Critical Illness Insurance

Navigating the complexities of critical illness insurance can be daunting, but the advent of AI personalization has revolutionized the way individuals approach this essential coverage.

By leveraging sophisticated algorithms, insurance providers can now offer tailored policies that align closely with the unique health profiles and risk factors of each applicant.

This not only ensures a more accurate assessment of needs but also enhances the customer experience by streamlining the application process and delivering personalized coverage recommendations.

As we look ahead to 2025, the landscape of healthcare and financial security continues to evolve, making the consideration of critical illness insurance more pertinent than ever.

With the rising costs of medical treatments and the increasing prevalence of chronic diseases, having a safety net in place can provide peace of mind and financial protection.

As individuals navigate the complexities of healthcare and financial planning, AI personalization emerges as a transformative tool in tailoring critical illness insurance policies to one’s unique needs. By harnessing the power of artificial intelligence, insurers can analyze vast amounts of data to predict potential health risks and offer customized coverage options.

This not only ensures that policyholders receive coverage that aligns with their specific health profiles but also optimizes the cost-efficiency of the insurance, avoiding a one-size-fits-all approach that may leave gaps in protection or result in overpaying for unnecessary benefits.

Critical illness insurance is designed to offer a lump sum payment upon diagnosis of specific conditions, helping to cover expenses that traditional health insurance may not, such as lost income, out-of-pocket costs, and experimental treatments, ensuring that you can focus on recovery without the added stress of financial burden.

Critical illness insurance can be a lifeline during an unexpected health crisis. With policies tailored to meet individual needs, policyholders have the flexibility to use the funds as they see fit, whether for high deductibles, travel to specialized medical facilities, or necessary home modifications.

This level of personalization ensures that support is available where it is most needed, allowing patients and their families to make health decisions based on optimal care rather than financial limitations.

Critical illness insurance coverage might be a vital part of financial planning, offering peace of mind and financial help through troublesome cases. This info is to answer the most common questions on essential illness insurance coverage, serving to assist you in making educated selections about your safety desires.

Q&A Section

Q1: What is critical illness insurance?

Critical illness insurance is a type of policy that provides financial protection to individuals in the event they are diagnosed with a specific serious illness, such as cancer, heart attack, or stroke, which can incur significant medical expenses and potential loss of income.

This form of insurance typically offers a lump-sum payment, which can be used at the policyholder’s discretion to cover costs like treatment, rehabilitation, or even daily living expenses during recovery.

It’s designed to alleviate the financial strain that can accompany a life-altering health diagnosis, ensuring that patients can focus on their recovery without the added stress of financial burden.

Critical illness insurance is a specialized type of insurance designed to provide financial support if you are diagnosed with one of the specific serious illnesses covered by the policy. Typically, this type of insurance pays out a lump sum amount, which can be used to cover medical expenses, lost income, or any other financial needs that arise during a difficult time.

Given the highly individual nature of critical illness experiences, it’s essential that insurance policies offer a degree of personalization to meet the unique needs of each policyholder.

This customization can range from the selection of covered illnesses to the choice of benefit amounts, ensuring that the protection provided aligns closely with the insured’s lifestyle and financial situation.

Moreover, some policies may offer additional features, such as the option for early payouts upon diagnosis or the flexibility to adjust coverage as life circumstances change, providing a tailored safety net that adapts to the evolving landscape of the policyholder’s life.

Unlike health insurance, which covers costs of medical care and treatments, critical illness insurance gives you the flexibility to use the funds as you see fit, helping to alleviate the economic pressures that often accompany a severe health diagnosis.

This financial cushion can prove invaluable, particularly when considering the hidden costs that aren’t always covered by traditional health insurance, such as travel expenses for treatment, home modifications, or even necessary adjustments to one’s lifestyle.

With critical illness insurance, policyholders have the autonomy to allocate funds where they’re most needed, whether that’s covering lost income during recovery or paying for specialized therapies.

Moreover, the peace of mind that comes with knowing you have a safety net can be just as beneficial to your mental health as the financial support is to your physical well-being.

Critical illness insurance coverage is a protection designed to supply a lump-sum payment in the event you are diagnosed with a particular critical illness, including most cancers, coronary heart assault, or stroke. This financial help will be utilized to cover medical bills, misplaced earnings, or lifestyle changes ensuing from your illness.

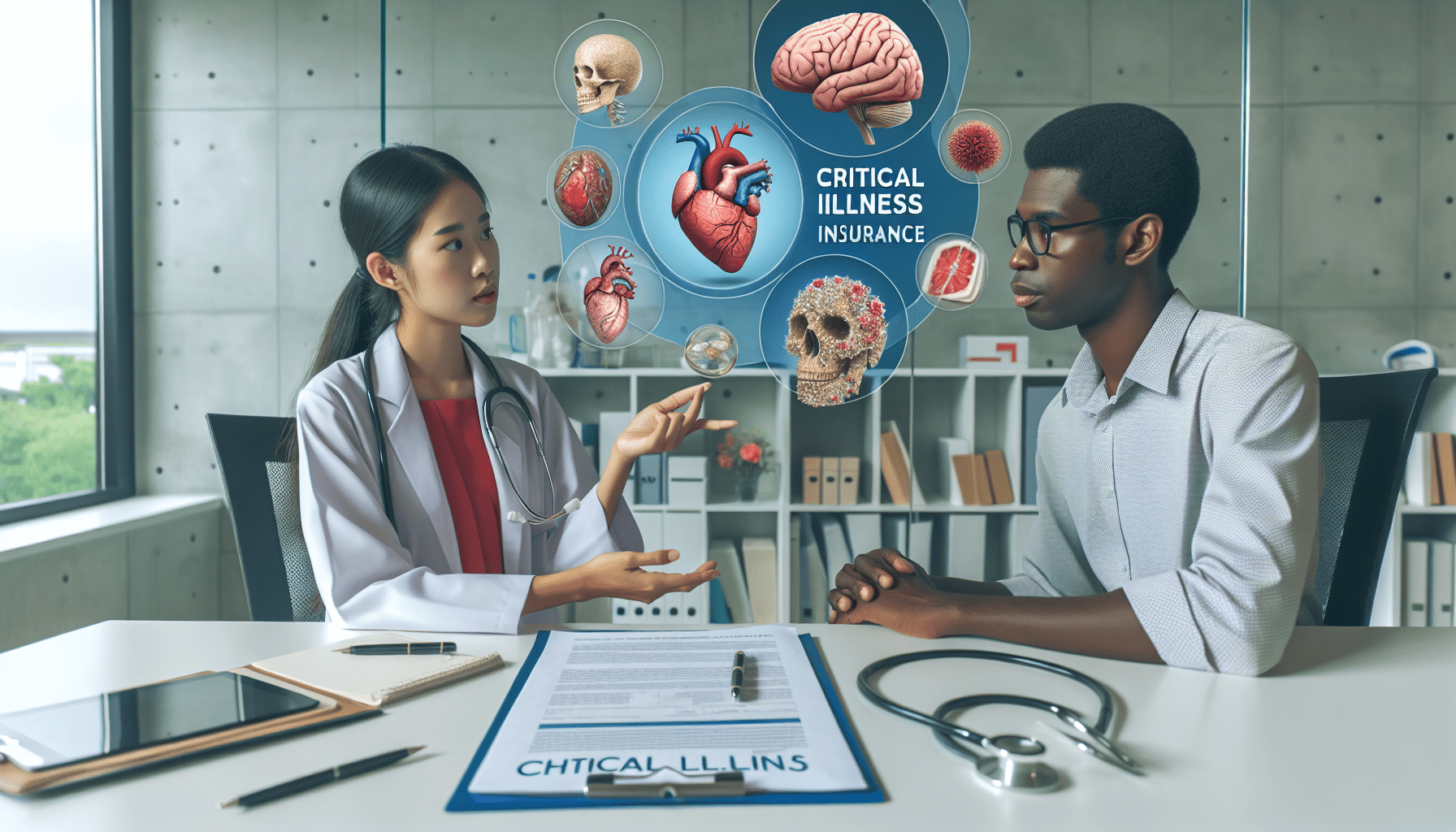

Q2: What illnesses are typically covered?

The range of illnesses covered by critical illness insurance can vary by policy, but they often include a predefined list of serious conditions beyond the ones mentioned. Typically, insurers provide a comprehensive catalog that may encompass organ transplants, kidney failure, multiple sclerosis, and major organ failure.

It’s crucial for policyholders to review their coverage details to understand the full spectrum of conditions that are included, as this knowledge is essential for planning and peace of mind.

The range of illnesses covered by critical illness insurance typically extends beyond just cancer, heart attacks, and strokes. Many policies also include coverage for conditions such as kidney failure, major organ transplants, and multiple sclerosis, among others.

When considering critical illness insurance, it’s important to review the specific terms and conditions of each policy. Some may offer additional benefits like partial payouts for less severe conditions or the option for a second medical opinion from a specialist.

Furthermore, the level of coverage can often be customized to suit individual needs and budgets, ensuring that you’re not overpaying for unnecessary protection.

It’s essential to review the specifics of an insurance policy to understand the full spectrum of diseases that are covered, as this can vary significantly between different insurers and plans. Coverage varies by provider; nevertheless, frequent ailments include:

- Cancer

- Heart assault

- Stroke

- Kidney failure

- Major organ transplants

When considering AI personalization in the realm of health insurance, it is essential to recognize the transformative impact it has on tailoring coverage to individual needs. Advanced algorithms analyze vast amounts of personal health data, allowing for a more nuanced understanding of risk factors and potential health issues unique to each policyholder.

As a result, insurers can offer highly customized policies, with premiums and coverage options that reflect the actual health profile of an individual, potentially leading to more equitable pricing and enhanced protection against unforeseen medical events.

When evaluating insurance policies, it’s also crucial to consider the level of personalization that comes with AI-driven platforms. These advanced systems are designed to analyze your individual health data and lifestyle choices, offering tailored recommendations and coverage options that best suit your unique needs.

As AI technology continues to evolve, the potential for hyper-personalized insurance experiences grows exponentially. By leveraging machine learning algorithms, insurance providers can now deliver policies that adapt in real-time to changes in your health status or life circumstances.

This means not only a more responsive insurance plan but also the possibility for proactive health management advice, aimed at preventing issues before they arise and keeping premiums as low as possible for the policyholder.

By harnessing the power of artificial intelligence, insurers can provide more accurate quotes and potentially identify early signs of the conditions listed above, thereby offering a proactive approach to healthcare management. It’s essential to assess each protection carefully to understand what is covered.

Q3: How Does Critical Illness Insurance Differ from Life Insurance?

Critical illness insurance is specifically designed to provide financial support upon the diagnosis of a severe health condition, such as cancer, stroke, or heart attack, among others.

Unlike life insurance, which pays out a death benefit to beneficiaries after the policyholder passes away, critical illness coverage disburses a lump-sum payment directly to the insured individual upon diagnosis of a qualifying illness.

This payment can be used to cover medical expenses, lost income, or any other financial needs that arise during treatment and recovery, offering peace of mind during a challenging time.

Critical illness insurance is distinct from life insurance in its very nature and purpose. While life insurance provides financial support to the beneficiaries of the policyholder upon their death, critical illness insurance is designed to offer a lump sum payment to the policyholder upon the diagnosis of a covered illness.

Critical illness insurance specifically targets the financial strain that can come with serious health conditions such as cancer, heart attack, or stroke. The lump sum received can be used at the policyholder’s discretion to cover medical expenses, lost income, or even to pay for alterations to their home to accommodate new health-related needs.

This type of insurance is particularly valuable for those who may not have extensive savings or employee benefits to fall back on, providing a safety net during a time that is often not only physically but also financially challenging.

This means that the funds from a critical illness policy can be used to cover medical expenses, lost income, or any other financial needs that arise during the treatment and recovery period, providing a financial safety net when it is most needed.

Given the unpredictable nature of critical illnesses, having a policy tailored to individual needs can provide immeasurable peace of mind. It allows policyholders to focus on their recovery without the added stress of financial burdens.

Moreover, the flexibility of critical illness insurance means that it can be personalized to fit various lifestyles and risk factors, ensuring that coverage is as comprehensive as it is comforting.

While life insurance coverage provides financial help to your beneficiaries after your demise, essential illness insurance coverage protection provides a payout upon diagnosis of a covered illness. This permits you to deal with payments and provides consideration to restoration while nonetheless alive.

This autumn: Who Should Consider Critical Illness Insurance?

Critical illness insurance is particularly beneficial for individuals who do not have a robust emergency fund or who would struggle with the financial burden of a serious illness. It’s also a prudent choice for those with a family history of health conditions covered by these policies, as it provides a safety net that can help maintain their lifestyle and cover medical costs.

Moreover, self-employed individuals or those without comprehensive health benefits through an employer may find critical illness insurance to be a valuable addition to their financial planning toolkit.

Individuals who have a family history of chronic diseases or those who may not have a substantial emergency fund to cover unexpected medical expenses should give serious thought to critical illness insurance. It is particularly beneficial for the sole breadwinners of the family or individuals with dependents who rely on their income for daily living expenses.

Critical illness insurance provides a lump sum payment that can be used to alleviate the financial burden associated with life-altering illnesses such as cancer, heart attack, or stroke. This financial safety net allows individuals to focus on their recovery without the added stress of monetary constraints.

Moreover, the coverage can also help cover the costs of treatments that may not be fully paid for by standard health insurance, ensuring access to a broader range of healthcare options and potentially life-saving interventions.

Moreover, as medical treatments advance and survival rates increase, this type of insurance can provide the necessary financial support to allow for a focus on recovery without the added stress of financial burden.

AI personalization in healthcare insurance not only enhances the customer experience but also streamlines the risk assessment process. By analyzing vast data sets, including individual health records and lifestyle information, AI algorithms can tailor insurance plans to precisely fit the needs and risk profiles of each policyholder.

This level of customization ensures that patients are neither over-insured nor under-protected, optimizing their coverage and potentially reducing unnecessary expenses.

Individuals with a family history of nice ailments, main breadwinners, or those without substantial monetary savings would possibly generate revenue from such insurance coverage. It serves as a financial safety net, reducing stress through a well-being catastrophe.

Q5: What Factors Affect the Cost of a Policy?

The cost of an insurance policy is influenced by a myriad of factors, including the age and health status of the applicant, the level of coverage desired, and the policy’s term length. Insurance providers also consider lifestyle-related risks, such as smoking or engaging in extreme sports, which can significantly increase premiums.

Furthermore, the geographical location and the local cost of healthcare services can impact the overall cost, as insurers adjust their rates to reflect regional medical expense trends and regulatory environments.

The cost of an insurance policy is influenced by a myriad of factors, including the age and health of the applicant, the level of coverage desired, and the policy’s term length. Insurers also consider lifestyle choices, such as smoking or high-risk hobbies, which can significantly increase premiums.

In the age of technology, artificial intelligence (AI) is revolutionizing the way insurers assess these factors, leading to a new era of personalized insurance policies. By harnessing vast amounts of data and advanced analytics, AI algorithms can tailor policies more precisely to an individual’s risk profile.

This not only enhances the accuracy of premium calculations but also enables insurers to offer customized coverage options and dynamic pricing that reflects real-time changes in a person’s lifestyle or health status.

Furthermore, the presence of chronic or pre-existing conditions can lead to higher costs or even make it difficult to obtain coverage, emphasizing the importance of securing insurance early in life. Several components affect coverage prices, along with

- Age

- Health standing

- Coverage amount

- Policy time interval

Understanding the nuances of insurance policies can be a complex undertaking, but AI personalization is revolutionizing the way individuals navigate this landscape.

By leveraging machine learning algorithms and data analytics, AI systems can tailor insurance recommendations to suit the unique profile of each customer, taking into account their specific age, health status, desired coverage amount, and preferred policy duration.

This level of customization not only simplifies the decision-making process for consumers but also helps in identifying the most cost-effective and comprehensive plans that align with their long-term financial and health objectives.

Lifestyle choices and occupation also play pivotal roles in determining insurance premiums. Engaging in high-risk activities or working in hazardous environments can significantly increase the cost of policies.

To mitigate these costs, insurance companies are increasingly turning to AI personalization. By harnessing the power of artificial intelligence, insurers can analyze vast amounts of data to tailor policies more closely to the individual needs and risk profiles of their clients.

This not only enables a more accurate assessment of risk, but it also allows for the creation of personalized insurance plans that can potentially lower premiums and offer better coverage for the policyholder.

Conversely, maintaining a healthy lifestyle with regular exercise and a balanced diet can lead to more favorable rates, as insurers take into account the reduced risk of illness and injury associated with such habits. Younger, extra-wholesome candidates normally acquire lower premiums.

Conclusion

In light of this, AI personalization in the insurance domain is not just a futuristic concept but a practical tool that is reshaping the industry. By leveraging vast datasets and sophisticated algorithms, insurers can now offer policies that are tailored to individual lifestyles, habits, and health profiles.

This level of customization not only benefits consumers by potentially lowering their costs but also allows insurance companies to more accurately assess risk and streamline their underwriting processes.

As technology continues to advance, we can expect AI-driven personalization to become increasingly nuanced, further transforming the landscape of insurance.

To truly capitalize on the benefits of a healthy lifestyle, individuals should consider not only their physical activities and dietary choices but also how they manage stress and sleep. Insurers increasingly recognize the importance of mental well-being and rest in the overall health equation.

In light of this holistic approach, AI personalization is becoming an invaluable tool in tailoring health and wellness plans to individual needs. By analyzing data on a person’s habits, preferences, and even genetic information, AI can provide customized recommendations for exercise routines, meal plans, and stress-reduction techniques.

This level of personalization not only enhances the effectiveness of health interventions but also empowers individuals to take charge of their well-being with strategies that fit seamlessly into their unique lifestyles.

As such, those who demonstrate a holistic approach to health, embracing both physical and mental self-care, are likely to be rewarded with even more advantageous insurance terms.

In this new era of personalized healthcare, AI-driven platforms are at the forefront, offering tailored advice and support that adjust in real-time to a person’s changing needs and circumstances. This level of customization ensures that each individual’s health journey is as unique as their fingerprint, providing a health companion that learns and grows with them.

By leveraging vast datasets and predictive analytics, these intelligent systems can foresee potential health issues and offer preemptive guidance, thus fostering a proactive rather than reactive approach to health maintenance.

Critical illness insurance coverage provides essential financial security when going through essential well-being challenges. By understanding the benefits and limitations, you probably can choose a protection that aligns with your financial targets and personal circumstances.

When evaluating critical illness insurance options, it’s important to consider the range of illnesses and conditions covered under each plan. Policies can vary significantly, with some providing comprehensive coverage that includes a wide array of conditions, while others may focus on a more limited set of critical illnesses.

Additionally, the level of financial support offered and the specific terms regarding the payout—such as lump-sum payments or staggered disbursements—can greatly influence the overall value and suitability of the policy for your individual needs.

Always study insurance coverage policies from utterly different suppliers and search the recommendation of with a financial advisor to ensure the right match matches your desires

Authoritative Outbound Links:

In addition to consulting with professionals, leveraging AI-driven tools can offer a more tailored approach to selecting insurance policies. These advanced systems analyze vast amounts of data, including your health history, lifestyle choices, and financial situation, to suggest the most suitable coverage options.

By integrating AI personalization into your decision-making process, you are more likely to secure a policy that not only provides comprehensive protection but also aligns with your specific circumstances and long-term objectives.

When considering AI personalization in the context of insurance, it’s essential to recognize the balance between tailored solutions and privacy concerns. Advanced algorithms can sift through vast amounts of data to offer bespoke coverage recommendations, potentially leading to more comprehensive and cost-effective policies for individuals.

However, the increasing reliance on AI for personalization in insurance also raises significant questions about data security and ethical use. Insurers must navigate stringent regulations designed to protect consumer information while harnessing the power of AI to enhance their offerings.

It is a delicate act of ensuring that the personalization benefits do not come at the cost of compromising sensitive personal data, thereby maintaining trust with policyholders.

However, it’s crucial to ensure that the use of personal data aligns with stringent data protection regulations and ethical standards, maintaining trust and integrity within the insurance industry.

To navigate this delicate balance, insurers are investing in sophisticated AI algorithms that are designed to anonymize and secure user data while still providing highly personalized experiences. This involves employing advanced encryption methods and data handling practices that meet or exceed industry standards.

Moreover, by adopting transparent data usage policies and offering customers control over their information, insurers can foster a more collaborative relationship, where personalization is seen not as an intrusion but as a value-added service.

By providing clear options and smart concepts, this information aims to empower you with the information needed to make knowledgeable choices about crucial sickness insurance protection.

This article allowed me to see this topic from another angle, thank you! By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/comment-investir-en-actions/.

Thank you for this article which is both well written and informative.

The pedagogical approach of this article is really nice. Thank you!

This blog is a valuable resource for me, thank you very much.

It’s always a pleasure to discover such well-thought-out content.

It’s so well written and so clear! I really enjoyed this post.

Congratulations for this article, I will come back to read the next ones.

A clear and insightful read, keep publishing content like this!

I highly recommend this blog to anyone interested in this topic.

Your expertise is felt in every sentence, thank you for this article. By the way, if you’re looking for more great content, check out this site: https://www.newsmixer.online/agricultural-technology/.

Your writing is really captivating, I was hooked from start to finish.

A clear and informative read, keep posting content like this! By the way, if you’re looking for more great content, check out this site: https://commentgagner.blog/creation-de-cours-en-ligne/.

Thank you for this exceptional work. This is an enjoyable and informative read.

Thank you for all this clear and useful information. By the way, if you’re looking for more great content, check out this site: https://www.gagnerargent.online/idees-pour-des-revenus-passifs/.

I truly appreciate the clarity in your explanations. By the way, if you’re looking for more great content, check out this site: https://www.shortener.cloud/facebook-data-center-a-look-inside/.

Your articles are always of high quality, I am looking forward to them.

I learned a lot from this article, thanks for your expertise.

This is exactly the type of post I was looking for. Thank you so much!

Your blog is a real treasure trove for information on this topic.

Thank you for this precise lighting, it answers my questions exactly.

Thank you for this article, it allowed me to better understand a complex subject.

I highly recommend this blog to anyone interested in this topic.

Your blog is a real treasure trove for information on this topic.

I learned a lot of new things by reading this article.

It is a pleasure to read such well-written and informative articles.

It’s so well-written and clear! I really enjoyed this post.

This blog is an essential reference for me from now on.