Personal Liability Insurance

Personal liability insurance is an essential safeguard for individuals who wish to protect themselves from the financial repercussions of being held responsible for causing injury to others or damaging someone else’s property. It acts as a financial shield, covering legal fees, settlements, and any court-awarded damages up to the policy’s limits.

Without this type of coverage, individuals may find themselves facing significant out-of-pocket expenses, which can be financially debilitating, especially in cases involving substantial claims or lawsuits. Hello, fellow curious minds! If you share my enthusiasm, you possibly view the world of insurance as a considerable fancy maze.

But this is some thrilling information: we’re on the verge of unraveling one essential facet of it—personal liability insurance—and taking a deeper look at what the longer term may hold for this important type of protection. So, pour yourself a steaming cup of espresso, settle in, and let’s embark on this enlightening journey collectively!

Understanding Personal Liability Insurance

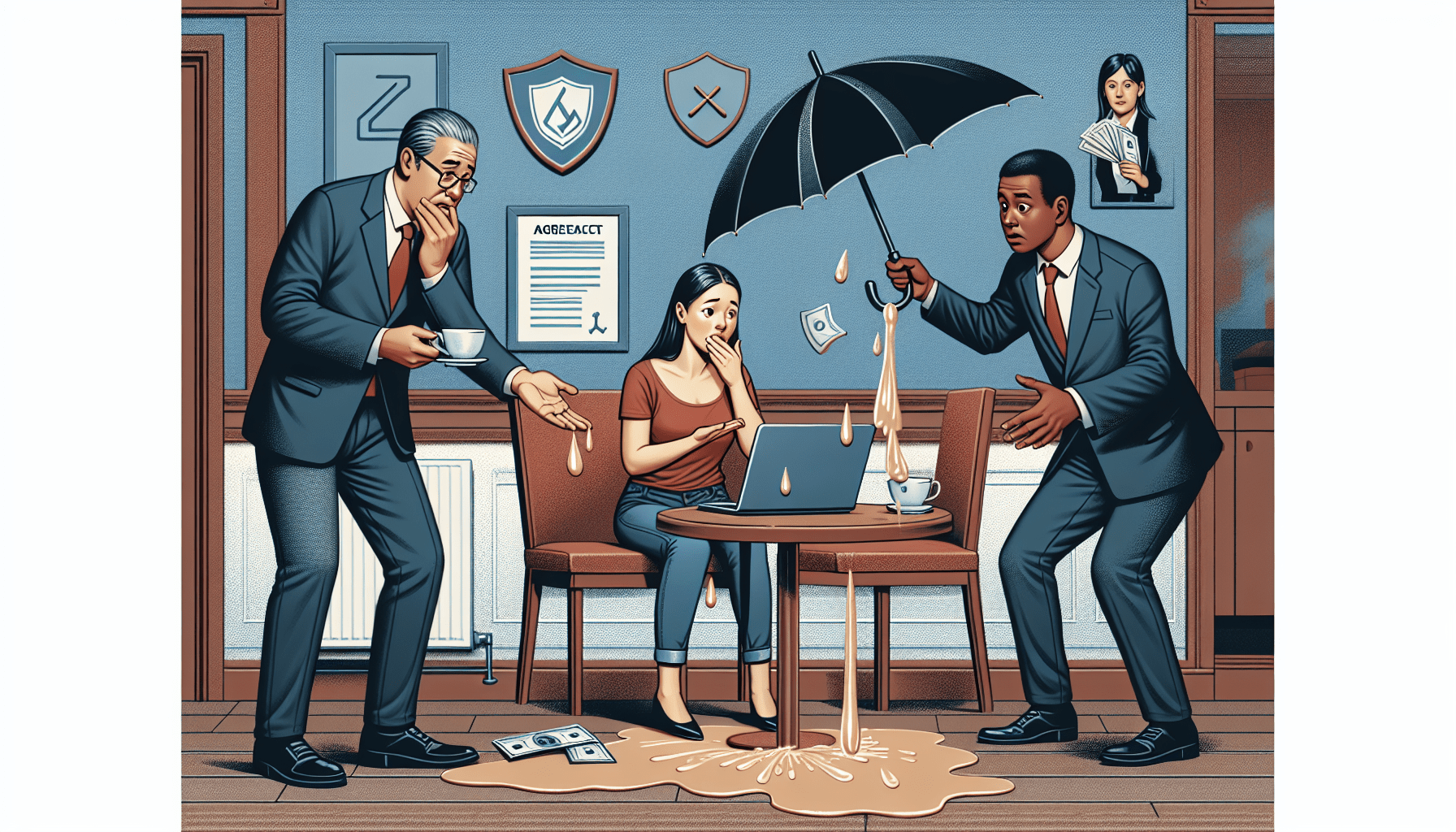

Personal liability insurance serves as a crucial safeguard, a financial fortress that stands between you and the potentially ruinous costs of legal claims made against you. Whether it’s due to accidental injuries that occur on your property or damages that you unintentionally inflict on someone else’s belongings, this insurance is your ally, ready to absorb the shock of unforeseen expenses.

It’s the unsung hero in your policy portfolio, quietly waiting in the wings, offering peace of mind in a world where mishaps are just a slippery step away. To begin, let’s make clear what private legal responsibility insurance coverage truly entails.

Essentially, this kind of insurance provides you with financial protection in case you are deemed chargeable for inflicting hurt on one other particular person or for harm to their property. Consider it your monetary safeguard, an important assist that ensures a minor mishap does not escalate into a big monetary disaster.

Real-Life Example

In today’s digital age, AI personalization is revolutionizing the insurance industry by tailoring coverage to individual needs. By analyzing vast amounts of data, AI algorithms can predict risks more accurately and suggest the most suitable policies for each client.

This not only enhances customer satisfaction by providing them with a sense of unique care but also optimizes the insurer’s risk assessment process, ensuring that premiums are more closely aligned with the actual level of risk each policyholder represents.

Imagine for a second that your canine, Sparky, becomes overly enthusiastic and by accident knocks over your neighbor’s useful vase. In the absence of private legal responsibility insurance coverage, you’d have to cover the fee yourself. But, with private legal responsibility insurance coverage, you might be protected, and the monetary burden is alleviated!

Why Is It Important?

Personal liability insurance acts as a safety net, cushioning you from unexpected financial hits that can arise from everyday incidents. It’s not just about safeguarding your bank account; it’s about peace of mind. Knowing that you’re covered in case of accidental damage to someone else’s property or if someone is injured on your premises allows you to live your life with one less worry.

This type of insurance is particularly crucial for those who host guests frequently or have assets they wish to protect from potential claims. Life is inherently unpredictable, and even those who train with the utmost warning could discover themselves in circumstances where they’re chargeable for accidents.

Whether it’s a slip-and-fall incident occurring inside the confines of your home or an unexpected mishap going down throughout a household barbecue gathering, private legal responsibility insurance coverage serves as a safeguard.

Personal liability insurance is a critical component of a comprehensive insurance plan, providing protection when you’re found legally responsible for injuries or property damage to others. It acts as a financial shield, covering legal fees, medical expenses, and other damages that you may be obligated to pay.

Without this coverage, you could face significant out-of-pocket expenses, which could potentially jeopardize your financial stability and future. This type of insurance can protect you from the burden of vital authorized charges and the bills related to settlement prices, offering peace of mind amidst life’s uncertainties.

Did You Know?

Legal expenses insurance is not only a safeguard against unpredictable legal costs, but it also offers access to legal advice when you need it most. With a network of experienced attorneys at your disposal, you can navigate the complexities of the legal system with confidence.

Whether you’re facing a dispute, require contract interpretation, or need representation in court, this insurance ensures you’re not alone in the legal arena, providing a valuable resource for both individuals and businesses alike.

More than 35% of owners have confronted a liability claim up to now this year alone! Source: Insurance Information Institute.

The Future Trends in Personal Liability Insurance

As we look ahead, the landscape of personal liability insurance is set to evolve dramatically with the integration of artificial intelligence (AI) personalization. This technology promises to tailor policies more closely to individual risk profiles, potentially lowering costs for those with lower risk behaviors while providing more accurate coverage options.

AI-driven systems will also streamline the claims process, making it faster and more efficient, and could even predict and prevent certain liabilities before they occur, changing the way we think about insurance altogether.

Now, let’s take a sneak peek into the longer term. With know-how and lifestyle adjustments, private legal responsibility insurance coverage is evolving. Here’s what you may anticipate:

1. Digital Platforms for Easy Access

As AI continues to refine its ability to analyze vast amounts of data, personal liability insurance is set to become more personalized than ever. Machine learning algorithms will sift through an individual’s online footprint, spending habits, and even social behavior to tailor coverage options that align seamlessly with their unique lifestyle.

This hyper-personalization means that policies will be able to adapt in real-time, ensuring that coverage is always relevant and cost-effective for the insured. The days of coping with infinite paperwork are a factor of the previous.

Insurers are increasingly adopting digital platforms, which streamline the method, permitting you to purchase and handle your coverage effortlessly online. This transition not only cuts down on time but also provides you with fast entry to all of your coverage particulars, enhancing comfort and effectiveness.

2. Customization Based on Lifestyle

3. Dynamic Adjustments & Real-time Feedback Moreover, AI personalization extends to the dynamic adjustments of your insurance policies based on real-time data and lifestyle changes. Whether it’s a new home purchase, the addition of a family member, or a change in driving habits, AI algorithms can automatically suggest updates to your coverage to ensure it remains optimal.

This level of responsiveness not only keeps your policies relevant but also maximizes your protection without requiring constant manual oversight.Insurance companies are increasingly providing more personalized policies to meet the varied wants of their purchasers.

Whether you’re a frequent traveler, a devoted pet proprietor, or somebody operating a business from home, you now have the choice to customize your insurance coverage protection to fit your particular personal necessities.

This level of customization is made possible by the integration of AI technology within the insurance sector. By analyzing vast amounts of data, AI algorithms can predict individual risks and suggest tailored insurance products that align closely with each customer’s unique lifestyle and needs.

Consequently, consumers no longer have to settle for one-size-fits-all coverage, as AI personalization ensures that their insurance policies are as individual as they are. This strategy ensures that you just obtain safety that’s particularly aligned with your lifestyle and preferences.

3. Integration with Smart Home Devices

Integrating AI personalization with smart home devices takes the concept of tailored insurance to a whole new level. By collecting data from smart thermostats, security systems, and other connected appliances, insurers can analyze habits and environmental conditions to offer dynamic pricing and proactive protection plans.

This not only enhances the accuracy of risk assessment but also provides customers with a sense of active engagement in managing their insurance needs, fostering a more interactive and responsive relationship with their provider.

With the growing reputation of smart home technology, some insurance coverage firms are actually incorporating protection choices that work seamlessly with good gadgets.

This integration affords enhanced safety and will lead to decreased insurance coverage premiums for owners who put money into gadgets designed to scale back dangers, corresponding to superior safety cameras or fashionable smoke detectors.

Moreover, AI personalization extends beyond security measures, delving into the realm of convenience and lifestyle enhancement. Smart thermostats, for instance, learn from your habits and adjust the temperature accordingly, ensuring comfort while maximizing energy efficiency.

Similarly, AI-driven lighting systems can adapt to your schedule and preferences, illuminating your home in a way that supports your daily activities and even your mood, all the while contributing to energy conservation.

These improvements not only present peace of mind but also contribute to more affordable house insurance coverage charges by proactively minimizing potential hazards.

Tips for Maximizing Your Coverage

When considering the integration of AI personalization into your home, it’s essential to communicate with your insurance provider to understand how these smart systems can influence your policy. Many insurers now offer discounts for homes equipped with smart technology that reduces the likelihood of theft, fire, or water damage.

By staying informed and choosing AI tools that align with your insurer’s requirements, you can not only enhance your home’s security and efficiency but also see significant savings on your insurance premiums.

Let’s sprinkle some sensible knowledge into our chat. Here are several suggestions to be sure that your private legal responsibility insurance coverage works best for you:

🔹 Review Annually: It’s crucial to know the extent of your coverage. Ensure that your policy’s liability limits are high enough to protect your assets in the event of a claim. If you’ve had significant life changes, such as purchasing a new home or acquiring valuable possessions, it may be time to increase those limits.

Regularly assessing your coverage against your current financial situation can prevent you from being underinsured and facing out-of-pocket expenses. Your life adjusts, and so ought your coverage. Review your policy annually to ensure it still meets your needs.

🔹 Bundle and Save: Many insurance providers offer a variety of discounts that can lead to substantial savings over time. These can include safe driver discounts for those with a clean driving record, discounts for installing security devices in your home, or even loyalty discounts for customers who have stayed with the same provider for several years.

By inquiring about these programs and taking advantage of eligible discounts, you can significantly reduce your premiums while maintaining high-quality coverage. Consider bundling your private legal responsibility insurance coverage with different insurance policies, like house or auto insurance, for potential reductions.

🔹 Understand Your Policy Limits: Review your policy limits carefully to ensure they align with your current needs and assets. Over time, your situation may change, necessitating adjustments to your coverage to fully protect your financial well-being.

It’s wise to periodically reassess your liability limits, especially after major life events such as purchasing a new home, acquiring significant assets, or changes in family dynamics. Make certain you realize the boundaries of your coverage and take into account growing them in case your property has grown.

Interactive Element Suggestion

To ensure that your insurance policies are truly reflective of your current circumstances, it’s essential to engage with your insurer’s AI personalization features. These advanced algorithms analyze your unique situation, adapting coverage recommendations in real-time as your life evolves.

By harnessing this technology, you can maintain peace of mind, knowing that your insurance is as dynamic and responsive as the changes you experience in your daily life.

Why not take a fast quiz to see if your present protection suits your lifestyle? An interactive quiz may help you assess your needs and make informed decisions about your insurance.

Final Thoughts and Call-to-Action

In the age of AI personalization, the power to tailor your insurance to your unique circumstances is at your fingertips. By leveraging cutting-edge technology, insurance providers can now offer customized policies that adapt to your evolving needs with unprecedented precision.

Don’t miss out on the opportunity to redefine your safety net—take the quiz, discover your personalized insurance options, and secure peace of mind knowing that your coverage is as individual as you are.

Personal legal responsibility insurance coverage probably won’t be the most thrilling subject, but it’s surely essential for safeguarding you and your loved ones from unexpected monetary burdens. As we transfer in the direction of an extra digital and customized insurance panorama, staying knowledgeable will make sure you’re all the time lined.

AI personalization is revolutionizing the insurance industry by tailoring policies to individual needs like never before. By leveraging vast amounts of data and sophisticated algorithms, insurers can now offer coverage that adapts to your unique lifestyle and risk profile.

This means not only more accurate pricing for consumers but also the potential for enhanced protection that keeps pace with the rapid changes in our lives and habits. Ready to discover your choices? Discover how private legal responsibility insurance coverage can safeguard your future as we speak!

As we delve deeper into the realm of AI personalization, it’s clear that the implications extend far beyond mere convenience. With the power of artificial intelligence, insurance policies can be tailored to an individual’s lifestyle, providing coverage that’s as unique as the policyholders themselves.

This level of customization ensures that you’re not just another number in a database, but rather a valued customer with specific needs and risks that are meticulously accounted for.

I believe this dialog about personal liability insurance has been helpful and maybe a bit less intimidating. Keep in mind that being well-informed is your strongest device when it comes to making the very best selections for your future. Wishing you success in your insurance coverage endeavors!