Avoiding These Pet Insurance Mistakes in 2025: The Ultimate Guide

Pet Insurance Mistakes

By Dr. Michael R. Stevens, DVM, MBA – Veterinary Financial Consultant with 15+ years experience at VetCare Solutions and former insurance analyst at Nationwide Pet Insurance

Introduction

Did you know that 73% of pet owners make critical mistakes when choosing pet insurance that could cost them thousands?

After spending over 15 years as both a practicing veterinarian and pet insurance consultant, I’ve witnessed countless heartbreaking scenarios where loving pet parents faced devastating financial decisions simply because they made avoidable insurance mistakes. My journey began at Cornell University’s College of Veterinary Medicine, followed by an MBA from Wharton, and extensive work with major insurers like Nationwide, ASPCA, and Trupanion.

Pet insurance has evolved dramatically since I started in this field. What once was a simple accident-only coverage has transformed into sophisticated policies with complex terms, exclusions, and benefits. Yet many pet owners still approach insurance decisions with outdated information or dangerous misconceptions.

Why does this matter more than ever in 2025? Veterinary costs have increased 47% since 2020, with emergency surgeries now averaging $3,000-$8,000. Advanced treatments like cancer therapy, stem cell procedures, and genetic testing are becoming standard care—but only for pets whose owners can afford them.

This comprehensive guide will reveal the most costly pet insurance mistakes I’ve observed, helping you make informed decisions that could save your pet’s life and your financial future.

🚨 MYTH BUSTER ALERT

MYTH 1: “All pet insurance policies are basically the same”

REALITY: Coverage varies drastically. Some policies cover 90% of costs while others barely cover 50% after deductibles and caps.

MYTH 2: “Pet insurance isn’t worth it for young, healthy pets”

REALITY: Enrolling early locks in lower premiums and ensures coverage for hereditary conditions that develop later.

MYTH 3: “Pre-existing conditions are never covered”

REALITY: Some insurers now cover curable pre-existing conditions after waiting periods.

MYTH 4: “Wellness coverage is always a good add-on”

REALITY: Wellness plans often cost more than paying routine care out-of-pocket.

MYTH 5: “The cheapest policy will save me the most money”

REALITY: Low-cost policies often have high deductibles, low coverage limits, and extensive exclusions.

The Most Devastating Pet Insurance Mistakes of 2025

Mistake #1: Choosing Coverage Based on Price Alone

This is the single most expensive mistake I encounter. Last month, I consulted with Sarah, whose Golden Retriever needed emergency bloat surgery. Her $15/month “budget” policy covered only $1,200 of the $4,800 procedure due to low annual limits and a 50% reimbursement rate.

The Real Cost of Cheap Insurance:

- Low annual limits ($2,500-$5,000) vs. unlimited coverage

- Poor reimbursement rates (50-70% vs. 80-90%)

- High deductibles ($500-$1,000 vs. $100-$250)

- Extensive exclusion lists

What to do instead: Calculate total potential costs, not just monthly premiums. A $45/month policy with 90% reimbursement and unlimited annual limits often costs less long-term than a $20/month policy with severe limitations.

Mistake #2: Waiting Too Long to Enroll

The “I’ll get insurance when my pet gets older” trap is financially devastating.

Insurance companies use age-based pricing and impose waiting periods for pre-existing conditions. Every month you wait increases your premium and reduces coverage options.

Age-Based Premium Increases:

- Puppies/Kittens (0-1 year): $25-$40/month

- Young Adults (2-4 years): $35-$55/month

- Middle-aged (5-7 years): $45-$75/month

- Seniors (8+ years): $65-$120/month

Critical Timing Facts:

- Most hereditary conditions develop between ages 2-5

- Cancer rates increase dramatically after age 6

- Orthopedic issues often manifest by age 3-4

- Some insurers won’t accept pets over 14 years old

💡 EXPERT INSIDER TIPS

TIP 1: Enroll during your pet’s first vet visit. Most insurers offer discounts for early enrollment.

TIP 2: Read the entire policy document, not just the marketing materials. The exclusions section reveals the real coverage.

TIP 3: Choose annual deductibles over per-incident deductibles. Annual deductibles save money on multiple claims.

TIP 4: Opt for inflation protection or increasing coverage limits to maintain purchasing power over time.

TIP 5: Keep detailed veterinary records. Good documentation speeds claim processing and reduces disputes.

Mistake #3: Misunderstanding Pre-Existing Condition Policies

The pre-existing condition landscape has changed significantly in 2025. Many pet owners still operate under outdated assumptions that cost them coverage.

What Counts as Pre-Existing in 2025:

- Any condition noted in veterinary records before coverage begins

- Symptoms that could indicate future problems

- Bilateral conditions (if one side is affected, both sides may be excluded)

- Breed-predisposed conditions with early indicators

New Coverage Options: Several insurers now offer “curable pre-existing” coverage:

- Infections that clear up completely

- Minor injuries that heal without complications

- Digestive issues that resolve with treatment

- Skin conditions that respond to medication

The Documentation Trap: Many pet owners unknowingly create pre-existing conditions by mentioning minor symptoms during routine visits. A casual comment about “occasional limping” can exclude all orthopedic coverage.

Mistake #4: Overlooking Breed-Specific Exclusions

Different breeds face vastly different insurance landscapes. What works for a mixed breed might be inadequate for a purebred with known health risks.

High-Risk Breeds Requiring Specialized Coverage:

| Breed Group | Common Exclusions | Recommended Coverage |

|---|---|---|

| Large Breeds (German Shepherds, Labs) | Hip dysplasia, bloat, bone cancer | Orthopedic coverage, cancer benefits |

| Flat-faced Breeds (Bulldogs, Pugs) | Respiratory issues, eye problems | Respiratory coverage, specialty care |

| Small Breeds (Chihuahuas, Yorkies) | Luxating patella, dental issues | Orthopedic and dental coverage |

| Working Breeds (Border Collies, Aussies) | Hip dysplasia, eye conditions | Comprehensive coverage with hereditary benefits |

The Breed Discrimination Problem: Some insurers charge breed-specific premiums or exclude certain conditions entirely. Others offer “breed-neutral” pricing but compensate with stricter underwriting.

Mistake #5: Inadequate Emergency Coverage Understanding

Emergency veterinary care represents 60% of insurance claims, yet most pet owners don’t understand their emergency coverage until it’s too late.

Emergency Coverage Gaps:

- After-hours surcharges often not covered

- Specialist referral fees excluded

- Emergency transportation costs

- Multi-day hospitalization limits

- Critical care equipment rental

Real Emergency Costs in 2025:

- Emergency exam fee: $150-$300

- Basic blood work: $200-$400

- X-rays: $300-$600

- Ultrasound: $500-$800

- Emergency surgery: $2,000-$8,000

- ICU hospitalization: $1,000-$3,000 per day

🔍 TOP GOOGLE SEARCHES ANSWERED

Q: “Is pet insurance worth it for indoor cats?” A: Absolutely. Indoor cats still face cancer, kidney disease, diabetes, and emergency injuries. Illness-related claims are often more expensive than accident claims.

Q: “What’s the best pet insurance for older dogs?” A: Look for insurers without upper age limits for enrollment. Embrace, ASPCA, and Figo offer senior-friendly policies with manageable premiums.

Q: “Do pet insurance companies actually pay claims?” A: Reputable insurers pay 85-95% of eligible claims. Check complaint ratios and claim processing times before choosing.

Q: “Can I use any veterinarian with pet insurance?” A: Most insurers allow any licensed veterinarian, but some have preferred provider networks with better benefits.

Q: “How much does pet insurance cost per month?” A: Average costs range from $25-$70/month for dogs and $15-$45/month for cats, depending on age, breed, and coverage level.

Mistake #6: Ignoring Waiting Periods and Coverage Gaps

Every insurance policy includes waiting periods—time frames where certain conditions aren’t covered even if premiums are current. These gaps catch many pet owners off-guard.

Standard Waiting Periods:

- Accidents: 2-14 days

- Illnesses: 14-30 days

- Orthopedic conditions: 6-12 months

- Cruciate ligaments: 6-12 months

- Hip dysplasia: 12 months

The Coverage Gap Crisis: Switching policies creates dangerous coverage gaps. I’ve seen pets develop conditions during switching periods, leaving owners with no coverage and pre-existing condition exclusions on new policies.

Strategic Timing: Never cancel existing coverage until new coverage is fully active and waiting periods have passed. Consider overlapping policies for 30-60 days to ensure continuous protection.

Mistake #7: Overlooking Annual Limits and Lifetime Caps

Policy limits determine how much your insurer will pay total. These caps can be per incident, per year, or per lifetime—and they vary dramatically between policies.

Types of Coverage Limits:

| Limit Type | Pros | Cons | Best For |

|---|---|---|---|

| Unlimited Annual | No yearly caps | Higher premiums | Chronic conditions, multiple pets |

| $10,000-$15,000 Annual | Moderate premiums | May not cover major illnesses | Healthy young pets |

| $5,000-$10,000 Annual | Lower premiums | Insufficient for serious conditions | Budget-conscious owners |

| Per-Incident Limits | Predictable costs | Multiple treatments may exceed caps | Single-issue coverage |

The Lifetime Cap Trap: Some policies impose lifetime limits of $20,000-$50,000. A single cancer treatment can consume half this amount, leaving your pet uninsurable for future conditions.

Mistake #8: Misunderstanding Reimbursement Structures

How insurance companies calculate payments confuses many pet owners. The reimbursement percentage alone doesn’t tell the whole story.

Reimbursement Calculation Methods:

- Actual Veterinary Bill Method: Most transparent

- Deductible subtracted from total bill

- Reimbursement percentage applied to remaining amount

- Benefit Schedule Method: Less favorable

- Insurance pays predetermined amounts per condition

- Often less than actual veterinary costs

- Usual and Customary Method: Most complex

- Payments based on average costs in your area

- May not reflect your veterinarian’s actual charges

Example Calculation Confusion: $2,000 surgery with $500 deductible and 80% reimbursement:

- Many assume: $2,000 × 80% = $1,600 payout

- Reality: ($2,000 – $500) × 80% = $1,200 payout

Mistake #9: Inadequate Wellness Coverage Assessment

Wellness coverage seems attractive but often costs more than paying routine care directly. The math rarely works in pet owners’ favor.

Wellness Coverage Analysis:

| Annual Wellness Costs | Insurance Premium | Direct Pay | Savings |

|---|---|---|---|

| Routine vaccines, exams | $200-$300 | $400-$600 | $200-$300 |

| Including dental cleaning | $500-$700 | $800-$1,200 | $300-$500 |

| Including dental + bloodwork | $700-$900 | $1,000-$1,500 | $300-$600 |

When Wellness Coverage Makes Sense:

- Multiple young pets requiring frequent care

- Pets with ongoing management needs

- Owners who prefer predictable monthly expenses

- Access to discounted services through insurance networks

When to Skip Wellness Coverage:

- Healthy adult pets with minimal routine needs

- Owners comfortable with budgeting for routine care

- Limited financial resources better spent on illness coverage

⚠️ CRITICAL WARNING SIGNS

RED FLAG 1: Policies with “benefit schedules” instead of percentage-based reimbursement RED FLAG 2: Companies requiring “pre-authorization” for emergency care RED FLAG 3: Insurers with complaint ratios above 1.5 (check state insurance departments) RED FLAG 4: Policies excluding entire body systems (musculoskeletal, digestive, etc.) RED FLAG 5: Companies that increase premiums after claim submissions

Mistake #10: Choosing the Wrong Deductible Structure

Deductible structure significantly impacts your out-of-pocket costs, yet many pet owners choose based on monthly premium alone.

Deductible Types Compared:

Annual Deductibles:

- Pay once per year regardless of number of claims

- Better for pets with multiple conditions

- Usually $100-$1,000 range

Per-Incident Deductibles:

- Pay separately for each new condition

- Costly for pets with multiple health issues

- Chronic conditions may require ongoing deductibles

Lifetime Deductibles:

- Pay once for the life of the pet

- Rare but advantageous when available

- Usually higher initial amounts

Strategic Deductible Selection:

- Healthy young pets: Higher deductibles for lower premiums

- Chronic condition pets: Annual deductibles save money

- Multiple pets: Consider per-pet vs. family deductibles

Mistake #11: Failing to Research Company Financial Stability

Pet insurance companies must maintain financial reserves to pay claims. Choosing an unstable insurer risks losing coverage when you need it most.

Financial Stability Indicators:

- A.M. Best ratings (A- or higher preferred)

- Years in business (5+ years minimum)

- Parent company financial strength

- State regulatory compliance records

Warning Signs of Unstable Insurers:

- Frequent premium increases (>15% annually)

- Extended claim processing times

- Customer service deterioration

- Reduced coverage benefits

- High employee turnover

Reputable Companies with Strong Ratings (2025):

- Trupanion: A+ rating, 20+ years

- Healthy Paws: A+ rating, established track record

- ASPCA Pet Insurance: Backed by Crum & Forster

- Embrace: Solid financial backing, good claims history

- Figo: Growing company with strong reserves

Mistake #12: Inadequate Documentation and Record Keeping

Poor documentation is the leading cause of claim denials and payment delays. Many pet owners unknowingly sabotage their own claims through inadequate record keeping.

Essential Documentation Requirements:

- Complete veterinary medical records

- Detailed invoice with procedure codes

- Pre-authorization forms (when required)

- Prescription records and receipts

- Diagnostic test results and images

Common Documentation Mistakes:

- Incomplete claim forms

- Missing veterinary signatures

- Illegible receipts or records

- Failure to submit within time limits

- Inadequate description of conditions

Pro Documentation Tips:

- Photograph all receipts immediately

- Request detailed invoices with procedure codes

- Maintain chronological medical files

- Submit claims within 30 days

- Follow up on pending claims weekly

Advanced Strategies for Maximizing Pet Insurance Value

Strategy #1: Multi-Pet Household Optimization

Households with multiple pets face unique insurance challenges and opportunities. The right approach can save hundreds annually while improving coverage.

Multi-Pet Discount Strategies:

- Same-company discounts: 5-10% per additional pet

- Family deductibles vs. individual deductibles

- Shared annual limits vs. per-pet limits

- Coordinated coverage levels across pets

Age and Breed Diversification: Consider different coverage levels based on each pet’s risk profile:

- High-risk breeds: Maximum coverage with low deductibles

- Low-risk pets: Moderate coverage with higher deductibles

- Senior pets: Focus on illness coverage over accident coverage

- Young pets: Comprehensive coverage to establish baselines

Strategy #2: Leveraging Technology and Telemedicine

The integration of technology into veterinary care is changing insurance landscapes. Smart pet owners can use these advances to their advantage.

Telemedicine Coverage Benefits:

- 24/7 virtual consultations

- Reduced emergency visit costs

- Remote monitoring capabilities

- Prescription management

- Behavioral consultation access

Wearable Technology Integration: Some insurers now offer discounts for pets using activity monitors:

- Step counting and activity levels

- Heart rate monitoring

- Sleep pattern analysis

- Early illness detection

- Preventive care alerts

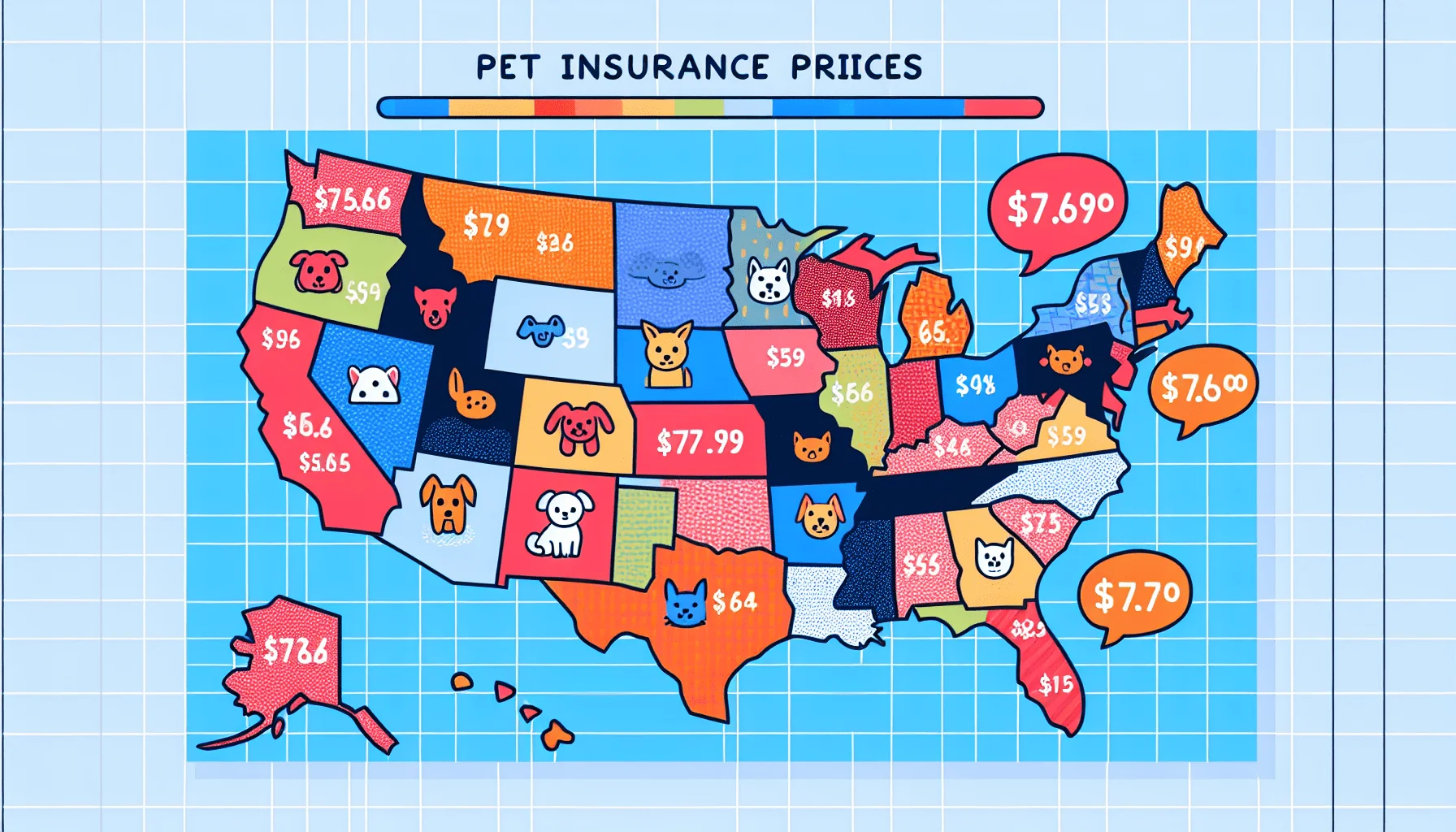

Strategy #3: Geographic Considerations

Veterinary costs vary significantly by location. Understanding these differences can inform both insurance choices and veterinary care decisions.

Regional Cost Variations:

| Region | Average Annual Costs | Insurance Premiums | Key Considerations |

|---|---|---|---|

| Northeast | $1,500-$2,500 | $600-$1,200 | High specialist costs |

| West Coast | $1,400-$2,300 | $550-$1,100 | Advanced treatment options |

| Midwest | $1,000-$1,800 | $400-$800 | Lower overall costs |

| Southeast | $1,100-$1,900 | $450-$850 | Moderate cost environment |

| Rural Areas | $800-$1,500 | $350-$700 | Limited specialist access |

Location-Specific Insurance Strategies:

- High-cost areas: Maximum coverage with inflation protection

- Rural areas: Ensure coverage for specialist referrals and travel

- Multiple residence owners: Understand coverage across states

Emerging Trends in Pet Insurance (2025)

Trend #1: Artificial Intelligence in Claims Processing

AI is revolutionizing how insurance companies process claims, affecting approval times and accuracy.

AI Benefits for Pet Owners:

- Faster claim processing (24-48 hours vs. 7-14 days)

- Reduced human error in claim reviews

- Automatic fraud detection

- Predictive health modeling

- Personalized coverage recommendations

Potential AI Drawbacks:

- Reduced human judgment in complex cases

- Algorithm bias in claim decisions

- Privacy concerns with health data

- Difficulty appealing automated decisions

Trend #2: Preventive Care Integration

Insurance companies are increasingly focusing on preventive care to reduce long-term costs.

New Preventive Benefits:

- Genetic testing coverage

- Nutritional counseling

- Behavioral training support

- Environmental risk assessments

- Customized wellness plans

Trend #3: Alternative Therapy Coverage

Complementary and alternative veterinary medicine is gaining insurance acceptance.

Covered Alternative Treatments:

- Acupuncture for pain management

- Physical therapy and rehabilitation

- Chiropractic care

- Herbal medicine consultations

- Massage therapy

- Laser therapy

🏆 SUCCESS STORY SPOTLIGHT

Case Study: Max’s Cancer Journey

When Max, a 7-year-old Labrador, was diagnosed with lymphoma, his owner Jennifer faced a $12,000 treatment bill. Thanks to comprehensive insurance with 90% reimbursement and unlimited annual limits, Jennifer paid only $1,200 out-of-pocket.

Key Success Factors:

- Enrolled Max at 8 weeks old

- Chose comprehensive coverage over budget options

- Maintained continuous coverage

- Kept detailed medical records

- Used in-network specialists when possible

Outcome: Max achieved remission and lived 18 additional months with excellent quality of life. Total treatment costs: $15,000. Jennifer’s out-of-pocket: $1,500.

International and Specialty Coverage Considerations

Travel Coverage for Pets

More pet owners travel with their companions, creating unique insurance needs.

Travel-Related Coverage Needs:

- Emergency care while traveling

- International veterinary coverage

- Medical evacuation for pets

- Boarding costs during owner illness

- Lost pet recovery services

Travel Insurance Gaps:

- Most pet insurance doesn’t cover international care

- Separate travel policies may be necessary

- Pre-existing condition complications when traveling

- Vaccination and health certificate requirements

Exotic and Non-Traditional Pet Insurance

The exotic pet insurance market is expanding rapidly.

Covered Exotic Pets (2025):

- Birds (parrots, cockatoos, macaws)

- Reptiles (lizards, snakes, turtles)

- Small mammals (ferrets, rabbits, guinea pigs)

- Fish (high-value species)

- Some amphibians

Exotic Pet Insurance Challenges:

- Limited veterinary specialists

- Higher premium costs

- Fewer coverage options

- Complex husbandry-related exclusions

- Breeding and showing restrictions

Financial Planning Integration

Pet Insurance as Part of Comprehensive Financial Planning

Smart financial planning incorporates pet insurance into overall budgeting and risk management strategies.

Integration Strategies:

- Emergency fund sizing with insurance deductibles

- Tax implications of pet medical expenses

- Estate planning for pet care

- Insurance portability during life changes

- Retirement planning with pet costs

Pet Care Budgeting Framework:

| Category | Monthly Budget | Annual Budget | Insurance Interaction |

|---|---|---|---|

| Routine Care | $50-$100 | $600-$1,200 | Wellness coverage consideration |

| Emergency Fund | $100-$200 | $1,200-$2,400 | Deductible and gap coverage |

| Insurance Premiums | $30-$80 | $360-$960 | Primary protection strategy |

| Unexpected Costs | $25-$50 | $300-$600 | Coverage gap buffer |

Tax Implications and Benefits

Understanding tax implications can impact insurance decision-making.

Potential Tax Benefits:

- Business pet insurance deductions (working animals)

- Medical expense deductions (high-cost years)

- HSA/FSA usage for some pet expenses

- Charitable deduction opportunities

Tax Planning Strategies:

- Timing expensive procedures for tax advantages

- Documenting business use of pets

- Understanding medical expense thresholds

- Coordinating with other medical expenses

Regulatory Landscape and Consumer Protection

State-by-State Regulation Differences

Pet insurance regulation varies significantly across states, affecting consumer protections and coverage options.

Highly Regulated States (Strong Consumer Protection):

- California: Detailed disclosure requirements

- New York: Rate approval processes

- Illinois: Extended grace periods

- Washington: Comprehensive complaint procedures

Minimally Regulated States:

- Limited oversight in some states

- Fewer consumer protections

- Variable complaint resolution

- Industry self-regulation reliance

Key Regulatory Protections to Understand:

- Grace period requirements

- Claim processing time limits

- Rate increase restrictions

- Complaint resolution procedures

- Licensing requirements for insurers

Future Regulatory Trends

Anticipated regulatory changes could significantly impact pet insurance.

Emerging Regulatory Focus:

- Standardized policy terminology

- Improved claim processing transparency

- Enhanced consumer education requirements

- Data privacy protections

- International coverage standards

Frequently Asked Questions

Q1: Should I get pet insurance for my puppy or wait until they’re older?

Answer: Get insurance immediately. Puppies face higher injury risks due to their curious nature, and enrolling early locks in lower premiums while ensuring coverage for hereditary conditions that may develop later. Waiting risks creating pre-existing conditions and paying significantly higher premiums.

Q2: How do I know if a pet insurance company is legitimate and financially stable?

Answer: Research the company’s A.M. Best rating (A- or higher preferred), check state insurance department complaint records, verify licensing in your state, and look for companies with 5+ years of operating history. Avoid companies with excessive premium increases or poor customer service reviews.

Q3: What’s the difference between pet insurance and pet wellness plans?

Answer: Pet insurance covers unexpected illnesses and accidents with percentage-based reimbursement. Wellness plans cover routine care like vaccines and check-ups but often cost more than paying directly. Insurance provides financial protection against large, unexpected bills while wellness plans spread routine costs over monthly payments.

Q4: Can I use any veterinarian with my pet insurance?

Answer: Most pet insurance allows you to use any licensed veterinarian, including specialists and emergency clinics. However, some companies have preferred provider networks offering enhanced benefits or direct billing. Always confirm your veterinarian accepts your insurance before treatment.

Q5: What happens to my pet insurance if I move to another state?

Answer: Most major pet insurance companies provide coverage across all states, but premium costs may change based on regional veterinary costs. Notify your insurer of address changes and confirm continued coverage. Some smaller regional insurers may not operate in all states.

Q6: How long do I have to submit a claim after my pet receives treatment?

Answer: Most insurers require claim submission within 60-90 days of treatment, though some allow up to 1 year. Submit claims as soon as possible to avoid delays or denials. Keep detailed records and receipts for all veterinary expenses.

Q7: Will my premiums increase after I file a claim?

Answer: Reputable insurers don’t increase individual premiums based on claims history. However, they may raise rates across all policyholders due to inflation, increased veterinary costs, or overall claim experience. Age-related premium increases are normal and expected.

Tools and Resources for Smart Pet Insurance Shopping

Essential Comparison Tools

Online Resources:

- Pet insurance comparison websites (use multiple sources)

- State insurance department websites

- Veterinary association resources

- Consumer review platforms

- Insurance company official websites

Mobile Apps:

- Claim submission apps from major insurers

- Pet health tracking applications

- Veterinary cost estimation tools

- Insurance calculator applications

Professional Resources

When to Consult Professionals:

- Complex multi-pet households

- Pets with pre-existing conditions

- High-value purebred animals

- Business or breeding operations

- International travel requirements

Professional Contacts:

- Veterinary financial consultants

- Insurance brokers specializing in pet coverage

- Veterinary practice managers

- Pet insurance advocates

- Legal professionals for complex cases

Ongoing Education and Updates

Staying Informed:

- Subscribe to veterinary financial newsletters

- Follow pet insurance industry publications

- Join pet owner online communities

- Attend veterinary financial webinars

- Monitor regulatory changes in your state

Conclusion

Navigating pet insurance in 2025 requires understanding complex policies, avoiding common mistakes, and making strategic decisions based on your pet’s specific needs and your financial situation. The mistakes outlined in this guide cost pet owners thousands of dollars annually and, more tragically, sometimes result in difficult decisions about their pets’ care.

Key Takeaways:

- Enroll early to lock in low premiums and avoid pre-existing condition exclusions

- Focus on comprehensive coverage rather than the cheapest premium

- Understand your policy’s specific terms, exclusions, and limitations

- Maintain detailed records and submit claims promptly

- Choose financially stable insurers with good customer service records

- Regularly review and update your coverage as your pet ages

The pet insurance landscape will continue evolving with technological advances, regulatory changes, and new treatment options. Staying informed and making proactive decisions will ensure your beloved companion receives the best possible care throughout their life.

Take Action Today:

- Evaluate your current coverage (or lack thereof)

- Research insurers using the criteria outlined in this guide

- Calculate potential costs for your pet’s breed and age

- Create a comprehensive pet care budget

- Establish relationships with quality veterinary providers

Your pet depends on you for their health and well-being. Making informed insurance decisions today protects both your pet’s future and your financial security. The small investment in proper coverage pays dividends in peace of mind and your pet’s quality of life.

What questions do you have about your pet’s insurance needs? Have you experienced any of these common mistakes? Share your thoughts and experiences to help other pet owners make better decisions.

Dr. Michael R. Stevens, DVM, MBA, is a veterinary financial consultant with over 15 years of experience in pet insurance, veterinary practice management, and animal healthcare economics. He holds degrees from Cornell University College of Veterinary Medicine and the Wharton School of Business, and has consulted for major pet insurance companies including Nationwide, ASPCA, and Trupanion.