Best Luxury Travel Insurance US Canada 2025 | Premium Coverage

Greatest Luxurious Journey Insurance coverage

While you’re planning a luxury vacation value hundreds of {dollars}, customary journey insurance coverage merely will not reduce it. Whether or not you are reserving a $15,000 African safari, staying in five-star resorts throughout Europe, or embarking on a luxurious cruise by the Caribbean, you want journey insurance coverage that matches the caliber of your journey expertise.

Luxury travel insurance goes far past primary journey cancellation and medical protection. It is designed for discerning vacationers who demand premium service, increased protection limits, and unique advantages that customary insurance policies merely do not supply. From concierge providers that may rebook your complete itinerary at a second’s discover to protection for high-value jewellery and electronics, luxurious journey insurance coverage is an funding in peace of thoughts.

On this complete information, we’ll discover the best luxury travel insurance suppliers out there in the USA and Canada for 2025. We’ll study what units premium insurance policies aside, analyze protection choices, examine prices, and supply professional suggestions that will help you select the right safety to your subsequent luxurious journey.

What Makes Journey Insurance coverage “Luxurious”?

Premium Protection Limits

Luxurious journey insurance coverage distinguishes itself by considerably increased protection limits throughout all classes. Whereas customary insurance policies would possibly supply $50,000 in journey cancellation protection, luxurious insurance policies typically present $100,000 to $500,000 or extra. This increased protection is crucial if you’re reserving costly lodging, personal jets, or unique experiences.

Concierge Providers

One of many hallmarks of luxurious journey insurance coverage is 24/7 concierge service. These aren’t primary customer support representatives – they’re educated journey consultants who can:

- Rebook complete itineraries when flights are canceled

- Safe last-minute reservations at absolutely booked eating places

- Organize various transportation when wanted

- Present real-time journey updates and proposals

- Coordinate with luxurious accommodations and repair suppliers

Excessive-Worth Merchandise Protection

Luxurious vacationers typically carry costly jewellery, electronics, and private gadgets. Premium insurance policies supply specialised protection for these high-value possessions, with some insurance policies protecting particular person gadgets value as much as $25,000 or extra.

Enhanced Medical Protection

Whereas customary insurance policies would possibly supply $100,000 in emergency medical protection, luxurious insurance policies typically present $1 million or extra. This contains protection for medical evacuation by way of personal jets, remedy at premium medical amenities, and prolonged protection durations.

Unique Supplier Networks

Luxurious journey insurance coverage corporations keep relationships with premium service suppliers worldwide, making certain you obtain five-star remedy even throughout emergencies.

High Luxurious Journey Insurance coverage Suppliers within the US and Canada (2025)

1. Berkshire Hathaway Journey Safety Elite

Greatest For: Extremely-high-net-worth people and luxurious leisure vacationers

Berkshire Hathaway’s Elite plan represents the top of luxurious journey insurance coverage. Backed by Warren Buffett’s insurance coverage empire, this coverage presents unmatched monetary stability and premium advantages.

Key Options:

- Journey cancellation protection as much as $500,000

- Emergency medical protection as much as $5 million

- $50,000 protection for high-value gadgets

- 24/7 concierge providers

- Cancel for Any Purpose protection as much as 80% of journey prices

- Unintended demise and dismemberment as much as $1 million

Premium Vary: $250-$800 per journey (relying on journey value and length)

Standout Profit: Their concierge staff can organize helicopter evacuations and personal medical transport, making it excellent for journey vacationers visiting distant luxurious locations.

Buyer Assessment: “When our luxurious safari in Kenya was disrupted by political unrest, Berkshire Hathaway’s staff had us relocated to a premium lodge in Tanzania inside 6 hours. The concierge service was completely phenomenal – they dealt with every little thing whereas we barely missed a day of our trip.” – Margaret Thompson, Toronto

2. AIG Journey Guard Platinum

Greatest For: Enterprise vacationers and frequent luxurious vacationers

AIG’s Platinum plan combines complete protection with business-friendly options, making it good for executives and entrepreneurs who journey in fashion.

Key Options:

- Journey cancellation as much as $200,000

- Emergency medical protection as much as $2 million

- $25,000 protection for enterprise gear

- Identification theft safety

- Missed connection protection as much as $2,000

- 24/7 journey help hotline

Premium Vary: $180-$600 per journey

Standout Profit: Specialised protection for enterprise vacationers, together with safety for laptops, tablets, and different important enterprise gear.

3. Allianz Journey Insurance coverage Premier

Greatest For: Multi-generational household journeys and group luxurious journey

Allianz Premier presents glorious household protection with particular provisions for youngsters and aged vacationers, making it excellent for luxurious household holidays.

Key Options:

- Journey cancellation as much as $100,000 per particular person

- Emergency medical protection as much as $1 million

- Kids journey free when mother and father are lined

- Pre-existing medical situation protection

- Journey sports activities protection

- Rental automobile harm safety

Premium Vary: $150-$500 per journey

Standout Profit: Complete household protection that features grandparents and covers pre-existing medical situations when bought inside 15 days of preliminary journey deposit.

Buyer Assessment: “Our three-generation household journey to Japan included my 85-year-old mom. When she had a medical emergency, Allianz organized for a personal medical session at our resort and lined all bills. The peace of thoughts was invaluable.” – David Chen, Vancouver

4. IMG World Signature Sequence

Greatest For: Worldwide luxurious vacationers and expatriates

IMG’s Signature Sequence is designed for classy worldwide vacationers who want complete worldwide protection.

Key Options:

- No most age restrict for candidates

- Protection in all nations worldwide (together with sanctioned nations with correct approvals)

- Emergency medical as much as $8 million

- Evacuation protection as much as $2 million

- Excessive-risk exercise protection

- Terrorism and political threat protection

Premium Vary: $200-$750 per journey

Standout Profit: Unparalleled worldwide protection, together with nations that almost all insurers exclude, making it good for journey luxurious vacationers.

5. Journey Insured Worldwide Worldwide Journey Protector Plus

Greatest For: Prolonged luxurious journeys and world vacationers

This coverage excels for longer luxurious journeys, providing glorious worth for prolonged journey durations.

Key Options:

- Journey cancellation as much as $150,000

- Emergency medical as much as $1 million

- Protection for journeys as much as 180 days

- Pre-existing situation waiver

- Cancel for Any Purpose (75% reimbursement)

- Journey sports activities protection included

Premium Vary: $120-$450 per journey

Standout Profit: Glorious protection for prolonged luxurious journeys with no extra charges for longer journey durations.

Complete Protection Comparability Desk

| Supplier | Journey Cancellation | Emergency Medical | Excessive-Worth Objects | Concierge Service | CFAR Obtainable |

|---|

| Berkshire Hathaway Elite | As much as $500,000 | As much as $5,000,000 | As much as $50,000 | 24/7 Premium | Sure (80%) |

| AIG Journey Guard Platinum | As much as $200,000 | As much as $2,000,000 | As much as $25,000 | 24/7 Normal | Sure (75%) |

| Allianz Premier | As much as $100,000 | As much as $1,000,000 | As much as $15,000 | Enterprise Hours | Sure (75%) |

| IMG Signature Sequence | As much as $200,000 | As much as $8,000,000 | As much as $30,000 | 24/7 Premium | Sure (75%) |

| Journey Insured Worldwide Plus | As much as $150,000 | As much as $1,000,000 | As much as $20,000 | 24/7 Normal | Sure (75%) |

What to Search for in Luxurious Journey Insurance coverage

Protection Limits That Match Your Journey Worth

The elemental precept of luxurious journey insurance coverage is making certain your protection limits match or exceed your journey funding. In case you’re spending $50,000 on a luxurious cruise, be sure your journey cancellation protection is no less than that quantity, ideally increased to account for extra bills like flights and pre-trip lodging.

Cancel for Any Purpose (CFAR) Protection

CFAR protection is crucial for luxurious vacationers as a result of it gives most flexibility. Not like customary journey cancellation that covers solely particular listed causes, CFAR lets you cancel for actually any purpose and obtain 75-80% of your non-refundable journey prices again.

To qualify for CFAR:

- Buy inside 15-21 days of preliminary journey deposit

- Insure 100% of your non-refundable journey prices

- Cancel no less than 48 hours earlier than scheduled departure

Medical Evacuation Protection

When touring to distant luxurious locations, medical evacuation protection turns into vital. Search for insurance policies providing no less than $1 million in evacuation protection, which ought to cowl:

- Air ambulance transportation

- Floor ambulance to airport

- Business medical escort if wanted

- Repatriation to residence nation

Excessive-Worth Merchandise Safety

Luxurious vacationers typically carry costly gadgets that require specialised protection:

Jewellery and Watches: Search for insurance policies protecting particular person gadgets as much as $25,000 or extra

Electronics: Guarantee protection for cameras, laptops, and different costly devices

Sports activities Gear: Specialised protection for golf golf equipment, snowboarding gear, or diving gear

Artwork and Collectibles: Some insurance policies supply protection for invaluable artwork items or collectibles

Concierge Providers High quality

Not all concierge providers are created equal. Premium concierge providers ought to supply:

- Multilingual help workers

- Relationships with luxurious service suppliers worldwide

- Authority to make bookings and reservations in your behalf

- Journey planning and itinerary adjustment capabilities

- Emergency coordination providers

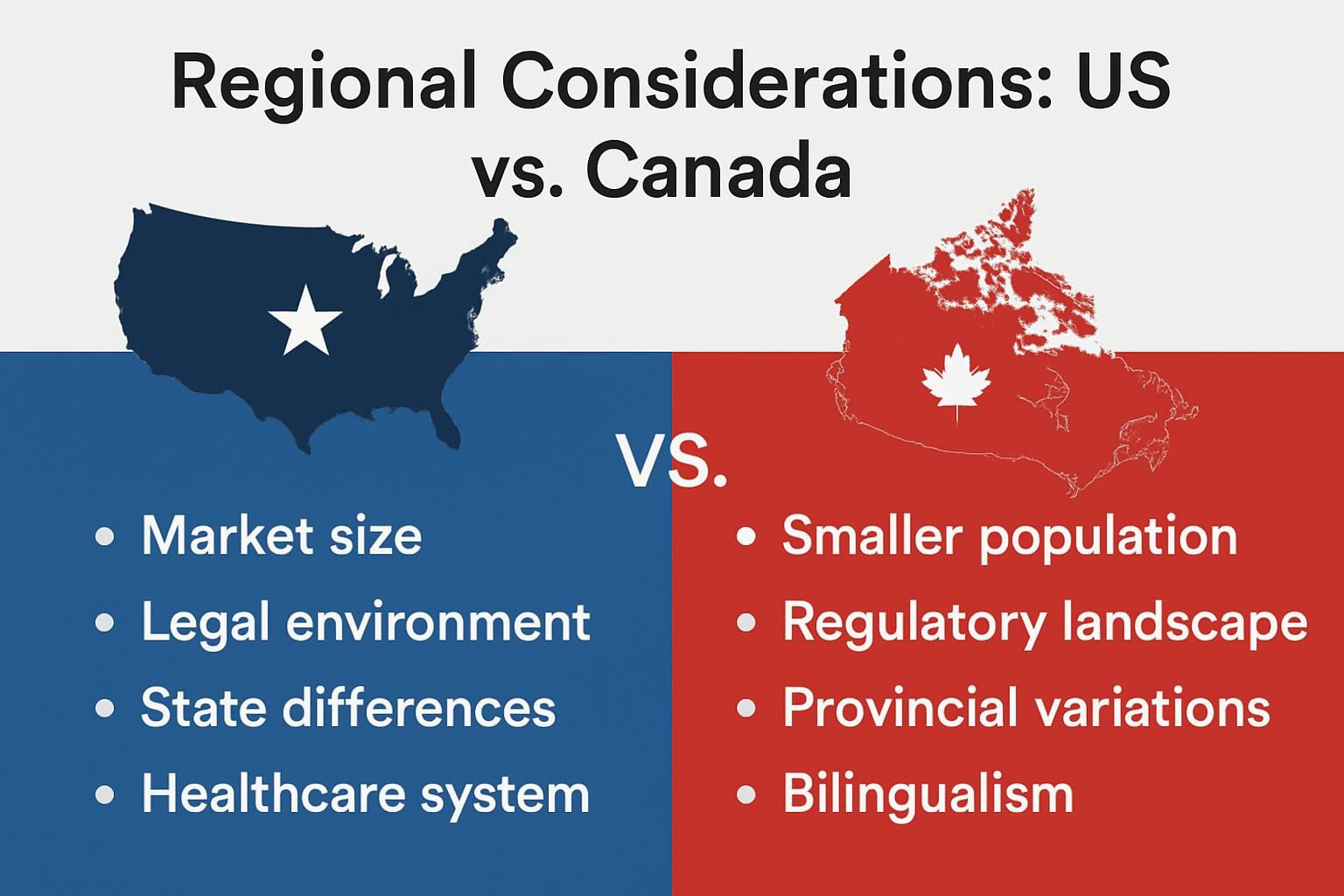

Regional Concerns: US vs. Canada

United States Vacationers

US vacationers have entry to the widest vary of luxurious journey insurance coverage suppliers, with aggressive pricing as a consequence of market competitors. American vacationers ought to pay particular consideration to:

- Worldwide Medical Protection: US medical health insurance hardly ever covers worldwide journey

- Political Threat Protection: Essential for journey to politically unstable areas

- Hurricane and Climate Protection: Essential throughout hurricane season journey

- State-Particular Rules: Some states have distinctive insurance coverage necessities

Canadian Vacationers

Canadian vacationers profit from provincial well being protection however nonetheless want complete journey insurance coverage for luxurious journeys:

- Provincial Well being Plan Gaps: Restricted worldwide protection

- Forex Alternate Safety: Some insurance policies supply safety towards unfavorable trade charge modifications

- Return Transportation: Protection for emergency return to Canada

- Winter Sport Protection: Important for Canadian vacationers partaking in snowboarding or winter sports activities

Price Evaluation: Is Luxurious Journey Insurance coverage Price It?

Typical Price Construction

Luxurious journey insurance coverage sometimes prices 4-12% of your whole journey value, in comparison with 2-8% for normal insurance policies. The premium you pay is dependent upon:

- Journey Price: Increased journey values require increased premiums

- Traveler Age: Older vacationers pay extra as a consequence of elevated medical dangers

- Vacation spot Threat: Journey to high-risk locations will increase premiums

- Protection Size: Longer journeys value extra to insure

- Pre-existing Circumstances: Could enhance premiums or require waivers

Return on Funding Evaluation

Contemplate this state of affairs: You e-book a $25,000 luxurious African safari. Normal journey insurance coverage may cost a little $500-$750, whereas luxurious insurance coverage prices $1,250-$1,875. This is what that additional $1,125 may prevent:

Medical Emergency in Distant Location:

- Normal coverage: $100,000 medical protection

- Luxurious coverage: $1-5 million medical protection

- Potential financial savings: $900,000+ in extreme medical emergencies

Journey Cancellation As a result of Sudden Sickness:

- Normal coverage: Could not cowl full journey value

- Luxurious coverage: Covers as much as $500,000 with CFAR choices

- Potential financial savings: $20,000+ in non-refundable bills

Excessive-Worth Merchandise Theft:

- Normal coverage: $1,500 merchandise restrict

- Luxurious coverage: $25,000+ particular person merchandise protection

- Potential financial savings: $23,500+ for costly jewellery or gear

Buyer Assessment Instance

“We spent $18,000 on a luxurious river cruise by Europe. Three days earlier than departure, my husband was hospitalized with a coronary heart assault. Our Berkshire Hathaway Elite coverage not solely lined our complete journey value by CFAR protection but additionally supplied a concierge who helped us rebook the identical cruise for the next yr at no extra value. The $720 premium saved us over $14,000.” – Susan Martinez, Calgary

Step-by-Step Information to Buying Luxurious Journey Insurance coverage

Step 1: Calculate Your Whole Journey Funding

Embody all non-refundable prices:

- Flights and transportation

- Lodging

- Excursions and experiences

- Eating reservations (if pre-paid)

- Journey gear and buying finances

Step 2: Assess Your Threat Tolerance

Contemplate these components:

- Your well being and age

- Vacation spot political stability

- Climate dangers throughout journey season

- Worth of things you will carry

Step 3: Analysis Supplier Monetary Stability

Test these scores:

- AM Greatest ranking (A- or increased really useful)

- Higher Enterprise Bureau ranking

- Buyer evaluation scores

- Claims processing popularity

Step 4: Evaluate Protection Particulars

Do not simply examine costs – study:

- Protection limits for every profit

- Exclusions and limitations

- Claims course of necessities

- Customer support availability

Step 5: Buy Inside Time Limits

To maximise advantages:

- Purchase inside 15-21 days of preliminary journey deposit

- Make sure you’re buying earlier than any journey advisories

- Full buy earlier than remaining journey cost

Step 6: Doc Every little thing

Hold information of:

- Authentic buy receipts

- Coverage paperwork

- Emergency contact numbers

- Claims procedures

Frequent Errors to Keep away from

Underinsuring Your Journey Worth

Many vacationers solely insure their preliminary deposit moderately than their full journey value. This leaves them susceptible to important losses if they should cancel after making remaining funds.

Ignoring Pre-Present Situation Waivers

In case you or a member of the family has well being situations, failing to buy insurance coverage inside the required timeframe can void protection for associated claims.

Overlooking Journey Sports activities Exclusions

Normal insurance policies typically exclude high-risk actions. In case your luxurious journey contains snowboarding, scuba diving, or mountaineering, guarantee these actions are lined.

Not Studying the Superb Print

Take note of:

- Most age limits

- Vacation spot restrictions

- Required documentation for claims

- Closing dates for submitting claims

Assuming Credit score Card Protection Is Ample

Whereas premium bank cards supply some journey insurance coverage, they hardly ever present the great protection luxurious vacationers want.

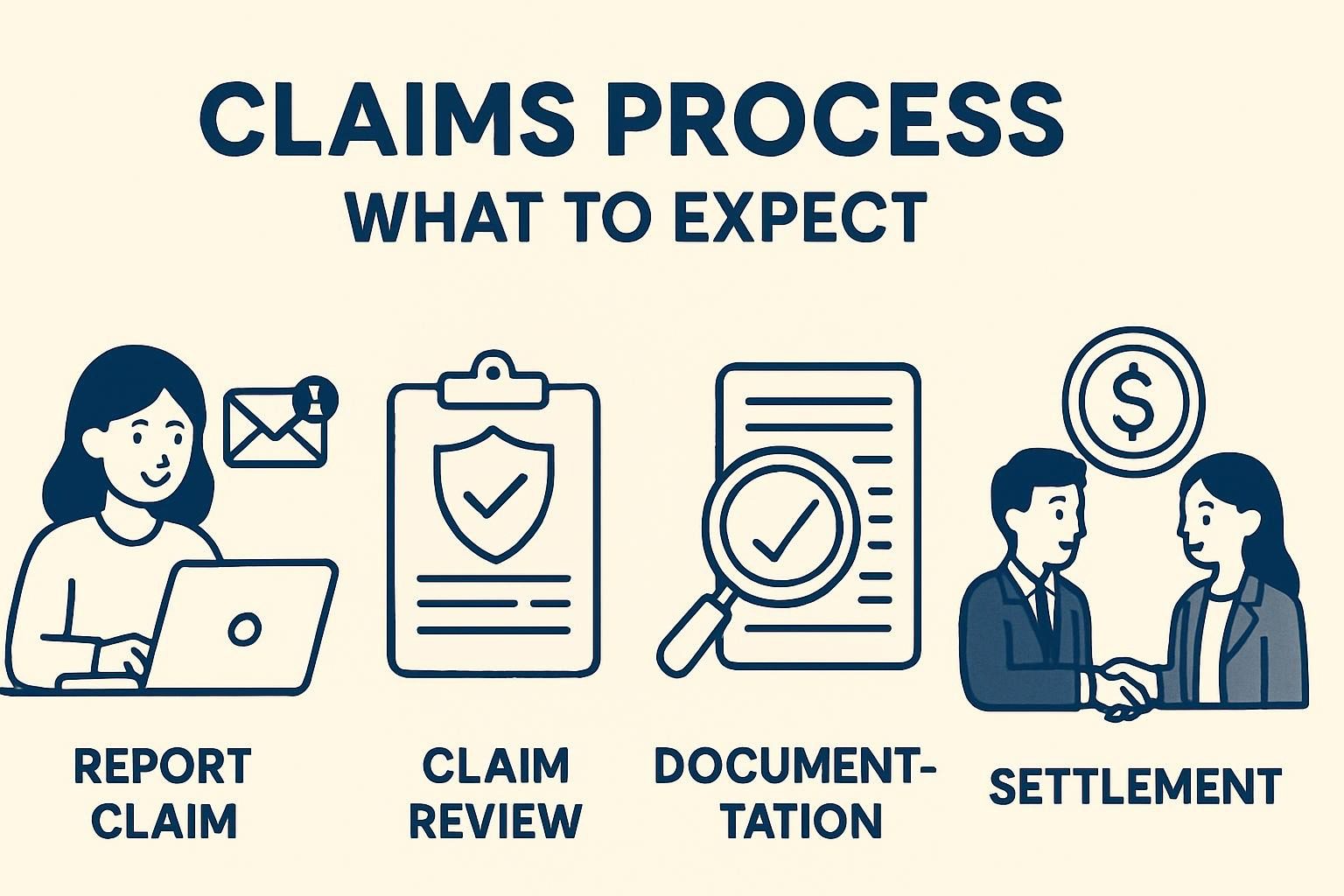

Claims Course of: What to Anticipate

Fast Steps After an Incident

- Contact your insurance coverage firm instantly (inside 24-48 hours for medical emergencies)

- Collect all related documentation (medical information, receipts, police experiences)

- Hold all authentic receipts for extra bills

- Do not admit fault or make statements concerning the incident

- Comply with all medical suggestions if health-related

Required Documentation

Typical claims require:

- Accomplished declare varieties

- Proof of insurance coverage buy

- Authentic journey receipts and itineraries

- Medical information (for health-related claims)

- Police experiences (for theft or authorized points)

- Proof of cancellation causes

Processing Timeframes

- Emergency medical: Fast authorization

- Journey cancellation: 15-30 days after receiving full documentation

- Baggage claims: 10-21 days

- Excessive-value merchandise claims: 30-45 days (could require value determinations)

Expertise and Innovation in Luxurious Journey Insurance coverage

Cell Apps and Digital Providers

Main luxurious journey insurance coverage suppliers now supply subtle cell apps that includes:

- Actual-time claims submitting with picture uploads

- GPS-based emergency providers

- Digital insurance coverage playing cards

- Journey alerts and updates

- Direct communication with concierge providers

AI-Powered Threat Evaluation

Superior suppliers use synthetic intelligence to:

- Assess journey dangers in real-time

- Present customized protection suggestions

- Predict weather-related disruptions

- Monitor political conditions affecting journey

Blockchain and Good Contracts

Some modern insurers are implementing blockchain expertise to:

- Automate sure claims funds

- Confirm documentation authenticity

- Cut back fraud

- Velocity up claims processing

Future Tendencies in Luxurious Journey Insurance coverage (2025-2030)

Pandemic and Well being Disaster Protection

Put up-COVID, luxurious journey insurance coverage more and more contains:

- Pandemic-related journey cancellations

- Quarantine expense protection

- Telemedicine consultations

- Vaccination requirement modifications

Local weather Change Diversifications

As local weather change impacts journey, count on enhanced protection for:

- Excessive climate occasions

- Sea-level rise affecting locations

- Temperature-related cancellations

- Environmental catastrophe evacuations

Area Tourism Protection

As luxurious house journey turns into actuality, specialised insurance policies will emerge protecting:

- Launch delays and cancellations

- Area illness medical remedy

- Gear failures in house

- Prolonged house station stays

Customized Threat Profiles

Future insurance policies will supply more and more customized protection primarily based on:

- Particular person well being knowledge (with consent)

- Journey historical past and patterns

- Private threat tolerance

- Life-style components

Ceaselessly Requested Questions (FAQs)

What is the distinction between luxurious and customary journey insurance coverage?

Luxurious journey insurance coverage presents considerably increased protection limits, premium concierge providers, specialised protection for high-value gadgets, and unique supplier networks. Whereas customary insurance policies would possibly supply $50,000 in journey cancellation protection, luxurious insurance policies can present $500,000 or extra. Moreover, luxurious insurance policies embody providers like 24/7 concierge help and enhanced medical evacuation choices.

Do I would like luxurious journey insurance coverage if I’ve premium bank card protection?

Premium bank card journey insurance coverage hardly ever matches the great protection of devoted luxurious journey insurance coverage insurance policies. Bank card protection sometimes has decrease limits, extra exclusions, and restricted concierge providers. For top-value journeys, devoted luxurious journey insurance coverage is crucial for ample safety.

How a lot does luxurious journey insurance coverage sometimes value?

Luxurious journey insurance coverage typically prices 4-12% of your whole journey value, in comparison with 2-8% for normal insurance policies. For a $20,000 luxurious journey, you would possibly pay $800-$2,400 for premium protection. The precise value is dependent upon your age, vacation spot, journey size, and chosen protection limits.

When ought to I buy luxurious journey insurance coverage?

Buy luxurious journey insurance coverage inside 15-21 days of creating your preliminary journey deposit to qualify for optimum advantages, together with Cancel for Any Purpose protection and pre-existing situation waivers. Do not wait till nearer to your departure date, as you could lose essential protection choices.

What gadgets are thought of “high-value” for protection functions?

Excessive-value gadgets sometimes embody jewellery value over $1,000, electronics like cameras and laptops, luxurious watches, designer clothes, sports activities gear, and artwork items. Most luxurious insurance policies cowl particular person gadgets as much as $25,000 or extra, however you could have to declare extraordinarily invaluable gadgets individually.

Are journey actions lined underneath luxurious journey insurance coverage?

Protection varies by supplier and coverage. Many luxurious journey insurance coverage insurance policies embody journey sports activities protection, however excessive actions like base leaping or skilled sports activities could also be excluded. At all times verify your coverage’s exercise protection listing and think about extra journey sports activities protection if wanted.

How shortly are claims processed for luxurious journey insurance coverage?

Emergency medical claims are sometimes pre-authorized instantly. Journey cancellation claims normally course of inside 15-30 days of receiving full documentation. Excessive-value merchandise claims could take 30-45 days, particularly if value determinations are required. Luxurious insurers typically course of claims quicker than customary suppliers.

Knowledgeable Suggestions

Based mostly on our complete evaluation, listed here are our professional suggestions for various kinds of luxurious vacationers:

For Extremely-Excessive-Internet-Price People

Suggestion: Berkshire Hathaway Journey Safety Elite Why: Unmatched protection limits, premium concierge providers, and the monetary backing of Berkshire Hathaway make this the gold customary for luxurious journey insurance coverage.

For Frequent Enterprise Vacationers

Suggestion: AIG Journey Guard Platinum Why: Specialised enterprise protection, gear safety, and glorious customer support make this excellent for executives and entrepreneurs.

For Household Luxurious Journey

Suggestion: Allianz Journey Insurance coverage Premier Why: Complete household protection, kids journey free choices, and pre-existing situation protection make this good for multi-generational journeys.

For Worldwide Journey Vacationers

Suggestion: IMG World Signature Sequence Why: Worldwide protection together with high-risk locations, journey sports activities inclusion, and political threat safety.

For Prolonged Luxurious Journeys

Suggestion: Journey Insured Worldwide Worldwide Journey Protector Plus Why: Glorious worth for longer journeys with complete protection and no extra charges for prolonged journey durations.

Conclusion

Luxurious journey insurance coverage is not only an add-on expense – it is a necessary funding in defending your important travel investments and making certain peace of thoughts throughout your most memorable journeys. The distinction between customary and luxurious journey insurance coverage can imply the distinction between a minor inconvenience and a monetary disaster.

When deciding on luxurious journey insurance coverage, deal with protection limits that match your journey worth, complete concierge providers, and suppliers with sturdy monetary scores. Keep in mind that the most affordable possibility isn’t the perfect with regards to luxurious journey safety.

The suppliers we have really useful – Berkshire Hathaway Elite, AIG Journey Guard Platinum, Allianz Premier, IMG Signature Sequence, and Journey Insured Worldwide Plus – characterize the cream of the crop in luxurious journey insurance coverage. Every presents distinctive benefits relying in your particular journey fashion and desires.

Do not let an uninsured emergency flip your dream trip right into a monetary nightmare. Put money into high quality luxurious journey insurance coverage and journey with the boldness that comes from figuring out you are fully protected, it doesn’t matter what challenges come up throughout your journey.

Prepared to guard your subsequent luxurious journey? Analysis the suppliers talked about on this information, calculate your journey’s whole worth, and buy your luxury travel insurance inside 15-21 days of reserving your journey to maximise your protection advantages. Your future self will thanks for the investment in full peace of thoughts.