Accident-Only Insurance Exclusions

“Did you know your accident-only insurance won’t pay for a broken arm from skiing or a concussion during a pickup basketball game?”

That’s right, many accident-only insurance policies often include a set of Accident-Only Insurance Exclusions that may surprise you. These exclusions commonly cover injuries sustained from high-risk recreational activities or organized sports, as insurers view these activities as having a higher risk of injury.

It’s crucial to read the fine print of your policy to understand what is and isn’t covered so you can avoid the shock of uncovered medical bills after an adrenaline-fueled weekend or a friendly game on the court. Accident-only insurance is designed to cover medical expenses and losses resulting from sudden, unforeseen accidents.

But what many policyholders don’t realize is that critical gaps exist, leaving them vulnerable to massive out-of-pocket costs. In this eye-opening guide, we reveal the top 5 shocking exclusions in accident-only policies, debunk myths, and provide actionable tips to safeguard your finances.

What Does Accident-Only Insurance Cover?

Accident-only insurance policies are designed to provide coverage for medical expenses that arise due to accidental injuries, such as fractures, burns, or lacerations.

Typically, these policies kick in to help cover the costs of emergency room visits, hospital stays, surgeries, and other immediate medical treatments required following accidental harm.

However, what is less known is that they often do not cover illnesses or medical conditions that are not directly caused by an accident, leaving a significant gap in protection for policyholders.

Accident-only insurance is a supplemental policy that pays benefits for injuries caused by accidental events, such as car crashes, falls, or burns. However, its narrow scope often clashes with policyholders’ assumptions.

👉 Key Terms: Coverage exclusions, policy limitations, accidental injury, supplemental insurance, insurance gaps

Top 5 Shocking Exclusions in Accident-Only Insurance

1. Injuries from High-Risk Activities (Skydiving, Rock Climbing, etc.)

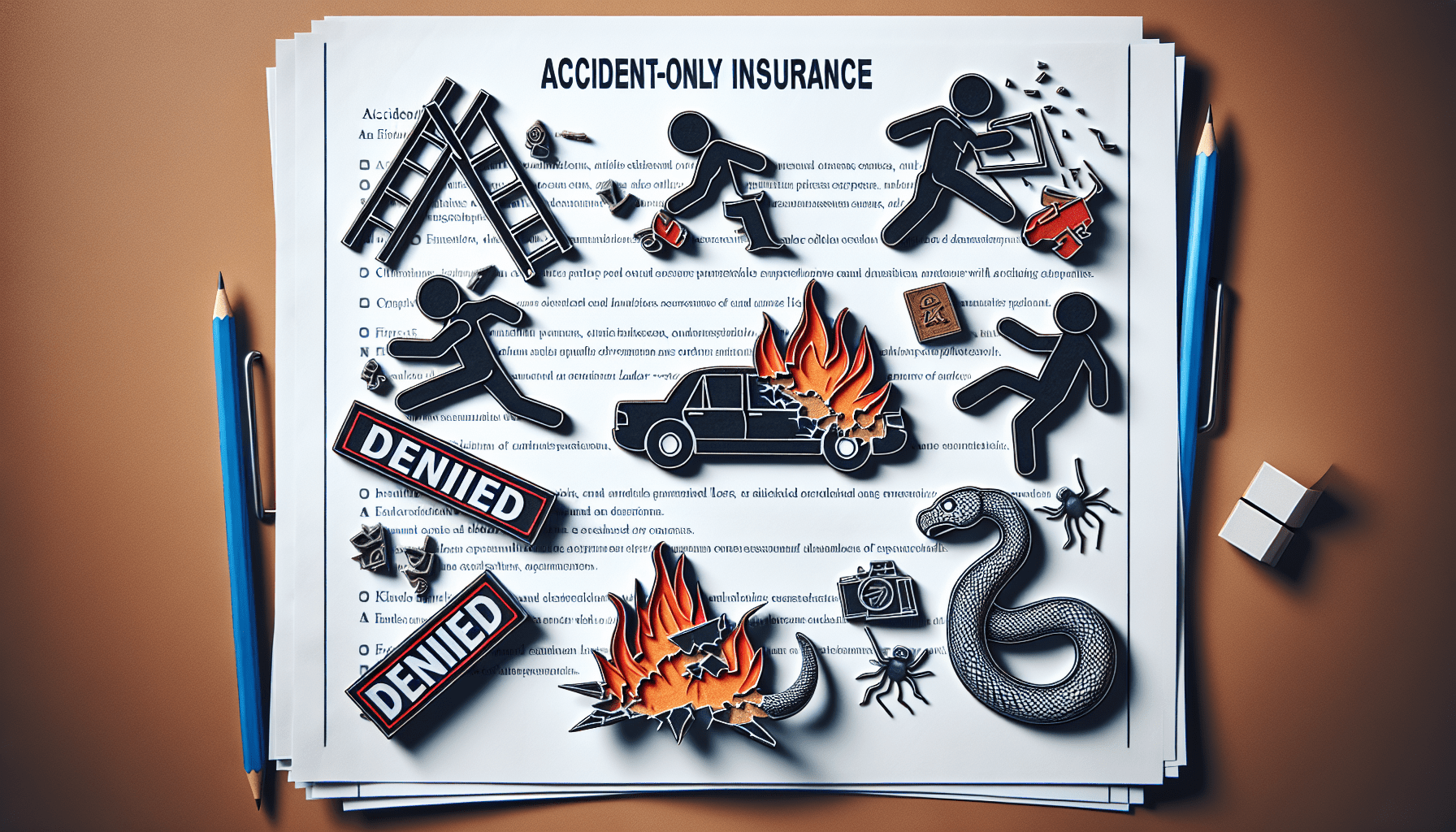

Many policyholders are caught off guard when they learn that injuries sustained during high-risk recreational activities are not covered under their accident-only insurance plans.

These policies typically exclude coverage for accidents that occur while participating in extreme sports or adventurous hobbies, which insurers classify as high-risk due to their increased likelihood of injury.

Consequently, individuals who frequently engage in such activities should consider securing supplemental insurance or a policy with broader coverage to ensure they are protected against potential financial burdens following an accident.

Accident-only policies often exclude injuries from “high-risk” hobbies. For example, a 2022 report by the Insurance Information Institute revealed that 68% of policies deny claims related to extreme sports.

Real-Life Case Study: To illustrate the impact of such exclusions, consider the case of Emily Torres, a 30-year-old avid rock climber who sustained a complex fracture while scaling a challenging cliff face. Despite having an accident-only insurance policy, Emily faced substantial medical bills after her claim was denied due to the policy’s specific exclusion of injuries related to rock climbing.

This situation left her navigating a financial hardship that compounded the stress of her physical recovery, highlighting the critical need for individuals to thoroughly understand the terms and limitations of their accident insurance policies. Sarah, an avid rock climber, fractured her spine during a fall. Her accident-only insurer denied her $25,000 claim, citing a “high-risk activity” clause.

2. Workplace Injuries

The case of Sarah is not isolated; many workers find themselves in similar predicaments when suffering injuries on the job. While employers often provide workers’ compensation, the coverage can be fraught with exceptions and fine print that limit payouts.

Employees must be proactive in understanding the extent of their coverage and the process for filing a claim, as this knowledge can be the difference between a fully covered medical bill and a devastating financial burden.

Most accident-only policies exclude injuries covered by workers’ compensation. If you’re a gig worker or freelancer without employer-backed coverage, you’re left unprotected.

Expert Insight: To bridge this coverage gap, it’s essential for gig workers and freelancers to consider supplemental insurance policies that cater specifically to their unique working situations.

These policies can provide the necessary safety net for accidents that occur on the job, ensuring that medical expenses and loss of income are adequately covered.

Furthermore, understanding the fine print of these insurance options is crucial, as it allows independent workers to make informed decisions about the level of protection they need based on their specific risk exposure and financial capabilities.

“Gig economy workers often assume their accident policy covers on-the-job injuries. That’s rarely the case,” says Janet Ruiz, spokesperson for the Insurance Information Institute.

3. Injuries Involving Intoxication or Recklessness

Understanding the nuances of insurance coverage is crucial, especially for those working in high-risk or unconventional job sectors. It’s imperative for individuals to thoroughly review their policies and seek clarification on any exclusions that might affect their eligibility for claims.

This is particularly important in scenarios involving intoxication or recklessness, as many insurers explicitly exclude coverage for incidents deemed to result from such behaviors, leaving workers vulnerable to significant financial strain in the wake of an accident.

If alcohol or drugs contributed to your accident, insurers can legally deny your claim. A 2023 CDC study found that 32% of denied accident claims involved substance use.

4. Long-Term Disabilities from Accidents

Long-term disabilities resulting from accidents can have a profound impact on an individual’s quality of life and financial security. The process of filing for disability benefits is often complex and requires substantial evidence to support the claim.

Unfortunately, many who suffer from disabilities due to accidents face challenges in obtaining the necessary documentation, as insurance companies may scrutinize claims to minimize payouts.

This necessitates a thorough understanding of the legal system and, in many cases, the assistance of a knowledgeable advocate to navigate the intricacies of disability law and insurance policies.

Accident-only insurance typically covers immediate medical bills but excludes long-term disability costs. For example, a traumatic brain injury requiring lifelong care won’t be fully covered.

Stat Alert: Given the limitations of accident-only insurance, individuals must consider comprehensive disability insurance that encompasses a wider range of eventualities.

This type of insurance is designed to provide financial support for both short-term incapacitation and long-term disabilities that may arise from a variety of causes beyond accidents, such as illness or chronic conditions.

Understanding the fine print of these policies, including the definition of disability and the duration of coverage, can make a significant difference in the level of protection and peace of mind an individual can secure for themselves and their loved ones. Only 12% of accident-only policies include disability benefits, per Forbes.

5. Accidents During Illegal Activities

It’s crucial to understand that insurance coverage for accidents incurred while engaging in illegal activities is typically excluded from policies. Insurers are clear in their stance that they will not reward or encourage unlawful behavior by providing financial support for such incidents.

Consequently, individuals who suffer injuries or disabilities as a result of illegal acts often find themselves without the safety net of insurance, facing significant medical expenses and potential loss of income with no recourse through their accident policy.

Injuries sustained while committing a crime (e.g., fleeing police) are excluded. Even minor offenses like trespassing can void your claim.

Debunking 3 Myths About Accident-Only Insurance

🔲 Myth 1: “Accident insurance covers all emergencies.”

Truth: Accident-only insurance is often misunderstood, with many policyholders mistakenly believing that it acts as a catch-all for any sudden medical issue.

In reality, this type of insurance is specifically designed to cover accidents, which are typically defined as unforeseen, injurious events caused by external, forceful means.

It does not extend to medical emergencies stemming from natural causes or diseases, such as heart attacks or strokes, which are critical distinctions to understand when selecting a policy. It excludes illnesses, pre-existing conditions, and non-accidental injuries.

🔲 Myth 2: “My policy covers my teen’s sports injuries.”

Truth: Unfortunately, this assumption can lead to unexpected out-of-pocket expenses for families. Many standard accident insurance policies do not extend coverage to sports-related injuries, especially if they occur during organized, competitive events.

Parents of young athletes need to review their policies carefully or consider additional coverage options to ensure their children are fully protected during sports activities. Most school sports injuries are excluded unless specified in a rider.

🔲 Myth 3: “I don’t need health insurance if I have accident coverage.”

Truth: Health insurance and accident coverage serve different purposes and complement each other. While accident coverage may provide a lump sum payment or cover specific costs associated with an accidental injury, health insurance offers broader protection against a wide range of health-related expenses.

This can include hospital stays, surgeries, doctor’s visits, and sometimes even prescription medications. It’s crucial to have both types of insurance to ensure comprehensive financial protection against unforeseen medical events. Accident-only plans are supplemental and lack comprehensive health benefits.

Block 2: Top 3 Google Queries Answered

❓ “Does accident-only insurance cover dog bites?”

✅ Answer: Absolutely, accident-only insurance typically includes coverage for injuries resulting from dog bites. However, it’s essential to review the specific policy details, as coverage can vary between insurers.

Policyholders should also be aware of any exclusions or limitations in their plan, such as incidents involving their pets or certain breeds that may be excluded from coverage. Only if the policy explicitly lists animal attacks. Most exclude them.

❓ “Are car accidents covered by accident insurance?”

✅ Answer: Certainly! Here’s the continuation of the article: If you’re involved in a car accident, accident insurance can indeed provide coverage, but it’s important to understand the specifics.

Typically, this type of insurance is designed to cover medical expenses, loss of income, and sometimes rehabilitation costs that result from accidental injuries, which can include those sustained in a vehicle collision.

However, it’s crucial to review your policy or speak with your insurance provider to determine whether there are any restrictions or special conditions that apply to motor vehicle accidents, as coverage can vary widely between different policies and insurers. Yes, but only if you’re not at fault (varies by state).

❓ “Can I get accident insurance for pre-existing conditions?”

✅ Answer: Certainly! Here’s a continuation of the article in the same style: When considering accident insurance for pre-existing conditions, it’s essential to understand the insurer’s definition of such conditions. Typically, a pre-existing condition is any health issue that existed before the start of your insurance policy.

Most insurers have a specific look-back period to determine what qualifies as pre-existing. It’s crucial to disclose all relevant medical history when applying for coverage to avoid any disputes in the event of an accident.

However, some policies may offer coverage with certain limitations or waiting periods, so it’s important to read the fine print or consult with an insurance expert to fully grasp your benefits. No. These policies exclude injuries related to prior health issues.

3 Essential Tips to Avoid Coverage Gaps

1️⃣ Audit Your Policy: Update Your Information Regularly: Life is full of changes, and your insurance needs may shift as you reach different milestones. Whether it’s a change in marital status, the birth of a child, or a significant alteration in your health, updating your insurer with the latest information ensures that your coverage reflects your current situation.

By keeping your insurer informed, you can avoid potential gaps in coverage that might otherwise arise from outdated details on your policy. Check for exclusions related to hobbies, occupations, or locales.

2️⃣ Bundle Policies: Review Discounts Regularly: Insurance companies often offer a variety of discounts that can significantly lower your premiums. These may include reductions for having multiple policies with the same provider, maintaining a good driving record, installing security systems in your home, or being a member of certain organizations.

Make it a habit to inquire about any new discounts you may qualify for at least once a year during your policy review, ensuring you’re always getting the best possible rate. Pair accident insurance with critical illness or disability coverage.

3️⃣ Negotiate Riders: Review Coverage Limits: It’s crucial to periodically reassess your coverage limits to make sure they align with your current lifestyle and financial situation. As life events occur—such as marriage, the purchase of a new home, or the birth of a child—your insurance needs may change.

By regularly reviewing and adjusting your coverage limits, you can ensure that you’re neither underinsured nor paying for more coverage than you need. Add custom riders for high-risk activities (e.g., skiing, martial arts).

How to Supplement Your Accident-Only Policy

1: Compare Health Insurance Plans: Consider Critical Illness Coverage: Accident-only policies typically do not cover illnesses, which can be financially devastating if a serious condition arises.

To supplement your accident coverage, look into critical illness insurance, which can provide a lump-sum payment upon diagnosis of specific illnesses like cancer or heart attack.

This type of insurance can help cover costs that aren’t included in your accident policy, such as medical treatments, living expenses, or even travel for specialized care. Use tools like Healthcare.gov or Policygenius.

2: Consider Disability Insurance: Investigate Critical Illness Insurance: In the face of serious health conditions, critical illness insurance acts as a financial safety net. It provides a lump sum payment that can be used to alleviate the burden of expenses not covered by traditional health insurance, such as copays, deductibles, and non-medical costs that can pile up during recovery.

When evaluating critical illness insurance options, compare the coverage specifics, such as the list of illnesses covered and the benefit payout structure, to ensure it aligns with your individual needs and risk factors. Brands like Breeze offer affordable monthly plans.

3: Leverage HSAs: Utilizing Health Savings Accounts (HSAs) can be a strategic way to manage the financial burden of potential critical illnesses. Contributions to HSAs are tax-deductible, and the funds can be withdrawn tax-free for qualifying medical expenses, including deductibles, copayments, and coinsurance.

By integrating an HSA with your critical illness insurance, you can create a comprehensive safety net that not only provides a lump-sum benefit if you’re diagnosed with a covered illness but also helps manage out-of-pocket costs associated with your treatment and recovery. Use Health Savings Accounts to cover excluded expenses tax-free.

FAQs: Your Accident Insurance Questions Answered

Q: Does accident insurance cover COVID-19 complications?

A: While accident insurance typically covers injuries resulting from unexpected events, complications from illnesses like COVID-19 may not be included under standard accident insurance policies.

However, it’s important to review your specific policy or speak with your insurance provider as coverage can vary. Some insurers may offer additional riders or special coverage options that can extend protection to include certain complications arising from infectious diseases such as COVID-19. No. Illnesses are excluded unless caused by an accident.

Q: Are natural disasters covered?

A: Natural disasters, often referred to as “acts of God,” typically fall under a special category in travel insurance policies. Coverage for such events is usually included, but it’s essential to read the fine print to understand the extent of the protection provided.

For instance, if a volcanic eruption or hurricane disrupts your travel plans, a comprehensive travel insurance policy may cover trip cancellations or interruptions, but the specifics can vary widely between different insurers and plans.

Always confirm the details with your insurance provider to ensure you have the necessary coverage in place before embarking on your journey. Only if the disaster directly causes an injury (e.g., falling debris).

Q: Can I claim mental health treatment after an accident?

A: Certainly, mental health treatment is recognized as an important component of post-accident care. Many insurance policies are now evolving to cover therapy and counseling sessions when they are directly related to trauma resulting from an accident.

However, it’s critical to review your policy’s fine print, as coverage for mental health services can vary greatly, and there may be limitations on the type of treatments covered or the duration for which they are available. Always engage with your insurance provider to clarify these specifics and to understand the process for submitting claims for such treatments.

Rarely. Most policies exclude psychological care.

Conclusion: Accident-Only Insurance Exclusions

Navigating the labyrinth of insurance exclusions can be daunting, but it’s essential to arm yourself with knowledge to prevent unpleasant surprises. By thoroughly reviewing your policy documents and asking pointed questions, you can gain a clearer picture of what is covered and what isn’t.

Remember, insurance is a critical component of your financial planning, and understanding its nuances can mean the difference between a secure safety net and a precarious financial future.

Accident-only insurance is a valuable tool—but only if you understand its limitations. By auditing your policy, adding riders, and diversifying coverage, you can avoid devastating financial surprises.

Call to Action: To ensure that you’re fully protected, it’s crucial to regularly review your accident-only insurance policy. Consider consulting with an insurance expert who can help you identify any coverage gaps and suggest appropriate riders or additional policies.

Remember, the goal is to build a comprehensive safety net that addresses all potential risks, giving you peace of mind and financial stability when you need it most. Share your experience with accident insurance gaps in the comments!

Discussion Question: When considering the intricacies of accident insurance, it’s crucial to understand the role of AI personalization in tailoring policies to individual needs. Advanced algorithms can now analyze vast amounts of data to predict potential risks with greater accuracy, enabling insurers to offer coverage that aligns more closely with your lifestyle and activities.

This not only ensures a better fit for your insurance plan but also often results in more competitive pricing, as you’re not paying for unnecessary coverage. As we move forward, the intersection of AI and insurance promises to make personal protection more accessible and adaptable than ever before.

Should insurers be required to disclose exclusions in bold print?