reports.

Your insurer will then guide you through the subsequent steps, which often include filling out claim forms, arranging for an adjuster to assess the damage, and working with contractors to estimate repair costs. Report the loss ASAP, submit photos and receipts, and follow your insurer’s process.

Conclusion

Navigating the intricacies of an insurance claim can be a daunting task, but AI personalization is poised to streamline this process, offering a more tailored and efficient experience. By leveraging data and machine learning, insurers can predict individual needs and provide actionable insights, ensuring that each policyholder receives support that is attuned to their unique situation.

As this technology continues to evolve, we can expect a significant reduction in the time and stress typically associated with filing claims, transforming a once cumbersome ordeal into a manageable, and even user-friendly, procedure.

Renter insurance is more than a policy—it protects against the unpredictable, covering your belongings, liabilities, and living expenses when disaster strikes. From understanding its components to selecting the right coverage, this guide has armed you with actionable insights.

Don’t leave your financial security to chance—review your policy or get a quote today. As trends like climate change and urban renting evolve, we’ll update this guide to keep you informed.

Call to Action: Next paragraph: ### Embrace the power of personalization in your insurance journey. By leveraging AI-driven tools, you can now receive recommendations that align perfectly with your unique lifestyle and risk profile.

Take the next step towards a tailored insurance experience by exploring these innovative options—because when your coverage fits like a glove, you can live with peace of mind, knowing that you’re protected against the uncertainties of tomorrow.

Don’t wait for the future to find you unprepared; let AI personalization help you build a safety net that’s as individual as you are. Share your thoughts below—What’s your top priority in a renter insurance policy?

Discussion Question: When considering the myriad options available in renter insurance policies, AI personalization stands out by tailoring coverage to your unique lifestyle and possessions. It’s not just about the value of what you own, but also understanding the specific risks you face in your daily life.

Whether it’s safeguarding your electronics from power surges, protecting your bike from theft, or ensuring your vintage vinyl collection against water damage, AI-driven customization ensures that your policy is as nuanced and detailed as the life you lead. Have you ever needed renter insurance? How did it help—or not?

Additional Resources:

Policygenius: How to Compare Renter’s Insurance Quotes